Future risks, past losses, and the call to move out the MMI fund

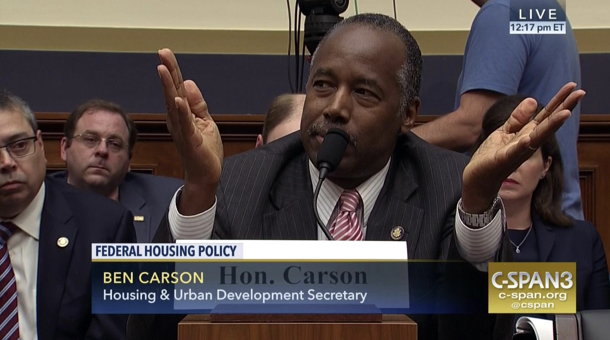

If there is one thing surgeons are skilled at it is stopping blood loss during surgery. The Home Equity Conversion Mortgage has come under increased scrutiny with HUD’s annual reports to Congress and the ensuing actuarial reports showing wild and unpredictable swings in the economic value of the reverse mortgage program. In his recent comments before the House of Representatives, HUD Secretary Dr. Ben Carson states “the changes we’ve made will sort of stop the bleeding in terms of [new reverse mortgages]”. While recent HECM reforms will help reduce the likelihood of future losses, what can we expect in the near future?

As an equity-based loan that relied heavily on steady home appreciation rates to offset future risks, the reverse mortgage stood to suffer significant losses as a result of the housing crash and increased defaults for non-payment of property charges. While these losses are baked into the HECM program, few have asked or even opined if recent reforms would help erase past losses already incurred.

All which brings us to moving the HECM from the Mutual Mortgage Insurance Fund to the General Insurance/Special Risk fund, where it once resided. While the move was promoted by a few think tanks, few officials or politicians publicly made the call for the move. The tide has shifted.

3 Comments

While GAO has no inherent powers to yank the HECM program out of one fund and put it into another, it does have the power to research the requests of Congressional members and respond. Their suggestions and recommendations can have significant impact on Congress depending on the suggestion and who is in power at that time.

Industry members have accused HUD, FHA, Congress, and the White House of “taking” funds out of the HECM program and placing them in anything from the military to the latest slush fund. While it is hard to tell what has happened to the HECMs in the GSRI Fund, the actuaries have done a superior job in identifying unusual transactions in the HECM portion of the MMI Fund which there have been at least five.

As to the MMI fund, what we have seen is eight years of twists and turns in tweaking the HECM, an awful decision as to structuring financial assessment, and raiding other MMI Fund programs and placing them in the HECM portion of that fund to the extent of a net $5.8 billion-plus questionably putting all of the Treasury funds of $1.7 billion also into the HECM portion of the MMI Fund. What had been hoped as an end to the losses in the HECMs endorsed since the start of fiscal 2009 was nothing more than a lowering of the net liabilities in excess of assets down to $7.7 billion instead of the $15.2 billion where it should be based solely on the actual and projected net cumulative performance of the HECMs endorsed after 9/30/2008. What we do not know is the net performance of all HECMs endorsed before 10/1/2008.

It is the not knowing that gives caution about simply placing all of the HECM program or all HECMs endorsed after some specific date in the future in the GSRI Fund. Unlike many, I question the accuracy of the guesses provided by industry members of how much HECMs have saved Medicaid and other government programs especially in light of the new push toward wealthier seniors by most lenders. Certainly, lenders have few if any, marketing campaigns directed towards Medicaid beneficiaries; they rarely have. Then how would such campaigns line up against the image that lenders do not push that HECM borrowers have turned to HECMs over Medicaid?

I find this interesting that these changes “will stop the bleeding.” I thought a majority of the concerns are with the fixed rate loans prior to 2013.

My suggestion is the following:

Lets have loan modifications done on all of these loans prior to 2013. The benefit to the borrower would be a lower interest rate which could lead to additional equity when they sell their home. This would also lessen risk to FHA over the long-term.

Jake,

First, what about the tens of thousands of fixed rate HECMs that closed in fiscal 2013? Remember all HECMs with case numbers dated before 3/31/2013 and not more than six months old could generally close as a fixed rate Standard at any time in fiscal 2013 as long as the related appraisal met HUD deadline requirements.

Second, don’t you at least read the most significant parts of the actuarial reports? Are you that apathetic and intellectually lethargic? The actuaries continue to project losses for every fiscal year following implementation of financial assessment. To the actuaries as to me and a few others preserving the MMI Fund through financial assessment has been, remains, and always will be a hoax started by lenders and perpetuated through originators.

So you think that the contracts between investors, Ginnie Mae, issuers, lenders, and borrowers can be modified at any time HUD decides to do that? Who is it that will make up the losses to the investors? HUD has no legal authority to do that even through the Reverse Mortgage Stability Act of 2013.