Will massive stimulus spending spike inflation?

The chaos and legal disputes in the wake of the presidential election have nearly eclipsed the earlier debate on additional coronavirus economic stimulus payments. As a society, these are uncertain times. Economically we face the prospects of continued GDP growth, a recession, and most importantly the true cost of economic stimulus and trillions of dollars of debt incurred from the pandemic. First, the Federal Reserve slashed rates to zero to one-quarter of a percent. Next came the PPP or the Paycheck Protection Program which was allocated approximately $349 billion of the $2.2 trillion Coronavirus Aid and Relief & Economic Security Act or CARES Act. While the sheer amount of money sloshing around in the gas tank of our economy is frightening the U.S. fiscal stimulus is a mere fraction of what other developed nations have paid with the U.S. stimulus representing only 13% of our GDP, compared to 33% for Germany, and 42% of Japan’s gross domestic product. However, the sheer size of our GDP when compared to other developed countries should be considered.

[read more]

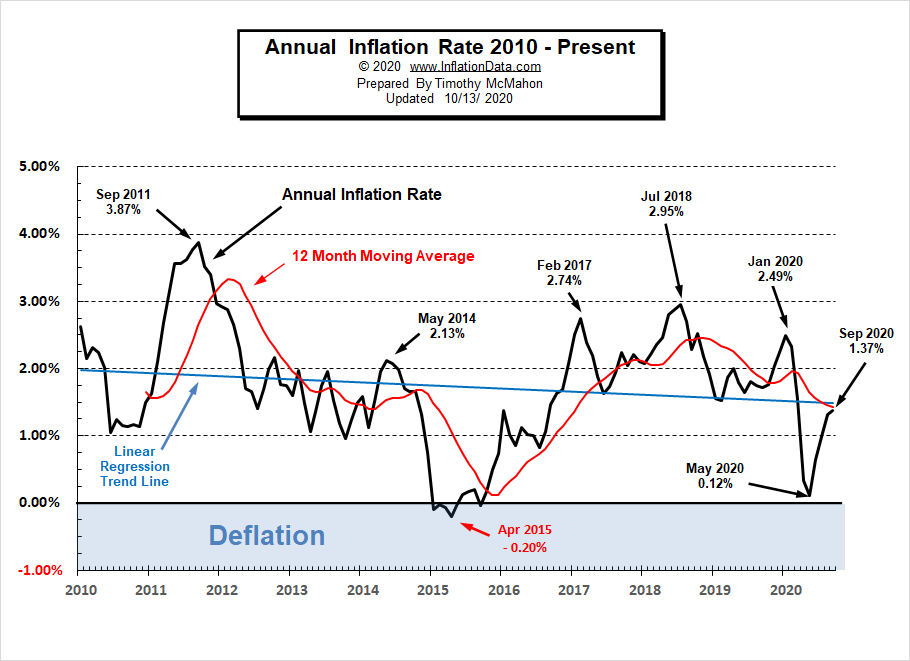

While economic stimulus measures stopped further economic damage in the early days of the pandemic it certainly comes at a cost. That cost is inflation should there be too many dollars chasing American goods and services. However, almost as if defying economic gravity U.S. inflation remains below its two-percent target. Certainly, there was a noticeable spike in food prices early this spring in the wake of supply chain interruptions, but beyond that inflation as broadly defined appears to be somewhat disconnected from extreme quantitative easing. The question is how long will these economic antibodies last? Some say for the foreseeable future. Others point to the 30-year U.S. Treasuries being particularly sensitive to inflation showing expectations of rising food and energy inflation.

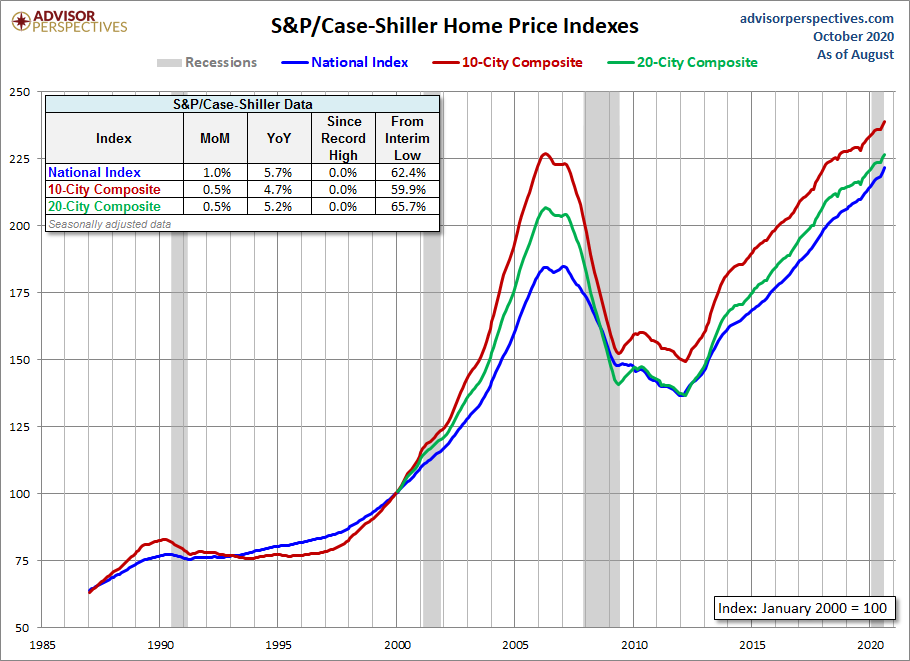

But alas there are signs of inflation of another variety. No other segment of the economy has been more inflated than housing values thanks to extremely low interest rates. However as we’ve discussed repeatedly on this show, a backlog of postponed foreclosures may act as the proverbial needle popping the housing bubble.

All of which brings us back to mid-November 2020. Setting aside what appears to be an ugly general election likely to be settled in the courts in the coming weeks or months, what can we do to prepare for 2021 and beyond? What do YOU control? One, if you haven’t already brush up on your CMT knowledge. HECM professionals who worked prior to 2009 are familiar with the Constant Maturity Treasury Rate. Second- anticipate some short-term pricing volatility in the secondary markets until tranches of HECM mortgage-backed securities tied to the CMT are sold. Of course in the short-term, this may impact your compensation. Third, know that the Fed and other world banks across the globe plan to keep interest rates near zero until the economy gains a solid fiscal footing. That means barring any structural changes to the HECM borrowers stand to net significantly more dollars from their home’s value. However, the HECM’s available principal limit or line of credit growth will slow to a near crawl. Fourth, plan on selling from a distance using remote technology until mid-2021. Until a COVID-19 vaccine is available senior homeowners will be understandably reluctant to meet face to face. Perhaps now is the time to invest in professional lighting and an improved camera to increase the effectiveness of your remote sales.

Resources mentioned in this episode:

Jump in 30-year Treasury yield raises expectations of Fed purchases [READ]

S&P/Case-Shiller Home Price Index [READ]

[/read]

1 Comment

While not a major concern in this Presidential election, inflation is of real concern especially to the Federal Reserve in the era of massive stimulus. If inflation takes off through 1) a lower valued US Dollar, 2) higher prices for domestic goods and services, 3) higher interest on US national debt due to unfavorable market conditions especially on the 30% of the debt owed to such foreign nations as the People’s Republic of China, and Japan, 4) generally lower concern about the lack of accountability for the use of taxpayer dollars, and 5) other numerous causes. Yet because of stimulus, there is still a very real concern about stagflation. Stagflation is a condition that exists when a relatively slow economy with significant unemployment is combined with significant inflation.

It seems even the bulwark against growing debt and deficit spending, the Grand Old Party, is no longer the bulwark it once was since the death of John McCain. It seems the only way we try to get out of problems nowadays is to spend our way out. It seems prudent spending is now the domain of the less powerful.

If forbearance ends in massive foreclosures due to borrowers not being able to afford their restructured debt, potential HECM borrowers could see substantial drops in home values resulting in lower principal limits for most of, if not all of, 2021. In that case and if commission rates do not recover from the loss of LIBOR, HECM originators could experience significantly lower commissions in 2021.

Within days both the annual report to Congress and the annual actuarial review conducted from HUD’s independent actuaries for the fiscal year ended September 30, 2020 should be released showing likely economic conditions for HECMs for fiscal 2021. It should be pointed out that even the OMB during the Obama Administration had real problems with the optimistic bias of HUD in its fiscal 2010 budget projections but even the OMB was optimistic.

Following the adage of Zig Ziglar, we should: “Expect the best. Prepare for the worst.”