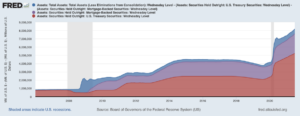

Do you know who the biggest player in the housing market is today? Is it hedge funds, REITs, or the largest developers? If you answered the Federal Reserve, congratulations.

Some members of the Federal Reserve’s policy-setting committee want to end the Fed’s purchasing of $40 billion a month of MBS (mortgage-backed securities) sooner than later. The question is how much and how soon. In a presser following the Fed’s two-day meeting discussing how to reduce asset purchases Federal Reserve Chairman Jerome Powell said, “There really is little support for the idea of tapering MBS earlier than Treasuries. I think we will taper them at the same time.”

The wind-down of asset purchases will put pressure on yields. Today, with the Fed consistently purchasing most mortgage-backed securities lenders don’t have to offer higher yields to attract investors, this allows them to offer lower rates. When rates eventually do increase modestly homebuyers will have to reconsider the price range homes they consider for purchase. Sellers may also rethink their asking price as home affordability erodes. Both would cool the pace of housing appreciation and bring some modicum of normalcy to an overheated market.

Monday Federal Reserve Bank of Atlanta President Raphael Bostic said the central bank should move to taper asset purchases in light of recent strong employment gains. Speaking of the timing of tapering Bostic said, “Right now I’m thinking in the October-to-December range, but if the number comes back big” as with the last report “or maybe even a little bigger, I’d be open to moving it forward. If the number really explodes, I think we would have to consider that.”

While employment gains are substantial, many economists are concerned as millions of small businesses cannot fill open positions. Employer-mandated vaccinations or mask-wearing may further strain the rate of employment growth when coupled with the $300/week federal unemployment bonus. Both could postpone the Fed’s tapering of asset purchases. However, inflationary concerns could also spur the central bank to accelerate its timeline. The central banks’ mantra is they see the surge of inflation as merely transitory. Time will certainly tell.

For now, even a moderating seller’s market still will benefit reverse mortgage applicants in the short term when coupled with historic low interest rates significantly increasing their available loan proceeds. While it’s uncertain how long the market will continue its run, reverse mortgage originators couldn’t ask for a more ideal market.

-Shannon Hicks

1 Comment

The asset purchase policy of the Fed has impact on many different securities. If it stops buying, or worse, starts selling assets, the current economy will be negatively impacted. While current Fed policy seems to have an outlook to slow down current asset purchasing, the extent of that slowdown could be the difference between little business disruption to even a recession. The current Fed does not seem prone to any moves that would result in a cooling down of the current economic growth and with the return of pandemic deaths, for the near term, this announcement seems reasonable and conservative in nature.