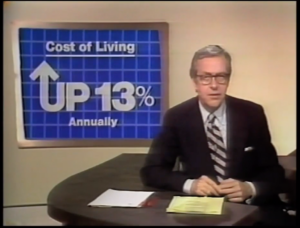

Interest hikes are coming as inflation soars

Inflation is at a 39-year high and it appears not to be transitory. As a result, last Wednesday the Federal Reserve announced last Wednesday they will reduce their bond purchases twice a fast as previously planned and plans on raising interest rates three times in 2022; all in the effort to stem runaway inflation. The Fed has two mandates: maximum employment, and stable prices meaning moderate and stable inflation.” Keynesian economics argued that the government could tax and spend its way to full employment”, wrote the former president of the Federal Reserve Bank of St. Louis in 2005. If that economic theory sounds familiar it should. Consider our government’s response to the Covid-19 pandemic and the massive increase of our money supply.

We’ve faced the monster of inflation before.

[read more]

In 1979 the new incoming Fed Chairman Paul Volcker started dishing out some tough love. His solution to runaway inflation in the late 70s and early 80s was not only to increase interest rates but also to reduce the money supply. By 1981 Volcker had raised the Fed funds rate to a record 20%. The result was one of the deepest economic recessions since the Great Depression and the eventual curbing of inflation.

What’s the Federal Reserve Chairman and Board of Governors plan? The first step is to rapidly reduce purchases of treasury and mortgage bond purchases which have held down long-term rates for mortgages. The second is to increase interest rates perhaps as early as March. Consequently, two questions come to mind? Will the Fed’s countermeasures slow inflation or will it continue to erode our purchasing power? Second, how could this impact the reverse mortgage lending market?

First, inflation may not slow if supply-chain bottlenecks persist. China’s shutdown of factories along the Yangtze River Delta last week in response to the Omicron Variant only stands to compound supply chain shortages. If initial rate hikes don’t slow rising prices the Fed may opt for more severe deflationary measures with additional rate hikes which would certainly flatten any economic recovery.

Second, what does this mean for the reverse mortgage industry? Depending on the magnitude of interest rate increases home buying demand will soften. This could lead to a plateau of home appreciation nationally and price reductions in overheated markets. Now to the HECM. The Constant Maturity Treasury Rate and the SOFR upon which federally-insured reverse mortgages are attached are certain to rise. The Secured Single Overnight Finance Rate is published daily by the Federal Reserve Bank of New York. It shows the cost of overnight transactions between borrowers and lenders which are collateralized or backed by Treasury securities. As the cost of securities increases so will the overnight swap rate.

So what can be done as the spigot of easy stimulus money and loose monetary policy come to an end? The first is to eliminate debt as quickly as possible, or more realistically restructure how it’s held. For a consumer, this could mean converting their high-balance credit card into a 12-15 month 0% interest rate transfer offer to accelerate their pay down of the principal balance. On a larger scale, older homeowners may want to evaluate their exposure to both inflation and high-interest rates and consider converting their debts into a reverse mortgage to avoid payment shocks as minimum payments spike. While a HECM’s balance certainly compounds, cash flow is usually king when one is retired and on a fixed income. Now is the time to discuss inflation and increasing interest rates with your potential borrowers. In doing so you could be throwing them a much-needed financial lifeline before the storm hits.

Resources:

Federal Reserve Board Press Conference

Volcker’s handling of the great inflation taught us much

Yahoo News: The Fed to tighten rates

The mandate of the Federal Reserve

The US Money Supply (M1)

[/read]

1 Comment

Are any lenders actually using SOFR yet?