Why HELOCs will disappear…again

It was just two short years ago that several major banks stopped offering HELOCs or home equity lines of credit. Wells Fargo and JP Morgan Chase were the most notable lenders who cited an uncertain economy in the early days of the Covid-19 pandemic as the rationale for hitting the pause button on home equity loans. While the pandemic may be behind us we may see HELOC lending suspended again.

Today banks remain wary of the risks of home equity loans, especially those that are in a second-lien position which exposes them to the increased risk of loss should their borrowers suffer a financial setback that makes repayment impractical or impossible. The previous curtailment of HELOC lending has been a minor inconvenience with most opting instead for cash-out refinances. However, with mortgage rates two percentage points higher than they were a year ago, cash-out refis are no longer practical.

Suspended HELOCs

Even homeowners who’ve already secured a HELOC are at risk of…

[read more]

losing access to their home’s equity. On its website, Chase explains the basics of a HELOC suspension. “You will not be able to draw additional funds from your home equity line of credit if it’s suspended. Suspended accounts must be reviewed for reinstatement of your credit line.” While many suspensions are made based the individual borrower’s change in financial circumstances, the blanket freezing of credit lines can be enacted by the bank as they see fit.

Why HELOCs will disappear. History has taught us HELOCs can and will disappear and those who’ve already secured one are likely to see their credit line suspended. During the 2008 housing crash banks froze existing HELOC and personal lines of credit and ceased offering home equity loans. It’s not rocket science. Bank’s equity position was no longer secure, in fact, in most cases, it was gone as home values tanked.

The forces shaping today’s housing market

While a nationwide crash in housing values is unlikely we are seeing the early warning signal of home value declines in several markets. Sellers are beginning to show desperation and are slashing their prices. This trend is likely to spread to other metros increasing the pace of reduced asking prices and subsequently softening the housing market in specific regions.

Here are median listing price cuts for 15 metropolitan areas with San Jose leading the pack with the highest median drop in home asking prices. Not surprising considering the median home value in San Jose today is one-point-three million dollars. Next are Honolulu Hawaii, San Francisco, Los Angeles, and San Diego, California.

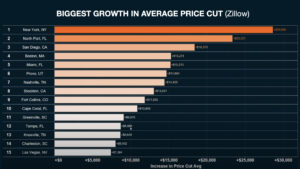

More home sellers are dropping their prices the most in New York with the increase in home price reductions increasing by $28,000. You can check out your market or those shown here and you’ll likely see price reductions in the attempt to attract buyers who are struggling with higher interest rates and a lack of affordability.

The good news is older homeowners with substantial home equity may qualify for a line of credit in the federally-insured reverse mortgage, or HECM- Home Equity Conversion Mortgage. Unlike a traditional HELOC, the credit line cannot be reduced when home values drop or even if home values fall. Even better, the unused portion of the line of credit grows each month increasing the homeowner’s future borrowing power. Also, unlike the federally-insured reverse mortgages, HELOCs borrowers face the risk of payment shock. During the initial HELOC draw period, only interest-only payments are required, however, after the draw period monthly principal and interest payments are required for a term set by the lender, typically 10-20 years. Certainly, the overall loan costs of a reverse mortgage are substantially higher than a HELOC, but homeowners seeking the flexibility of making reduced or no monthly payments and having a secure growing line of credit may be willing to pay the price of entry.

Older homeowners who choose to get a HELOC could be in for an unpleasant surprise if market conditions lead to their credit line being frozen. Consequently, the HECM deserves serious consideration for those seeking the ability to tap into their home’s equity today, tomorrow, and in the years to come.

Resources:

Chase HELOC Suspensions:Understanding suspended HELOC accounts

[/read]

5 Comments

Shannon,

Very valuable information, good job, this is very important, especially for the reverse mortgage industry.

Thanks for the broadcast,

John A. Smaldone

Shannon,

Why do so many seniors keep exposing themselves to potential cash flow problems by originating or refinancing mortgages that require monthly payments of interest and principal. Some even require require monthly payments of PMI or MIP as well.

Cash outflow can be a cruel and ruthless tyrant in retirement.

Great subject matter!

Thank you Cynic.

Banks simply don’t want to play unless the deck is stacked entirely in their favor. If they are concerned home value’s could drop their not going to be taking positions on that. Whole truth faster I don’t believe a single banking institution could brave a run on it by its depositors.

There all over extended and they all know it. They are simply trying to limit their exposure. OK a

If a HELOC IS cancelled by a lender they should be required to return any fees charged a borrower to secure the line..albeit on a prorated basis to the # of year that the line was in effect. Banks should not profit on duping borrowers on the stability of their initial offering…just sayin.