The 10-year cycle of the reverse mortgage industry

A recent email from a coaching firm got me thinking about the 10-year business cycle. It’s natural to ask if there is such a thing. Is it real? How does this play out in real life? Business consultant and author Samuel Cupp teaches that every 10 years a small business has on average six good years, two great years, and two terrible years. I would argue that the same could be said of reverse mortgage lenders and brokers and large businesses. Let’s examine that cycle and how it may apply to our industry.

[read more]

The 10-year business cycle

Reverse mortgage loan volume has roughly followed the same trajectory described by Cupp. HECM endorsement volume was relatively stable for the six fiscal years of 2012-2018. The fiscal year 2019 was an aberration from that cycle due to changes in HECM principal limit factors, the interest rate floor, and changes to HECM’s FHA mortgage insurance premium structure. 2020 was a year of relative stabilization as endorsements began to return to their previous median volume of prior years followed by two years of surging endorsement volume thanks to interest rate cuts and rising home volumes pushing the fiscal year 2022 HECM volume up 106% higher than 2019’s dismal performance.

All this leads us to the last two years of the cycle. Two years with strong headwinds and setbacks. So if we’re in the two-year downturn cycle, which it appears we are, what can we do? The Entrepreneurial Operating System’s Blog suggests a reverse-accountability chart. What’s that? Well, unlike a typical organizational chart that seeks to fill key positions to accommodate business growth, a reverse chart looks to adjust resources in the future with reduced revenue. In other words, where can I tighten up my spending? Where are my marketing dollars best spent?

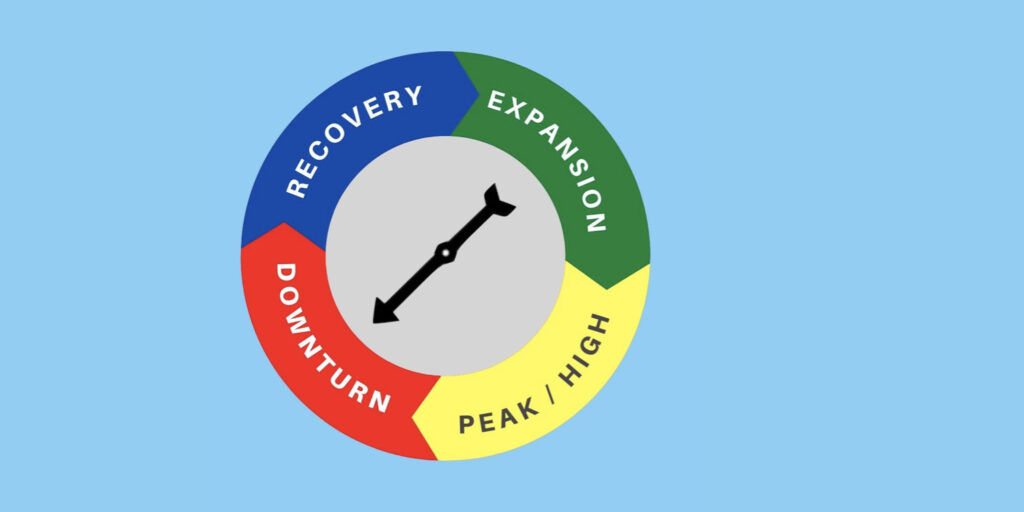

Mortgage lending has generally followed the same waypoints found in the economic or business cycle. The stages are expansion, a peak market, contraction, and a trough or bottom. And most importantly I would add a fifth stage- recovery when a market begins to shift to an upswing in demand and volume.

All markets are cyclical

Knowing that all markets are cyclical should motivate us to analyze our own business practices. Where did we lose focus and overly fixate on a particular type of transaction, such as refinances? How do we continue to steadily attract new borrowers amid a boom so that practice can buffer against a sudden collapse of refinancing transactions? It’s best to address these questions before the next boom and even better to put our new strategies into practice during our current market challenges. In the final analysis, we should never be surprised by a downturn. Call it the circle of life of business and economics. The trick is to find a way to be both positive and proactive.

What do you recommend to survive or even thrive in our present business cycle? I know that you our loyal listeners have a wealth of knowledge that our community could benefit from so please comment below.

[/read]

No comment yet, add your voice below!