Recent FHA case number data reveals a new course in HECM lending

When considering the reverse mortgage industry’s coerced shift away from HECM-to-HECM refinances to first-time borrowers, the analogy of turning an aircraft carrier around comes to mind. However, truth be told a number of variables such as speed, market currents, and wind direction may allow some vessels to execute the turn within 5 minutes.

The challenge for HECM lenders was the irresistible opportunity presented by record-low interest rates and surging home values. The undercurrents of these market forces resisted the incentive to attract first-time HECM borrowers. Consequently, the HECM ship has turned slowly leaving a wake of dismal monthly endorsement totals after the refi boom.

The ‘lag effect’

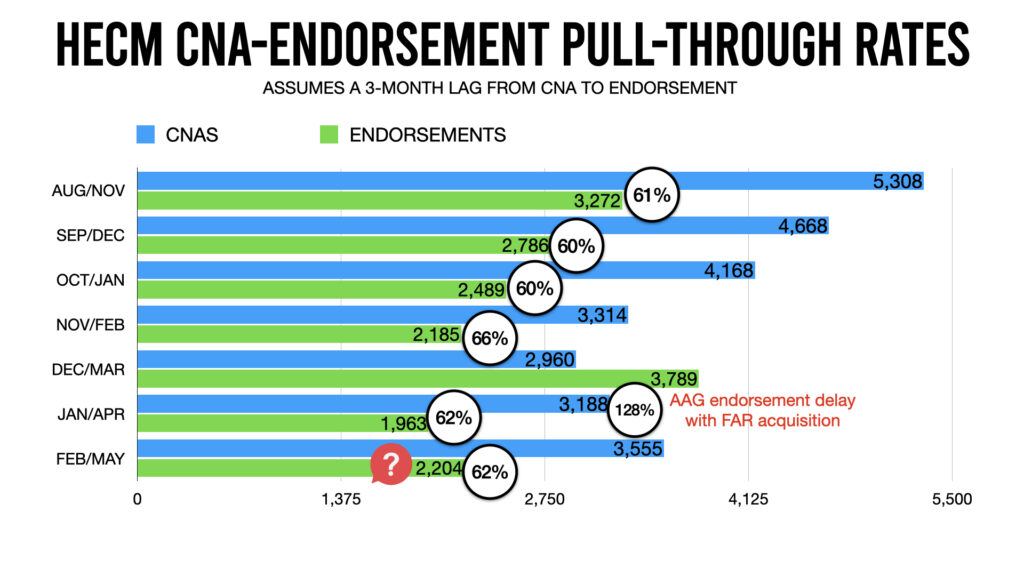

Like an aircraft carrier any course corrections have a significant lag time. In the case of HECMs, the lag between issuing an FHA case number assignment on an application and the subsequent endorsement can take three to four months to be realized.

As the Federal Reserve began its quantitative tightening with a series of interest rate hikes last spring application activity began to fall; much like traditional mortgage loan volumes. In fact, since April 2022 month-over-month HECM case numbers fell each month with the exception of last August. The silver lining, however, is the trough in application activity may have been seen in December which contributed to April’s record-low endorsement total.

Charting a course for first-time borrowers

Yet, the ship appears to have turned toward the new reality of attracting first-time borrowers as evidenced by three consecutive months of growth in HECM case number assignments. Month-over-month case numbers grew by eighteen percent in January, eleven percent in February, and fourteen percent in March.

Necessity and market conditions have shown their undeniable sway in steering us toward a pool of untapped borrowers.

Assuming an average pull-through rate of 62% May endorsements should modestly outperform April’s lackluster endorsement total. However, while the ship may be pointing to attracting new HECM borrowers the headwinds of a softening housing market and potential rate hikes portend a slow recovery from April’s low water point. Not impossible, but slow and steady.

A smooth sea never made a skilled sailor

Every reverse mortgage professional has a small yet vital role to play in keeping the ship pointed toward market expansion despite a turbulent and uncertain market. Perhaps our new motto should echo the words of Franklin D. Roosevelt. “A smooth sea never made a skilled sailor”. Some tough sailors are stepping up to the helm and that’s certainly prudent. We cannot control the currents of market forces, but we can control our approach whether it be in calm waters or a gale. In the end, turning a ship requires patience and a coordinated effort from a skilled crew.

FHA Case Number Assignment Data (FHA Single Family Production Report)

-Shannon Hicks

1 Comment

Shannon,

Great timing on your article and I agree with most all of it. Yet we all know the need for a reverse Mortage has not changed and that we can’t forget! Many seniors are in need of a HECM but have little or wrong knowledge about them.

We need to be out there in front of groups that represent seniors, be putting on workshops, go to your municipalities, most have a department on aging! They may be happy to sponsor a workshop on HECM’S for seniors. Plus, there are many other wats of putting on seminars/workshops for seniors such as teaming up with Elder Law Attorneys, Home health Care providers ETC.

Great article Shannon, really appreciate it,

John