Americans can no longer ignore their economic pain

Last Friday the bond rating agency Moody’s downgraded the United State’s credit rating to a negative. Reuters reports the agency lowered its outlook on the U.S. credit rating to “negative” from “stable” citing large fiscal deficits and a decline in debt affordability.

The repercussions of this downgrade extend beyond the government, affecting American consumers who are grappling with mounting debt burdens amid rising prices for everyday necessities and the reliance on credit cards for routine purchases.

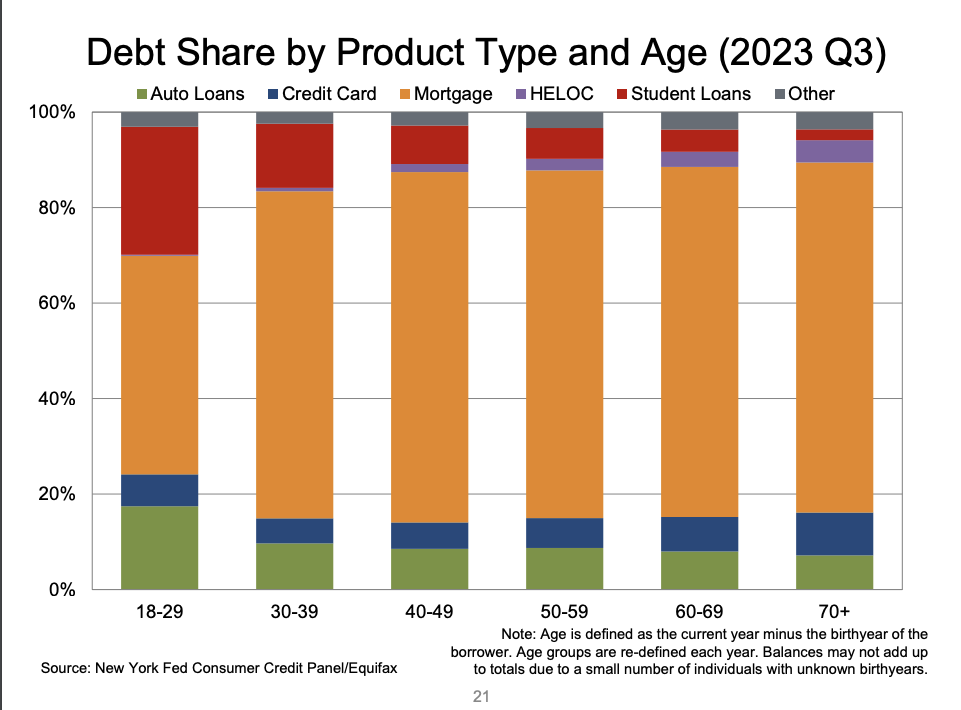

The Federal Reserve Bank of New York’s recent quarterly report on U.S. household debt, released last Tuesday, highlights the widespread financial strain felt across various age groups. The report discloses a significant surge, with total household debt increasing by $228 billion (1.3%) in the third quarter of 2023, reaching a staggering $17.29 trillion. Credit card balances experienced a notable uptick of $48 billion, reaching $1.08 trillion in Q3 2023, indicating a 4.7% quarterly rise. Auto loan balances also saw a $13 billion increase.

[View a PDF of the full report]

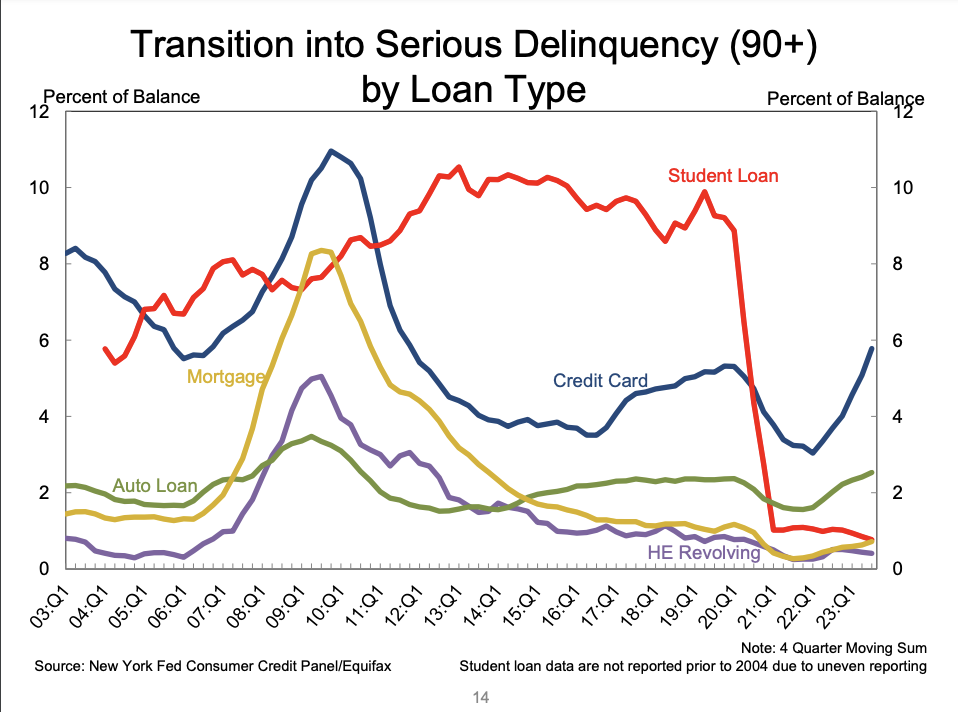

Remarkably, both credit card and auto loan delinquencies are on the upswing, with the trend of individuals transitioning into serious delinquency (defined as 90 days or more overdue) mirrored across all age groups. Interestingly, the most recent data closely resembles the patterns leading up to the 2008 Great Financial Crisis (GFC), characterized by escalating delinquencies, heightened debt, and increased bankruptcy filings.

The data underscores that an increasing number of Americans, including older homeowners, are currently contending with some form of financial distress compared to just a few months ago. While this may signal a potential leading economic indicator of an impending recession, it also provides an opportunity for older homeowners who may have been previously resistant to consider a reverse mortgage. These homeowners could potentially tap into the accumulated value in their homes to alleviate some of their most pressing economic challenges.

Many individuals often delay addressing their financial issues through various means, such as taking on a side hustle, transferring a credit card balance to a zero-interest promotional offer, or using a credit card for purchases when cash is insufficient. However, there comes a point of realization, and an increasing number of Americans are recognizing the urgency. The silver lining for many older Americans is the economic refuge they possess, namely home equity that can be accessed without escalating their monthly expenses.

As a result, those who had dismissed the idea of a reverse mortgage may find themselves reconsidering in light of the undeniable economic realities.

3 Comments

Such events stimulated the peak fiscal years for HECM endorsements of 2997, 2008, and 2009. Each of those years reached over 100,000 HECM endorsements with fiscal 2009 being the peak year with nearly 115,000 HECM endorsements.

The big difference between now and then is that HECM endorsements were on their way up in fiscal years 2004, 2005, and 2006. Each of those fiscal years reached the highest total HECM endorsements of any fiscal year that preceded it. None of those fiscal years had H4P endorsements (HERA of 2008 was the law that first allowed purchase transactions to qualify for HECM endorsements). None of those years saw HECM (formerly HECM to HECM) Refi endorsements reach even 7% of the total HECM endorsements. (Fiscal year 2022 had 28,749 HECM Refi endorsements which was 44.6% of the total HECMs endorsed in that fiscal year.)

Will the financial squeeze among seniors today propel us to the lofty endorsement numbers of fiscal years of 2007 through 2009? Maybe but it will take several years to get there if we get there that soon.

This is test comment on HECM.

Test