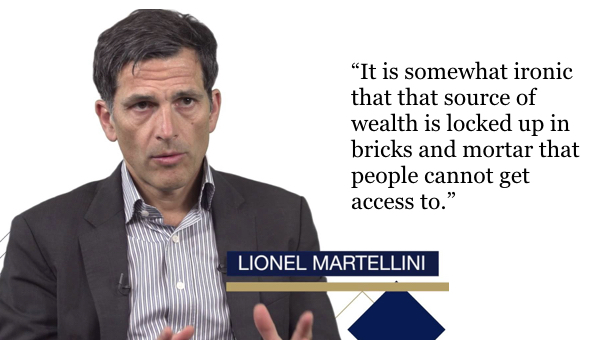

“It’s ironic that the biggest source of wealth is locked up in bricks & mortar…”

While more financial professionals are embracing the HECM, ironically our cousins across the pond seem to better grasp the concept of home equity management and its role in funding retirement. Is today’s choice of retirement investment vehicles adequate to meet the needs of today’s savers and retirees? Can asset management live up to it’s name without including a retiree’s largest tangible investment?

While more financial professionals are embracing the HECM, ironically our cousins across the pond seem to better grasp the concept of home equity management and its role in funding retirement. Is today’s choice of retirement investment vehicles adequate to meet the needs of today’s savers and retirees? Can asset management live up to it’s name without including a retiree’s largest tangible investment?

Hedgeweek is a blog for hedge fund managers and institutional investors…the big players. Moving in the deep waters of asset management, their recent post recognizes challenges similar to those faced by American retirees seeking to fund retirement. Beyond a lack of saving, individual investors are stymied with a choice of investment products that may not meet their needs.

[mailmunch-form id=”538935″]

1 Comment

Shannon,

Thanks for the information.

Our concept of a reverse mortgage is a corruption of the the French model of “en viager.” Europe seems to be trying to catch up with the American view of a reverse mortgage.

For the sake of seniors, it is hard to imagine a government insurance program better than HECM. Yet the financial position of that program is a mess. It is not the model it was once believed to be. Other nations should carefully consider what financial safety measures are appropriate as to their facts and circumstances.