As moratoriums end, seniors stand to lose the most

A federal ban on evictions expired Saturday, July 31st. Consequently millions of Americans are facing the specter of housing insecurity or homelessness. The financial protections put in place for millions of households throughout the pandemic including foreclosure moratoriums, stimulus checks, and unemployment benefit bonuses only delayed the inevitable for some.

While the federal government has extended eviction and foreclosure protections multiple times, it’s unlikely we will see another intervention. However, as we are recording today’s show we should note that anything can happen. Case in point- the rapid increase of new cases of the Covid Delta Variant led the CDC to reverse its recent mask guidance for vaccinated individuals. While Covid hospitalizations and deaths had dropped precipitously the government could justify further stimulus and housing protections due to the potential economic impact of the Delta variant strain.

While eviction moratoriums are scheduled to end on July 31st struggling homeowners have until…

[read more]

September 30th to request a mortgage forbearance. Homeowners who obtained a forbearance last spring have up to 18 months of protection. That means someone who entered forbearance last March would exit forbearance this month. Their choices would be to obtain a loan modification, sell the home, or let the mortgage go into default. Those with an FHA, USDA, or VA loan are not required to make a lump sum repayment of missed payments.

The good news is only 2.9% of all active mortgages are over 90 days late reports the Wall Street Journal. That’s a marked improvement from the 4.4% of households who were delinquent last summer. The bad news is roughly 1.55 million are still seriously delinquent and some of those are over the age of 60. Those who stand the lose the most are those who’ve paid down their mortgage balance significantly over the years and have a strong equity position in the property which would be lost in a foreclosure.

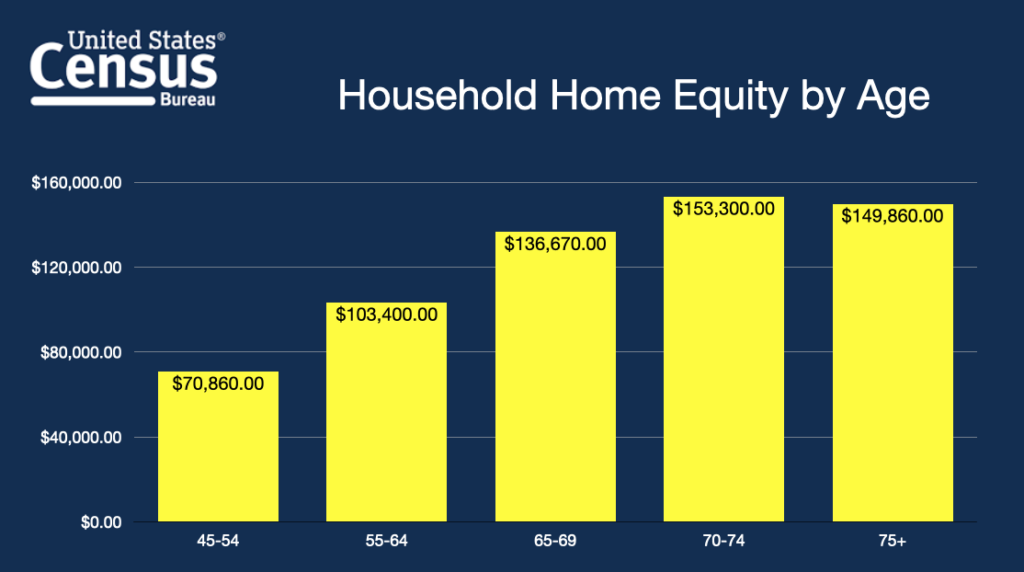

Of all age groups, older homeowners stand to lose the most having accrued significant equity. Census Bureau data shows households aged 45-54 have an average of $70,860 in equity totaling 64% of their net worth. Those aged 55-64 have $103,400 in equity for 61% of their net worth. Homeowners between 70 and 74 have $153,300 in home equity totaling 72% of their net worth. That spells trouble for the struggling homeowner who is delinquent on their mortgage and the opportunity for many to escape potential eviction with a reverse mortgage. This data also confirms that the banks stand to profit the most by foreclosing on older homeowners with substantial equity.

All things considered, we can conclude the following outcomes are likely- There will be a spike in foreclosures across the country, how big we don’t know. Those foreclosures will impact housing values and stand to improve existing home inventory. We can also expect further government intervention and stimulus, especially considering the strong reactions to the Delta variant despite vaccinations. Those emergency measures when added to previous protections will come at a significant economic cost- one that older American’s are ill-suited to absorb.

Moratoriums are winding down and struggling older Americans stand most at risk of losing their accumulated home equity. That’s where you, our viewers, as reverse mortgage professionals can offer a potential remedy to restore housing and financial security.

[/read]

4 Comments

It would seem one obvious potential solution for homeowners over 62, with substantial equity, facing foreclosure would be a Reverse Mortgage. Why choose a foreclosure or a sale without at least considering a Reverse Mortgage?

If it is a Reverse Mortgage going into foreclosure, has anyone considered that the reason might be a potential Medicaid Estate Recovery claim? These claims are against the estate, so they generally are not recorded against the home. It’s almost impossible for even the person on Medicaid to determine the size of the claim because no statements are available. If the Reverse Mortgage balance plus the potential Medicaid claim exceeds the value of the home, foreclosure is an obvious reasonable option for the borrower or heirs. No change in underwriting or Principal Limit factors will stop this type of foreclosure because the Medicaid claim alone can easily exceed the value of many homes. The only way to stop the losses on these homes is to change the servicing process so there is more helpful communication from the servicers. Another thing that would be helpful would be for Medicaid to provide monthly statements showing the patient the size of the potential Medicaid claim. I’ve never seen this issue of how Medicaid claims can create Reverse Mortgage losses discussed anywhere.

Medicaid claims can create forward mortgage foreclosures and losses too. These losses could also be mitigated by changes in servicing procedures. The difference is that Medicaid will create losses on such a small percentage of forward mortgages that the effect will not be noticed. The percentage of Reverse Mortgages affected by Medicaid would obviously be much higher simply because of the difference in demographics between typical forward and Reverse borrowers.

Perhaps the reason that you have never read about Medicaid having a priority higher than a mortgage is that it does not. Unless the claim is against the house, a reverse mortgage would have a higher claim against the market value of the home than others who do not have liens.

To understand your point, please cite the law identifying the specific provision that concludes that Medicaid has a higher priority than mortgages. Since you state that Medicaid files no liens against the home, your case seems very, very weak. I am no expert on Medicaid but to show your expertise, you need to provide more than just conjecture.

My concern is it will be the folks who struggled to make payments BEFORE working with their lenders to take a forebearance that will be in the most struggle to keep their homes, and if there are many other debts that are behind, we may not be able to assist them even with a LESA. Just as the folks who had loan modifications to their mortgages during the recession, I am also concerned about how the banks will “willy nilly” how they handle the payback of the forebearances and the documents will get “lost in transition”. It would be beneficial if there would be a universal method to handle the payback and not leave it up to each individual bank. It might end up being a nightmare, or maybe not, but I believe this will be a long, drawn out event. Yes, we should try to help as many as we can, but we also may see that too many cannot be helped.

I know it is constantly being claimed that voluntary LESAs are a good thing for seniors BUT if the senior is capable of paying property charges timely and the mortgage is an adjustable rate HECM that claim seems highly unlikely.

When it comes to claims about monetary results, well crafted projections with full disclosure is the best approach. Reasonings and anecdotes without full disclosure only adds to the confusion.

If there were a universal approach to paybacks on forbearance, it would by its nature be disastrous. What if all lenders took the position that a lump sum payback was required. Or say that principal payments had to be doubled until the unpaid balance is where it was projected to be on that date according to the amortization schedule provided at closing, no matter whether the mortgage was fixed or variable. The lenders did not create the problem and with the help of Uncle Sam, they should be encouraged to work out the situation with borrowers whenever feasible but only if the lender will not have a loss for doing so.