Sure. The speculation is rampant and varies widely among housing market ‘experts’ and economists. But are today’s housing prices really sustainable?

There are three reasons why the answer is likely a resounding no.

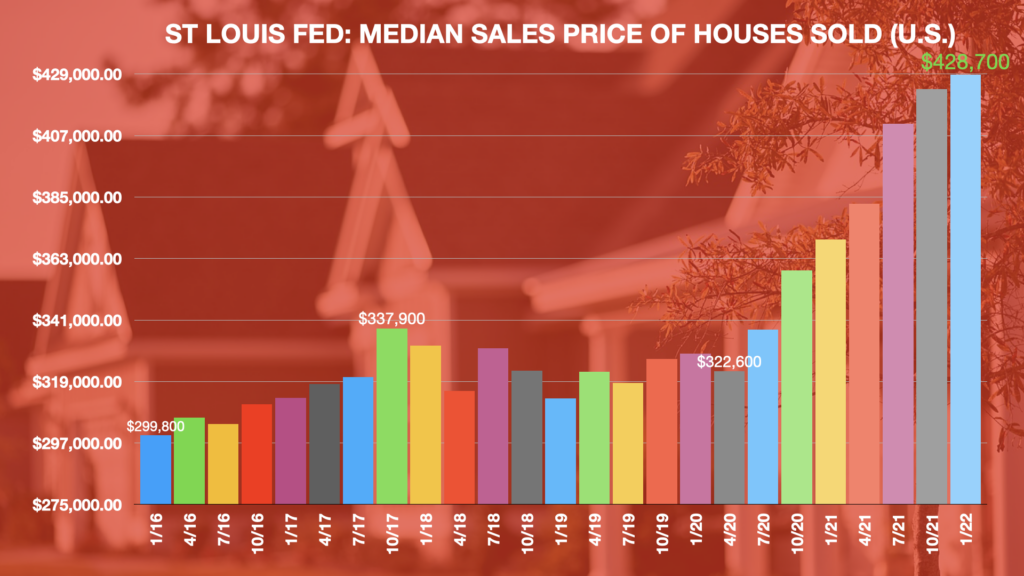

One is current U.S. home prices may be unsustainable is the massive spike in the median home price of homes sold. In January 2016 the median sale price of a home was $299.800. By January of this year, the median price skyrocketed up to $428,700.

The second reason is rising mortgage interest rates. The average 30-year fixed-rate mortgage in the U.S. was 3.92% in January 2016. By November of 2018, the average rate had steadily climbed up to 4.94% at which time the median home sales price was $322,800. Despite a longstanding shortage in housing supply mortgage rates helped moderate the rate of housing appreciation. Driven by worries that Trump’s trade war with China would dampen an expanding economy the Fed began cutting rates in the summer of 2019. The rate cuts continued nearly through the Thanksgiving holiday and plateaued until February 2020.

As the coronavirus pandemic swept across the globe in early 2020 the central bank opened the spigots of cheap money slashing interest rates between February and April. By March the average 30-year mortgage rate was at 3.5%, nearly two percentage points down from its November 2018 high. Consequently, U.S. home prices began to climb and have not stopped surging for over two years.

The third reason is we are entering a recession. Thanks to inflation, a labor shortage, and the war in Ukraine, the U.S. economy is already contracting. Economists had projected positive GDP (gross domestic product) growth in the first quarter of this year of 1.1%. Instead, the economy shrank by 1.4% on an annualized basis in Q1. While some economists argue the results are actually neutral when accounting for seasonal GDP variations, whispers of a recession are growing louder. However, consider this; the U.S. housing market accounted for 17.7% of the GDP in the first quarter of 2021. In other words, the housing market has a significant influence on economic output.

Reverse mortgage professionals typically track our industry’s loan volume or endorsements or any potential regulatory changes to the HECM program. However, as we know, one major factor that determines an applicant’s eligibility is home prices. As we are likely approaching the peak of home values every reverse mortgage professional should begin asking how can I prepare for the inevitable? Where and how can I expand my reach?

Home appreciation rates are cyclical and this cycle has nearly ran its course. Acknowledging this fact is the first step in preparing for the new market norm.

.

2 Comments

Already seeing price declines in certain markets.

Thank you, Ron. In which markets are you seeing price drops?