The real-life impacts of our national debt and inflation will force more Americans to make some difficult choices

Many reverse mortgage professionals have seen homeowners who’ve made numerous poor financial decisions: racking up high balances on their credit cards, spending more than they earn, and not setting aside money for the future.

But there’s another spendthrift whose unchecked spending and accumulation of debt impacts us all. His name is Uncle Sam.

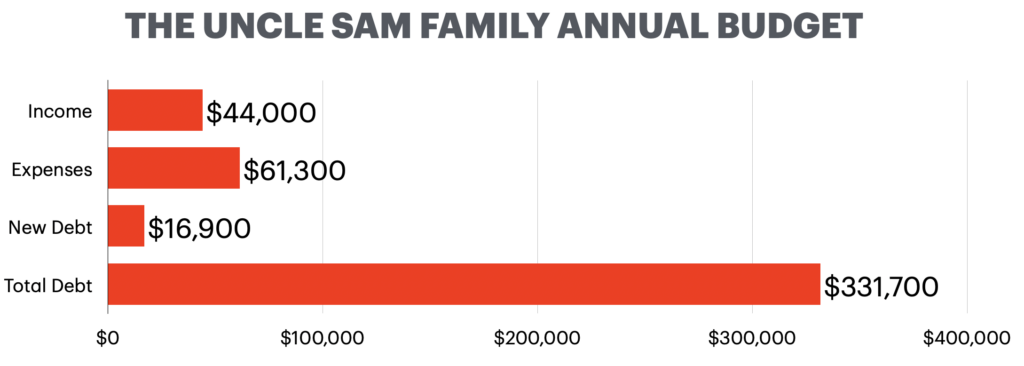

In his column, A Reverse Mortgage on the Country David Thomas simplifies the scope of the federal government’s debt making it more tangible. To simplify matters he deducted eight digits from the nation’s expenditures and income creating a fictitious family unit.

Here are the key numbers from the U.S. government’s 2023 Federal budget:

Uncle Sam’s Family Budget:

Dropping eight digits we can see that Uncle Sam’s family brings in approximately $44,000 each year, has $61,300 in annual expenses, has incurred $16,900 in new debt, and now owes a total of $331,700 to date. However, unlike your neighbor Uncle Sam (AKA the U.S. government) can do one thing to manage his increasing debt- create inflation.

How inflation is used to reduce the national debt

Because our national debt is based on the U.S. dollar reducing the value of the dollar reduces the value of the debt. This transfers the burden of our national debt from the creditor (the Federal government) to the borrower (every current and future U.S. resident). Consequently, every American today is shouldering part of the national debt as inflation erodes their purchasing power and reduces their standard of living.

“Essentially, what we have is a reverse mortgage on the country, a practice where we draw upon future resources to meet present demands”, writes David Thomas.

Older homeowners suffering under the burden of inflation may consider a reverse mortgage drawing from the accumulated value of their homes to offset the hidden tax of inflation that was forced upon them.

In conclusion, our national debt is more than just a number- it’s a game-changer that impacts everyone, especially retried Americans living on a relatively fixed income. With the U.S. debt continuing to climb some hard choices will have to be made as inflation continues to rob us of our purchasing power.

Shannon Hicks

Editor in Chief: HECMWorld.com

As a prominent commentator and Editor in Chief at HECMWorld.com, Shannon Hicks has played a pivotal role in reshaping the conversation around reverse mortgages. His unique perspectives and deep understanding of the industry have not only educated countless readers but has also contributed to introducing practical strategies utilizing housing wealth with a reverse mortgage.

Shannon’s journey into the world of reverse mortgages began in 2002 as an originator and his prior work in the financial services industry. Shannon has been covering reverse mortgage news stories since 2008 when he launched the podcast HECMWorld Weekly. Later, in 2010 he began producing the weekly video series The Industry Leader Update and Friday’s Food for Thought.

Readers wishing to submit stories or interview requests can reach our team at: info@hecmworld.com.

2 Comments

Shannon, great article!

David, thank you very much!