How COLAs Are Determined

The Social Security Administration (SSA) calculates COLAs using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index tracks the prices of various goods to measure inflation, but it doesn’t always reflect the specific costs that impact retirees the most.

The CPI-W tends to underrepresent key expenses for older Americans, such as rising homeowner’s insurance, property taxes, and prescription drugs. In 2024 alone, these costs increased significantly: 21% for homeowner’s insurance, 19% for property taxes, and 5% for prescription drugs. However, Social Security COLAs haven’t kept pace with such surges.

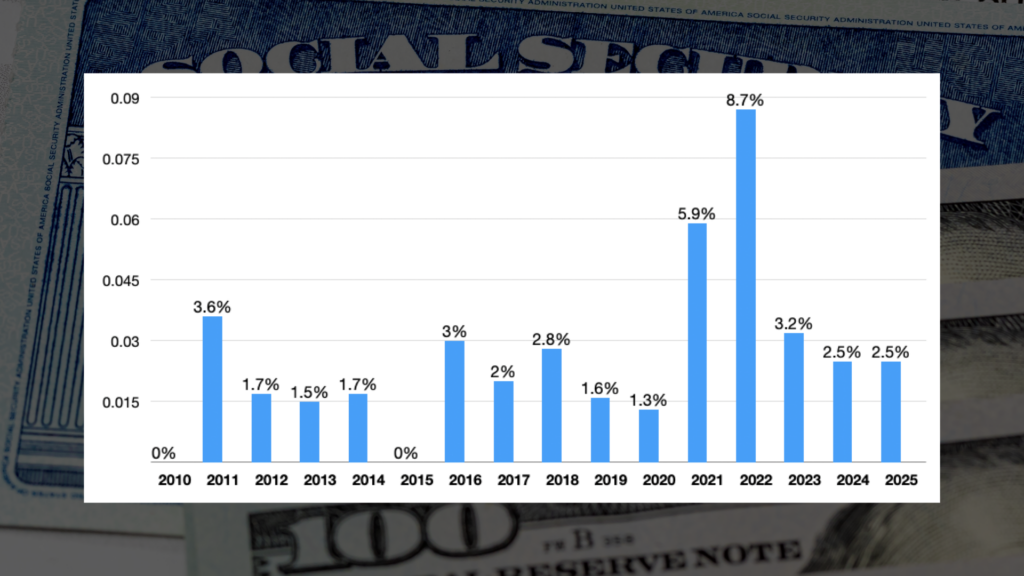

From 2020 to 2024, COLAs increased by 1.3% (2020), 5.9% (2021), 8.7% (2022), 3.2% (2023), and the projected 2.5% for 2024. A retiree who received $1,800 a month in 2019 would see an increase to $2,220 by 2024—an improvement, but not enough to keep up with overall living costs.

Erosion of Purchasing PowerDespite these adjustments, Social Security benefits have lost considerable purchasing power. As previously reported on HECMWorld a 2024 report by the Senior Citizens League found that Social Security benefits have lost around 20% of their purchasing power since 2010. For upper and middle-income retirees, Social Security represents around 30-40% of their total income, while for lower-income seniors, it can account for up to 90% of their income. As inflation outpaces these adjustments, many retirees are left with tough financial decisions.

Reverse mortgage professionals can help uncover the pain of true inflation outpacing a retiree’s income with a few short questions such as:

- What’s your current monthly Social Security benefit?

- What’s your spouse’s? (if applicable)

- By what percentage has your homeowner’s insurance increased in the last year?

- How much have your property taxes increased since 2019?

Comparing these rising costs to COLA increases often reveals a shortfall. This gap forces retirees to make tough decisions: downsize, withdraw more from retirement accounts, cut expenses, or even use credit cards.

The loss of one’s spouse is one of the most painful experiences an individual will face. However, the pain of loss goes far beyond the loss of companionship. If grieving isn’t enough of a burden surviving spouses are likely to face a significant cut in monthly Social Security income despite having reached full retirement age.

For example, a husband receives a monthly benefit of $2,300 and his wife brings in $1,850. After the husband’s death, the wife is entitled to survivor benefits but not her own. The surviving spouse in this example would likely receive the higher of the two benefits but her benefit would stop. That means her monthly income will decrease by $22,200 a year!

When gathering financial information from potential borrowers take a closer look at their Social Security income to understand and mitigate the risks in light of these challenges. In doing so you’re not selling a loan but a solution that could be a lifesaver or an ace in the hole when the unexpected life change does come to pass.

Shannon Hicks

Editor HECMWorld.com

As a prominent commentator and Editor in Chief at HECMWorld.com, Shannon Hicks has played a pivotal role in reshaping the conversation around reverse mortgages. His unique perspectives and deep understanding of the industry have not only educated countless readers but has also contributed to introducing practical strategies utilizing housing wealth with a reverse mortgage.

Shannon’s journey into the world of reverse mortgages began in 2002 as an originator and his prior work in the financial services industry. Shannon has been covering reverse mortgage news stories since 2008 when he launched the podcast HECMWorld Weekly. Later, in 2010 he began producing the weekly video series The Industry Leader Update and Friday’s Food for Thought.

Readers wishing to submit stories or interview requests can reach our team at: info@hecmworld.com.

No comment yet, add your voice below!