Despite MetLife’s exit their endorsements remain on this month’s report. There is a little jockeying around amongst the top 10 and trends indicate some big changes in the coming months. See the full Top 100 Retail HECM Lenders Report for more.

Continue readingInterview with Sarah Hulbert of 1st Reverse Mortgage USA: Industry Image and Future

Exclusive interview with 1st Reverse Mortgage USA’s Sarah Hulbert discussing industry image, regulation, industry volume and marketing.

Continue readingAbundance? Yes even in our industry.

We are surrounded by it although we may not see it. Abundance. Despite our challenges we have much to be grateful for. Learn what in this week’s episode.

Continue readingIndependence Day

It’s almost Independence Day…but as we grow older, and as the need for assistance increases with age, independence again becomes a questionable commodity.

Continue readingMortgage Cadence Acquires Prime Alliance Solutions

News Release: Mortgage Cadence Acquires Prime Alliance Solutions, Inc.

Combining Forces to Provide the Single Best Customer Experience for Lenders and Consumers

June 20, 2012 ˆ Mortgage Cadence, LLC, a leading provider of Enterprise Lending Solutions (ELS), Document Services, Compliance and Default Servicing Technology for the financial services industry, has acquired Prime Alliance Solutions, Inc., the leading provider of mortgage technology and related solutions to the credit union industry. Uniting these two powerful players within the mortgage industry will solidify Mortgage Cadence‚s stronghold as the industry‚s most complete, end-to-end technology provider on the market, capable of supporting the top 10 top banks and lending institutions along with the burgeoning credit union space, while also expanding market share in the community and regional bank arena.

Prime Alliance and Mortgage Cadence share similar histories, culture and visions. The decision for Mortgage Cadence to acquire Prime Alliance was largely based on a shared passion to automate the mortgage process through rules and tasking, ultimately striving to achieve 100% compliant products. Dan Green, previous executive vice president of Prime Alliance who will assume the position of executive vice president of marketing for Mortgage Cadence said, „After our very first conversations with Mortgage Cadence, it was clear we share the same vision for the future of the mortgage lending industry. I expect to quickly combine our already strong companies together and create one brand and extensive product suite that continues to revolutionize the lending landscape by taking a manufacturing approach to the process and creating zero defect mortgages.‰

Prime Alliance and Mortgage Cadence share similar histories, culture and visions. The decision for Mortgage Cadence to acquire Prime Alliance was largely based on a shared passion to automate the mortgage process through rules and tasking, ultimately striving to achieve 100% compliant products. Dan Green, previous executive vice president of Prime Alliance who will assume the position of executive vice president of marketing for Mortgage Cadence said, „After our very first conversations with Mortgage Cadence, it was clear we share the same vision for the future of the mortgage lending industry. I expect to quickly combine our already strong companies together and create one brand and extensive product suite that continues to revolutionize the lending landscape by taking a manufacturing approach to the process and creating zero defect mortgages.‰

Historically, Mortgage Cadence has provided solutions to top lenders and large Credit Unions and has an outstanding track record of implementing Orchestrator® into some of the largest and most advanced financial institutions in the market. With credit unions at the center of Prime Alliance‚s customer base, Mortgage Cadence saw an opportunity to build off of Prime Alliance‚s superior technology and talented team to provide unrivalled solutions to credit unions and their members. Executive Vice President of Sales at Mortgage Cadence, Trevor Gauthier, stated, „I believe that we are combining two of the most innovative groups in the financial services space in an effort to provide the single best customer experience for lenders and consumers. We are already a formidable force in the market, and this transaction exponentially strengthens our position. No other company will have the available technology stack or industry experts that the new Mortgage Cadence brings to bear with the addition of Prime Alliance.‰

Currently, Prime+, Prime Alliance‚s comprehensive, all-inclusive lending solution has been successfully positioned within the credit union and regional lending space. Prime Alliance is acutely aware of the challenges facing lenders today and knows that exceeding their clients‚ expectations has been the key to their success. With the acquisition, Mortgage Cadence will be able to leverage Prime+ as a tried and true solution for this market segment, while also offering Prime Alliance‚s current customer base a migration pathway to Orchestrator‚s enterprise lending suit. Eliminating disparate systems in favor of one, paramount solution will only enable Prime Alliance‚s lenders to exceed customer satisfaction and drive down costs, all while ensuring compliance. „BECU, Prime Alliance‚s creator, and its board of directors, are proud of the Company‚s accomplishments and are eager to see its technology enhanced and its reach expanded. We want Prime Alliance to continue helping our customers remain the best-regarded mortgage lenders in the industry. Doing so requires a strong partner with similar aspirations and talents, and that partner is Mortgage Cadence‰ said Joe Brancucci, founder, chairman, and CEO of Prime Alliance Solutions, Inc.

Prime Alliance will retain its focus and its leadership while building on, and integrating, the two organizations‚ technologies. “Combining our two companies makes tremendous sense. Prime Alliance‚s technologies and ours mesh in ways that significantly benefit all customers, lenders and partners”, concluded Michael Detwiler, chief executive officer and chairman of Mortgage Cadence. “This is an exciting time for both organizations. We will continue to focus on our employees and on our customers. We will offer the most invigorating, creative work environment, inherently providing our customers with leading-edge solutions and world-class customer service. At Mortgage Cadence, our clients are our lifeblood. We work hard to improve the profitability of some of the most forward thinking players in the lending space, and our employees‚ experience and hard work will help take that to the next level. The end goal for our organization has remained constant; provide the last open lending and financial services platform our clients will ever need.”

About Mortgage Cadence, LLC

Mortgage Cadence is the leading provider of Enterprise Lending Solutions (“ELS”) which employ an extensive financial services data model wrapped with a native rules engine to deliver data-driven workflow automation tools to mortgage banks, lenders, service providers and servicers. Mortgage Cadence has developed enterprise solutions that integrate all functions and data elements required to optimize, manage and score lending performance. The mortgage industry is always shifting to meet demands and minimize risks. Mortgage Cadence‚s flexible solutions continue to evolve to meet those needs. To learn more, please visit http://www.mortgagecadence.com

About Prime Alliance Solutions, Inc.

Prime Alliance Solutions, Inc. is the largest credit union service organization concentrating on mortgage lending and is the industry‚s recognized leader in innovative mortgage solutions. Prime Alliance‚s technology is the first and only system that enables fully paperless, completely electronic mortgage lending. More than 30% of all credit union mortgages are originated on Prime Alliance‚s Lending Suite. The Company offers a full family of real estate solutions, including online applications, loan origination software, loan servicing, closing and settlement services and real estate services. Visit the website at www.primealliancesolutions.com.

Sarah Volling

Marketing Manager

P 720.389.0306

F 720.389.0328

Minimize Effort. Maximize Profitability.

Mortgage Cadence, LLC

www.mortgagecadence.com

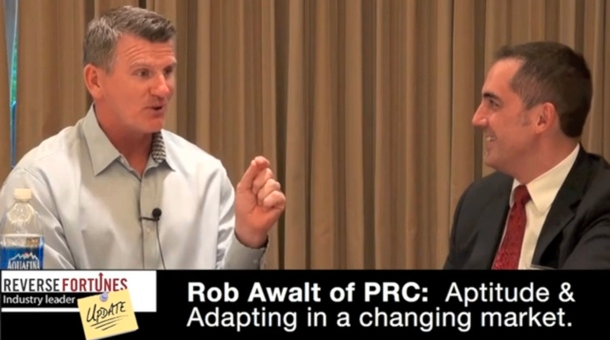

Interview with Rob Awalt of PRC

Rob Awalt of Premier Reverse Closings (PRC) speaks to adapting to a changing market, the skills required to thrive in more in our exclusive interview recorded at the NRMLA Western Regional Meeting in Irvine California.

Continue readingStepping out of your Comfort Zone

The Comfort Zone. We naturally gravitate toward it. But how can we step out as reverse mortgage professionals in a practical way? What rewards can be reaped?

Continue readingIndustry Outlook: Interview with Peter Bell

What is going on behind the scenes and what can we expect this year? See our interview with NRMLA President Peter Bell to learn more about regulation, lawmaking effecting reverse mortgages and more.

Continue readingMorning Ritual for Success

What’s your morning ritual. How you start your day determines the rest of it. Here’s what highly successful individuals have found that works. Five tips to make what you do before breakfast jump start your day!

Continue readingDecision Tree: One Home, So Many Options

Many seniors don’t realize that when choosing a reverse mortgage, they’re at the start of a decision tree resembling a Chinese menu of options — though with a much longer lasting outcome!

Continue reading