Seeing the potential of something with such incredible benefit but lacking the workforce to spread the word must be frustrating. Reverse mortgage professionals can certainly empathize.

Continue readingThe Big Shift in HECM Lending has Begun

Recent data reveals a major market shift is underway

Continue readingHow to be a retirement lifeguard

How to be a retirement lifeguard (and recruit others)

There are millions of older Americans swimming in the pool of retirement. The question is who’s looking after those retirees showing signs of distress or in danger of drowning financially? The best lifeguards are proactive looking for the slightest hint of any problem that could become a life-threatening situation. It takes a sharp-eyed financial advisor to catch a problem before it becomes a crisis, especially when you have hundreds of clients swimming. Some are in the deep end taking the biggest risks, some are in the shallows and prefer to play it safe, while others are quite comfortable regardless lounging along the sides.

[read more]

Let’s be honest. None of us have the wherewithal to protect every retiree in our city, much less those who live on our block. First, you don’t have the time, and second, you don’t have direct access to that pool of retirees because you’re not privy to their financial status. You’re a reverse mortgage professional; not a financial advisor or accountant.

What we’re talking about is not some new scheme that will somehow boost our personal or collective loan volume to new heights. We’re talking about becoming a relevant part of the retirement conversation and helping real people with real needs that may determine the quality of their life, health, and relationships.

One of those needs is being prompted by the big squeeze, otherwise known as inflation. A mere 10% increase in the cost of living can reduce a portfolio’s longevity for retirees drawing fixed-income investments or savings. That’s a 50% reduction or half as many years that their money will last. Any competent financial advisor knows this and will make excess withdrawals due to inflation a key part of their annual review with clients.

As a financial lifeguard, it’s never fun to tell someone that they’re drowning but they just don’t know it. Yet that’s exactly what many advisors will face in that difficult conversation. Will they tell them they need to reduce their expenses or standard of living? Perhaps, but who really wants that? Will their advisor suggest that they increase their investment returns by taking more risks? Not likely if they have a conscience and any common sense. Will they tell them to go back to work part-time or find ways to generate more monthly income? Perhaps, when it makes sense and their client’s health allows for a return to work.

The more likely strategy financial professional may suggest are to increase allocations of energy, materials, and financial stocks while reducing exposure to retail and consumer service sectors. But even if that works will that strategy generate enough earnings to offset inflation. Likely not. That generally leaves one choice, assets. The question is whether to sell an asset outright or slowly dissipate the accumulated equity. To suggest a retiree sell their home, downsize or rent and invest the proceeds is a bitter pill to swallow. After all, who wants to get rid of the home they worked so hard and diligently to pay down or pay off completely? The home where they feel safe and surrounded by memories.

The more palatable solution advisors can present is an asset dissipation plan. One that avoids selling stocks when their share prices are down as a realized loss. A solution that takes some of the winnings off the table while finding more financial assets to extend or preserve sustainable withdrawals. A typical asset dissipation strategy, often called asset depletion, takes a fixed withdrawal from an account to boost income. But what happens when that asset’s value has been drained? It’s gone. However, a reverse mortgage provides the ability to tap into the value of an asset that typically appreciates and outperforms the market without relinquishing ownership or encumbering other assets as security. Now that’s one strategy that could substantially boost any financial professional’s skillset as a retirement lifeguard. Not only could they prevent their client from drowning, but they could actually give them the means to swim with confidence, or even relax along the sides knowing the lead weight of inflation won’t sink them after all.

[/read]

The Big Squeeze

Equity-rich homeowners find themselves squeezed between inflation and a volatile stock market

We should never forget that today’s economy isn’t just a hardship for retirees, for many it’s an outright nightmare. Older Americans are seeing their purchasing power evaporate as they ratchet up retirement withdrawals in the effort to stay afloat. Older renters who don’t have a nest egg of home equity built up are feeling the worst effects of inflation.

[read more]

The Pensacola, Florida station WEAR-TV reports one 64-year-old retiree, Ruby Gilbert, is going back to work and is looking for a job after the rent on her Lantana, Florida apartment was increased from $1,450 per month to nearly $2,000.

Inflation has another insidious side-effect; reduced retirement savings. Many pre-retirees have reduced or halted their automatic retirement savings investments finding life is getting just too expensive to save for tomorrow. The impacts of depressed savings will be felt in the next five to ten years.

All is not lost, however. In fact, one group of retirees may unwittingly be sitting on top of a potential solution to their inflation-driven cash flow woes. Homeowners. Some of the same policies that led to a surge in domestic inflation also inflated home values. And that’s good news for seniors on a fixed income who feel the brunt of inflation with housing, food, energy, and gasoline accounting for 75% of a typical senior’s budget. The challenge is the growth in home values that may help older homeowners has also damaged the overall housing market.

The run-up in home values has become so absurd homebuyers are finally deciding to stand on the sidelines. That’s not surprising considering the recent surge in 30-year fixed-rate mortgage rates coupled with peak home prices has made homeownership unaffordable for millions. Once again the housing market would have been relatively undamaged by a sudden rise in home mortgage rates if home appreciation grew at typical rates of 3%-4% a year. However, the Fed’s policies stoked another irrational white-hot housing market.

That leaves retirees facing uncertainty. For example, the S&P 500 index closed down 18% year to date while Moody’s Analytics data suggests the average home value is inflated by 24% with values outpacing income growth. In such circumstances, older homeowners are being squeezed on all sides with a declining retirement portfolio, inflation, and hundreds of thousands of dollars in equity that could begin to erode this year. Right now it’s too early to tell if we’ll have a housing market crash or a correction but mark my words, we will have one or the other. Housing prices cannot remain at these inflated values without the support of underlying economic fundamentals. Home sales have fallen four months in a row while the number of new home listings is surging across several key U.S. metros. And there’s a dirty little secret hiding in plain sight. The U.S. Census Bureau reports that 13.4 million Americans are either currently in default on their home payments for a mortgage or rent. Nearly 5 million of these households will be foreclosed on or evicted in the next two to three months. While these displacements are genuinely tragic they will substantially increase housing inventory putting pressure on home prices and rental rates.

Ironically loan delinquency rates are down 1.93% month-to-month and 42% less than they were one year ago according to Black Knight data. If the U.S. enters a recession, which seems a likely outcome, expect to see foreclosure start and filings surge. All things considered, older homeowners with considerable equity stand best-prepared to cope with the increasing cost of living. The question is are they aware of their options?

Census Bureau housing foreclosure & eviction data

[/read]

Why Wall Street landlords matter

Hedge fund landlords could lose big

Institutional buyers of single-family homes are about to take a bath- a bath in red ink. Why should reverse mortgage professionals care? Because institutional buyers have in part helped drive up home values since the pandemic, and soon they may be a major factor in several markets pushing down home values. We’ll get to which cities stand to be impacted the most in a moment.

Presently several forces are converging to put the hurt on institutional landlords. First…

[read more]

investor profitability on rentals is falling. Data from Zillow reveals the cap rate or capital rate- that’s the difference between the rent collected less the cost of the loan and expenses, is falling. Much of the erosion of profits or the cap rate can be attributed to rising mortgage interest rates. Next, corporate landlords are having to reduce rental rates for properties that have languished on local listings. Progress Residential, one of the nation’s largest landlords with over 80,000 units, is just one corporation feeling the pressure of a faltering real estate market. While home values are precariously perched for a fall, Progress has had to increase the interest paid to investors on its mortgage-backed securities from 2.2% in the summer of 2021 to 5.3% in June of 2022.

Redfin reported that investors’ home purchases have dropped 17% from their pandemic highs. A trend the real estate watcher expects to accelerate. These institutional investors have a huge market presence in several metros across the U.S. The percentage of homes purchased by investors or firms in the first quarter of 2022 was 33% in Atlanta, 32% in Jacksonville, Florida, 29% in Phoenix, and 28% in Miami. That means the housing market in these areas is likely to follow the fortunes or losses of corporate landlords. Investor purchases shockingly account for as much as 60% or more in several zip codes in southern Atlanta. Investors, big and small account for 20% or one-fifth of all single-family homes in the U.S.. That’s 20 million homes that could be sold as evictions and delinquent payments surge. This sell-off would open up home inventory, lower prices, and help homebuyers possibly find and qualify for a home at today’s higher interest rates.

Then there’s the California Connection. In its May 2022 report, the California Association of Realtors reveals that active listings for houses are up 46% from one year ago and pending sales are down 30% from May 2021, that’s the worse decline since the pandemic. While seeing a more balanced home market is good the importance of the California market cannot be overstated. In fact, over one-quarter of 26% of HECM endorsements in the fiscal year 2021 originated in the Golden State.

There are several scenarios that could play out this year and next, and quite frankly trying to predict the outcome will guarantee one thing failure. However, looking at this data a few likely outcomes can be examined. One possibility is that home prices will continue to drop as mortgage rates climb, investors sell off their inventory and get out of the landlord business, and stagflation sets in. In such an outcome many older homeowners would find themselves with a limited window of opportunity to secure current home values and interest rates before they get priced out of HECM eligibility. A better case scenario, such as the one described by economist Mark Schniepp at NRMLA’s western meeting would see inflation peak and then begin to fall as part of a strong global economic recovery. In this scenario, interest rate hikes would likely cease or even be curtailed which would revive a weakened housing market. Which scenario is likely? I tend to lean on the advice to hope for the best and prepare for the unexpected. The bottom line is the housing market has benefited millions of older HECM-age-eligible homeowners increasing their net worth, even as the stock markets eventually fell. And that’s good news because even when inflation eventually abates the high prices will remain in most cases as our new normal or baseline cost of goods and services..

[/read]

HECM Interest Rate Pain & Perspective

The immediate pain is real but don’t overlook the long-term ramifications

The Federal Reserve is frantically pulling at its last lever to curb runaway inflation, which is a series of increases in the central bank’s benchmark lending rate.

For many, this comes as no surprise. On this show, I predicted that the Fed would have to enact more drastic interest rate hikes and more often than announced. And that’s exactly what happened last Wednesday when the Federal Reserve’s Board of Governors voted to increase its benchmark lending rate by .75 basis points. The largest single increase since 1994. And the Fed has signaled another three-quarter point rate hike is likely in July.

Consequently, the index that’s keyed to the federally-insured reverse mortgage has been climbing. In fact the index has more than doubled since March 1st of this year.

[read more]

Consequently, the index that’s keyed to the federally-insured reverse mortgage has been climbing. In fact, the index has more than doubled since March 1st of this year. As of last Thursday, the 10-year Constant Maturity treaty rate was hovering just below 3.5%. As an originator, this can be both frustrating and disheartening. Borrowers who once qualified no longer have the funds required to close due to a spike in the expected interest rate. Pricing on HECM loans deteriorates from market conditions outside your control.

But before your throw in the proverbial towel consider the following. The last time the HECM’s average expected rate was nearing six percent (that is the base 10-year constant maturity treasury rate or CMT + plus the lender’s margin) was in 2005 and 2006 as housing prices began to take off in the years leading to the housing bubble and economic crash. In 2005 the national median home price was $241,000. In 2022 that number has nearly doubled to a median home sales price of $428,700.

Of course, the HECM’s principal limit factor ratios were much more generous at that time and the outstanding mortgage balance owed for most was nearly typical of that which we see today. However, unlike in 2005 older homeowners are facing historic inflation. So much so that some fear we will see hyperinflation or runaway inflation where a consumer’s pay raises or retirement adjustments are not enough to keep up with the increased cost of living.

In such circumstances, older homeowners could quite frankly care less what their expected interest rate may be. They just want to know if they simply qualify. And, yes, certainly many who would have qualified a few short months ago are no longer eligible due to rising rates but here’s the silver lining. Outside of those on the cusp of qualifying for a reverse mortgage and waiting too long are hundreds of thousands of seniors with ample equity and a genuine need. A need that is no longer easily swept aside. That need is for increased cash flow.

While we sought to move further away from the ‘needs-based-borrower’ another cohort of potential borrowers was silently surging. Those with moderate to low mortgage balances never gave a reverse mortgage serious consideration. After all, why would they 5 years ago? Inflation was at a meager 1.7% and the national average for a gallon of gas was $2.42. But how quickly things change. Even the so-called mass-affluent retiree with between $100,000 to $1 million dollars in liquid assets may find themselves needing to tap other assets to offset the ravages of inflation.

Certainly, the immediate effects of surging interest rates are downright ugly for pricing, eligibility, and your income but don’t forget that the reverse mortgage that so many once rejected or even repudiated is going to become much, much more appealing. And you are the one who knows how the largest asset they’re living under may in fact be their saving grace.

[/read]

Fear, loathing and stagflation

Now is the time for homeowners, financial professionals, and mortgage brokers to put aside notions based on bias and instead embrace the reality that most retirees are facing at this present moment

Continue readingIt’s time to raise the interest rate floor

Why it’s time for HUD to increase the HECM’s interest rate floor.

Continue readingThe HECM industry is at a crossroads

Where we stand

It’s not just the housing market that’s poised for a big shift. So is reverse mortgage lending. While industry participants have typically concerned themselves with potential changes to the federally-insured Home Equity Conversion Mortgage program or state regulations another sea change is approaching the horizon.

There’s an old investing adage that says, “don’t fight the Fed”. In other words, wise investors align their financial decisions with the current monetary policy of the Federal Reserve. Mortgage originators of all stripes did just that. Mortgage lenders certainly did.

For the last two…

[read more]

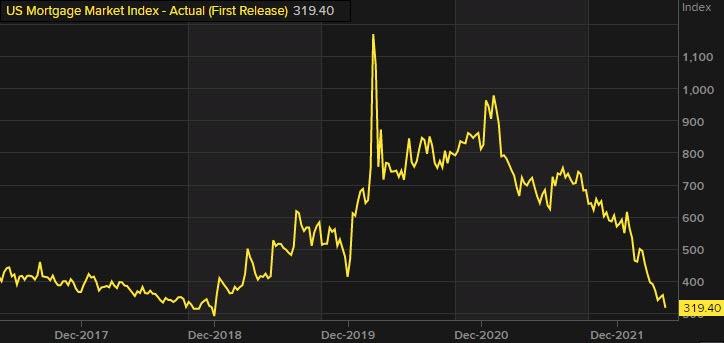

years refinance transactions have been the rage as the central bank slashed interest rates in the effort to stave of a recession due to Covid-19 shutdowns and stay-at-home orders. However, by late April after a series of rate hikes by the Fed, mortgage refinance volume collapsed to 68% less than it was one year ago. Can we expect the same for HECM refinances?

Quite honestly it’s too early to tell. FHA’s March HECM snapshot shows that 48% of all HECM transactions were for refinances. In the same month, 40% of FHA case number assignments for submitted HECM applications were for HECM-to-HECM refinances. What’s notable is that are nearly 10% fewer applications for a refinance than in January of this year and that may actually be good news.

In March traditional non-refinance and purchase applications accounted for 59% of all case number assignments. That’s a notable increase from January when only 50% of case numbers were for traditional and purchase HECM applications. Anecdotally this seems to indicate with fewer refinance opportunities available originators returned their focus to finding new first-time HECM borrowers.

To even the casual observer it’s quite obvious that rising interest rates and flattening home values will splash a modest amount of cold water on both traditional and mortgage lending volumes. However, reverse mortgage professionals have a unique advantage over traditional mortgage lenders. While unfortunate, inflation will thwart the ability of many middle-aged Americans to adequately save for retirement. While retirement deposits decline home equity will continue to accrue with the forced-savings plan which required mortgage payments require; all to the homeowner’s benefit; a benefit which they may be able to tap into using a reverse mortgage.

It would be both prudent and desirable to see non-refinance HECM volume continue to increase to replace what was once a reliable source of funded loans. After all, like the seasons bring hotter days and chilly nights, HECM refinances will become the notable exception rather than the rule. Despite rising rates and uncertain home values, our turbulent economy is increasing the necessity for additional cash flow. And that is where we ultimately stand.

[/read]

The mortgage meltdown: Are reverse mortgages recession-proof?

The mortgage meltdown.

Are reverse mortgages the recession-proof solution?

The pieces are now falling into place. Consumer spending has dropped considerably. Large ticket items and even housing could see deflation. Inflation is crushing consumers who are now cutting back on discretionary spending. Last week the nation’s two largest retailers Walmart and Target reported massive drops in profits. Target alone shed 25% of its stock value last week after reporting a stunning 52% drop in profits. CNN Business reports Target was also forced to write down the value of excess inventory that’s just sitting in warehouses. In other words, consumers are on strike only buying necessities.

Traditional mortgage lending is feeling the full force of economic forces that have returned to roost after a decades-long absence; inflation and rising interest rates.

On the supply side…

[read more]

the National Association of Homebuilders released a report that homebuyer traffic for new homes is down 29% year-over-year from May 2021. In a statement, the association said, “In a sign that the housing market is now slowing, builder confidence took a steep drop in May as growing affordability challenges in the form of rapidly rising interest rates, double-digit price increases for material costs, and ongoing home price appreciation are taking a toll on buyer demand.”

The finance side of the housing market is feeling the full force of this economic storm. The average 30-year fixed mortgage rate began at 3.66% in February and is now floating around 5.45%. Consequently, purchase and refinance applications have tumbled. Mortgage News Daily reports both suffered double-digit hits with its Market Composite Index that measures application volume dropping 11% from the previous week. Year-to-year application volumes are down 15%. Refinance volumes have fallen off a cliff. Today home refinances are down 76% from May of last year.

The issue is not merely interest rates. Case in point, in November 2018 the average 30-year fixed-rate loan was nearly five percent or just one-half point less than today’s average rate. The rub is both the massive inflation of home values and consumer goods. The median home price in November 2018 was $322,800; today it’s $428.700. The Consumer Price Index (a measure of the inflation of consumer goods) was only 2.2% in November 2018. Today the annually-adjusted inflation rate is estimated to be 8.5% It’s natural that higher mortgage payments coupled with the rapidly-increasing price of consumer goods is pushing many out of the housing market and forcing others to discard any hopes of a cash-out refinance or HELOC.

As a result, many mortgage lenders are now eying reverse mortgages, and who could blame them? Unlike younger homeowners who have little or no equity, older homeowners are sitting on trillions of dollars of accumulated equity- many who would qualify for a reverse mortgage, even at today’s interest rates.

Anecdotal reports already indicate today’s changing market is pushing many who’ve previously considered a reverse mortgage off the fence. Traditional mortgage lenders without a reverse mortgage division will find the move into reverse not only logistically challenging but culturally foreign to most of their originators. However, those lenders who have already bifurcated their business into traditional and reverse can more easily pivot prioritizing their investment and energies toward reverse lending. Wholesale mortgage brokers will be shopping for turn-key reverse mortgage business models.

One thing is certain. The historical increase in reverse mortgage loan activity corresponds with the number of lenders actively originating the loan. Does this mean we will see the return of one or two large retail banks? It’s too early to tell. However, with necessity being the mother of innovation we can expect to see more small to midsize banks and mortgage lenders move to reverse. In the end, that’s a good thing.

[/read]