Here’s why seniors with credit card debt could be worse off in 2022.

Continue readingThe Fed Announces Two Big Changes for 2022

Inflation is at a 39-year high and it appears not to be transitory. As a result, last Wednesday the Federal Reserve announced last Wednesday they will reduce their bond purchases twice a fast as previously planned and plans on raising interest rates three times in 2022…

Continue readingRetirees need to face their Financial Fears

Covid-19 isn’t the only pandemic spreading across our nation. Fear and uncertainty are just as contagious. Two particular groups are especially worried- older Americans nearing retirement and those who are already entered their non-working years

Continue readingHECM Lending Limit Increase: Here’s Who Benefits the Most

Which homeowners will benefit the most? We examine three specific groups who…

Continue readingHECM growth in 2022 will hinge on One Word

True market growth of the HECM is likely to hinge on ONE WORD…

Continue reading7 Takeaways from FHA’s Annual Report to Congress

7 takeaways from FHA’s report to Congress

Each November our industry eagerly awaits the release of FHA’s Annual Report to Congress on the status of FHA’s Mutual Mortgage Insurance Fund, and more specifically, the HECM’s performance. Today we will look at seven key takeaways from that report.

First- Over half of all HECMs were originated in 10 states.

[read more]

California is truly the golden state when it comes to HECM originations ranking in first place for all federally-insured reverse mortgages since 2009. According to the Independent Actuarial Review for Fiscal Year 2021, over half of all originations came from the following states: California, Florida, Arizona, Colorado, Texas, Washington, Utah, Oregon, New York, and Nevada. Today, these states account for 71% or nearly three-quarters of all HECM origination volume.

Second, Maximum claim amounts surged with home values. A surging housing market amid the pandemic boosted HECM Maximum Claim Amounts to a staggering average MCA of $433,870, up from $389,378 in 2020. The geographical concentration of maximum claim amounts means that the future performance of the HECM and its economic value will be heavily dependent on home price appreciation or depreciation in a handful of states which include California, Florida, Texas, Pennsylvania, and New York.

Third- The real estate market is king. When it comes to the HECM’s capital ratio inside FHA’s Mutual Mortgage Insurance Fund the impact of home prices significantly outweighs other factors. In fact, the MMIF capital ratio is three times more sensitive to a mere one-percent decrease of home price appreciation than a one-percent decrease in interest rates.

Fourth- A backlog of mortgage forbearances remains. Foreclosure moratoriums have been extended repeatedly since the beginning of the pandemic. While many borrowers have come out of forbearance there is still a sizable cohort of loans that could emerge from forbearance in the next six months which could strain the capacity of FHA and negatively impact the overall MMI Fund.

Fifth- Both the forward and HECM program’s capital ratios have dramatically improved. Since 2017 the forward stand-alone capital ratio inside FHA’s MMI Fund has doubled to a positive 7.99 percent. The HECM portion dug itself out from a negative 18.30 percent in 2017 to a positive 6.08 percent The improvement of the overall FHA capital ratio to 8.03%, which is well above the Congressionally-mandated 2% threshold, has led to renewed calls to reduce FHA insurance premiums for first-time homebuyers.

Sixth- Problematic HECMs originated between 2009-2013 are dwindling. The popularity of fixed-rate full draw HECM loans in the years following the housing crash of 2008 were problematic increasing assignments and payouts from FHA’s insurance fund. The good news is that cohort of vintage loans has decreased significantly.

Seventh- Type 1 insurance claims where HECM properties were sold at a loss have steadily dropped since 2015. In addition, low interest rates are slowing Type 2 claims which are for the assignment of HECM loans that have reached 98 percent of their original maximum claim amount.

[/read]

Equity Erased- It’s not what you think

Equity erased- and no it’s not always a reverse mortgage

Often critics and media pundits disparage the reverse mortgage loan as erasing a homeowner’s accumulated equity. Do reverse mortgages consume accumulated equity? Certainly, when the homeowner is not making payments. Reverse mortgages are negative amortization loans in which unpaid interest is added to the previous month’s principal balance. However, the equity is not ‘erased’ until a triggering event takes place. This week we look at the ways an older homeowner’s equity can actually be erased with or without a reverse mortgage.

Fraud-

[read more]

The first is Fraud- The Asheville Watchdog, a local publication in Asheville North Carolina reports that several elderly Black homeowners were allegedly defrauded by a local attorney and his real estate holdings company. Several homeowners reported being approached shortly after a mortgage or tax foreclosure notice was filed alleging they unknowingly signed deeds releasing interest in the property. In one instance a family received $1,200 only to see the property resold the same day for $45,000. In another case last September a judge returned home to a family after finding the same company obtained the property by fraud.

The next way equity is erased is by foreclosure. Traditional mortgage borrowers who default on their payments stand to lose any remaining equity in the home in a foreclosure. In fact, delinquent borrowers with substantial home equity are most likely to see an expedient foreclosure as the bank stands to recoup some or all of their lost payments.

Loss of employment. The leading cause of foreclosure is the loss of employment and income. Foreclosure trends may be localized based on regional unemployment or business closures.

The loss of a spouse. The loss of a life partner is not only emotionally devastating but can often have catastrophic financial consequences. The common challenges surviving spouses may face are the loss or reduction of pension payments, a reduction of Social Security benefits, or the loss of income if they were still working.

Adjustable-rate loans. Thanks to low fixed-rate mortgages in the wake of the 2008 housing crisis few older homeowners currently have ARMs or adjustable-rate mortgages and that’s good news. Unlike adjustable-rate reverse mortgages where interest rate changes have no impact on the homeowner’s cash flow, traditional ARMs can lead to payment shock when rising interest rates increase the required monthly mortgage payment.

Credit card debt. Sadly, some homeowners prioritize credit card payments over their mortgage payments leading to an eventual foreclosure. This is most unfortunate as some may be able to negotiate payments or file bankruptcy to eliminate their liability with creditors. It’s better to protect the roof over your head instead of worrying about your credit score.

The other ways one can see their equity erased are divorce, overspending, health emergencies, and financial shocks. And speaking of shocks inflation shows no signs of slowing or being ‘transitory’. The increased cost of living for older homeowners on fixed incomes could leave some facing the specter of foreclosure. So do reverse mortgages suddenly erase equity? No. However, they do use a portion of the home’s value and subsequently consume equity over time while the borrower enjoys the benefit of loan proceeds or the elimination of their previously required mortgage payments.

Rather than claiming reverse mortgages erase equity perhaps now is the time to erase misleading statements, hyperbole, and harmful advice that often ignores one’s largest financial asset.

[/read]

Why so few? It’s complicated.

Why so many don’t consider a reverse mortgage.…

Why so many don’t consider a reverse mortgage.…

“The numbers are worrisome. The typical 54- to 64-year-old with a 401(k) or IRA owns a median portfolio worth about $135,000 and more than a quarter of workers don’t have retirement savings accounts”, writes Chris Farrell in his column Is This a Good Time to Get a Reverse Mortgage in Next Avenue.

Considering the stark figures Farrell just cited the word ‘yes’ comes to mind. And the fact that homeownership for households 65 and older has risen to 81% according to the Harvard Joint Center for Housing Studies, would further bolster the argument that now is the time for many to at least look into a reverse mortgage. But many may not. It’s complicated. Laurence Kotlikoff, a Boston University economics professor and expert on personal finance and retirement planning explains. “I went from not liking them to thinking they aren’t as bad as I thought”.

So why are reverse mortgages not going mainstream, as many of us in our industry have hoped? Kotlikoff puts it this way. “I looked more carefully with our software, and it got me back to not thinking favorably about reverse mortgages,

[read more]

It’s a complicated product to get your brain around. If you couldn’t come up with any other option to stay in the home, then use a reverse mortgage.” Farrell agrees.

Therefore in his upcoming book Money Magic: An Economist’s Secrets to More Money, Less Risk, and a Better Life, Kotilikoff suggests a number of alternatives to a reverse mortgage. A multigenerational home, renting out rooms on Airbnb, or a sales leaseback are just a few options he suggests.

What is a multigenerational home? The U.S Census Bureau defines a multigenerational home as a household that consists of more than two adult generations living under the same roof or grandparents living with grandchildren under the age of 25. Ironically, before the advent of FHA, government-backed financing, and suburban developments such an arrangement was the norm for millions of Americans.

A sales leaseback entails the homeowner selling their home to a family member or company, possibly pulling out some equity, and continuing living in it while making monthly rent payments to the buyer. Unlike a reverse mortgage, this strategy requires relinquishing ownership to another party. Renting a room or accessory dwelling unit on Airbnb sounds appealing but typically requires approval from local authorities, the ability to provide regular thorough housekeeping or to hire out cleans, a loss of privacy, and liability insurance.

Each of the alternatives to a reverse mortgage has its own wrinkles and complications. But let’s look again at why many see today’s reverse mortgage is complicated. One reason the Center for Retirement Research at Boston college cites is homeowners’ aversion to borrowing again, whether they have a low loan balance, and especially if the home is paid off free and clear.

The California Department of Real Estate’s brochure Reverse Mortgages. Is One Right for You says reverse mortgages are more complicated than conventional loans and that the consequences of the various plans and options offered in the loan are not always obvious? In fact, there are dozens of state and federal consumer publications that describe the loan as complicated.

While these are valid explanations for why reverse mortgages appear to be complicated, they ignore one obvious explanation that’s hiding in plain sight. It’s a counter-intuitive loan. As the name implies it flips the idea of a traditional mortgage on its head. That in itself is enough to give some pause, and that’s to be expected. But I would caution, what seems simple to reverse mortgage originators is often intimidating and ambiguous to others. Finding a way to bridge the homeowner’s basic understanding of their traditional mortgage works to how a reverse mortgage function differently is key.

What’s your opinion? Leave your comments below.

Stories mentioned in this article:

Next Avenue: Is This a Good Time to Get a Reverse Mortgage?

Centers for Retirement Research: Home Equity: Useful but Unused

California Departement of Real Estate: Reverse Mortgages. Is One Right for You?

Harvard Joint Center for Housing Studies: Housing America’s Older Adults

[/read]

Two things that should be in every retirement plan

Two assets are typically ignored in retirement financial planning. One is Social Security claiming, that is the most advantageous way to structure Social Security benefit payouts. The other is…

Continue readingA window of opportunity is closing

As the housing market cools 2022 will require a pivot away from HECM refinances. Older homeowners stand to gain the most today.

As the housing market cools 2022 will require a pivot away from HECM refinances. Older homeowners stand to gain the most today.

In the first week of October traditional mortgage application volumes have plummeted to a three month low, and traditional mortgage refinances transactions are 16 percent lower than the same week one year ago. Then in late September the Federal Reserve signaled they would be tapering its $120 billion purchase of U.S. Treasury bonds and mortgage backed securities.Then there’s housing inventory which is up 30 percent since May. While some of these factors are not directly tied to the reverse mortgage market each will have an impact on interest rates, and most importantly, consumer sentiment in the housing market.

Meanwhile, U.S. homeowners 62 and older are sitting on a mountain of home equity. NMRLA’s RiskSpan Reverse Market Index shows senior housing wealth grew by 3.7 percent from the first to the second quarter of 2021 for a record total of $9.57 trillion. Is the window of opportunity closing for these equity-rich homeowners who haven’t got a reverse mortgage? It may be for those that have a high mortgage balance that leaves them on the cusp of qualifying at today’s interest rates and record home values. Then there’s older homeowners with little or no mortgage balance are likely to qualify in the future, albeit with higher interest rates and potentially lower home values.

Who would of thought we would see such ideal an ideal housing market and favorable lending conditions in an economy many expect is headed into a deep recession? However, as the housing market inflated the purchasing power of the U.S. dollar was steadily eroded by inflation, so much so that Social Security recipients will see a 5.9% cost of living adjustment in 2022 as we reported last week.

So the logical question is what’s next? First is the pivot.

[read more]

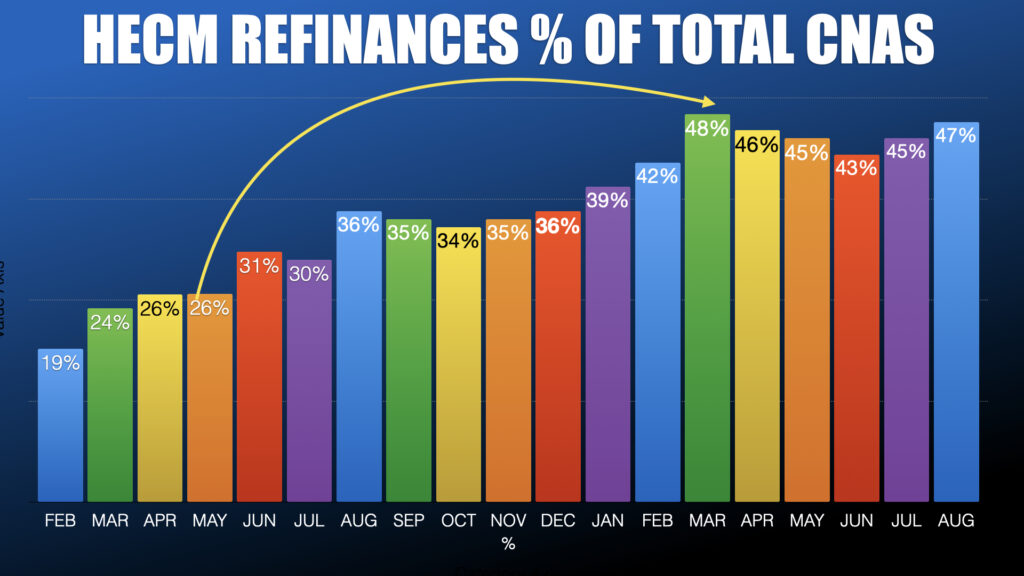

Since March HECM-to-HECM refinances have accounted for nearly 50% of all applications. Surprisingly that trend has persisted revealing that the market’s refi potential may not be quite tapped dry. But at some point it will. Looking forward to 2022 HECM the majority of endorsement volume will have to be drawn from first-time HECM borrowers. Today anecdotal reports show lenders and brokers are anticipating a move to a more customary lending market and are planning accordingly.

Since March HECM-to-HECM refinances have accounted for nearly 50% of all applications. Surprisingly that trend has persisted revealing that the market’s refi potential may not be quite tapped dry. But at some point it will. Looking forward to 2022 HECM the majority of endorsement volume will have to be drawn from first-time HECM borrowers. Today anecdotal reports show lenders and brokers are anticipating a move to a more customary lending market and are planning accordingly.

The shift to a more typical HECM market in 2022 is likely to be aided by increasing inflation and a growing sense of unease about the American economy. If history has taught us one thing it’s that financial need or anxiety are often the forces that push most to even consider a reverse mortgage in the first place. Certainly there are the mass-affluent who see an opportunity to hedge their future cash flow, but for most it’s a pragmatic decision fueled by their current financial circumstances. And that’s our window of opportunity. Record home values and low interest rates amidst an economy that’s flashing the warning signs of a recession and possibly stagflation. This increasingly makes the reverse mortgage an increasingly attractive bulwark against the ravages of inflation and economic hardship.

.

[/read]