In the wake of being blindsided by the most recent HECM changes, industry leaders are calling for stability…

Continue readingDiversification: HECM Lenders Expand Their Offerings

With the HECM becoming increasingly unpredictable, many reverse-only lenders are expanding to offer traditional mortgages…

Continue readingBREAKING- HECM Report: Losses & Future Impact

New Report Separates & Exposes HECM Liabilities

HUD’s most recent actuarial review and net value of the Home Equity Conversion Mortgage sent shockwaves through the reverse mortgage industry last week.

**Listen to this week’s podcast for the latest reverse mortgage news stories**

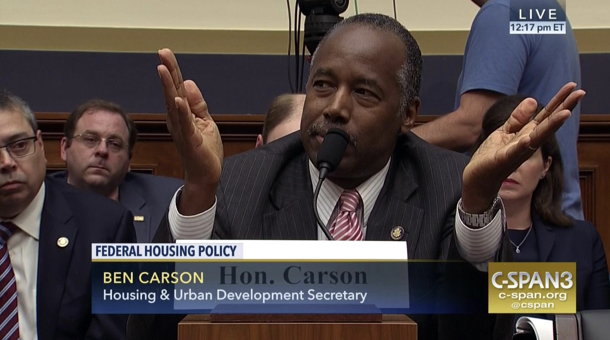

The 2017 Fiscal Year actuarial review of the HECM portion of FHA’s MMI fund showed a present negative net worth of $14.2 billion and a standalone negative net worth of $14.5 billion. With the traditional or forward mortgage book of business generating a positive cash flow value of $1.89 billion, the rationale behind repeated calls by both lawmakers and even the support of HUD Secretary Ben Carson to remove the HECM from the MMI fund become increasingly clear.

One could safely assume that HUD was aware of these developments when it chose to enact further cutbacks to the HECM by decreasing lending ratios in the effort to prevent future losses. Referencing October 2nd changes HUD senior advisor Adolfo Marzol said, “The HECM program has been a substantial net economic drain on…

HECM Challenges: Less Money-Higher Costs?

The good & the bad from recent HECM changes

Sudden industry product changes are always coupled with challenges. Reverse mortgage professionals are seeing first-hand the impacts that HUD’s October surprise will have on borrowers seeking to refinance and payoff their mortgage and those seeking to purchase a home with a HECM.

For several weeks on this show, we’ve run down several short and long-term consequences of HUD’s reduced lending ratios, the returns of origination fees, and new insurance premium pricing. Today we are going to look at two scenarios- the borrower with a higher mortgage balance and a HECM for Purchase scenario.

Despite the financial assessment, several borrowers who would meet the guidelines are seeking to eliminate an existing mortgage who still have a nearly 50% existing loan-to-value ratio. In this example, we have a 72-year-old single borrower with a home valued at $375,000 and an outstanding mortgage balance of $175,000 being well under 50% of the home’s present value. Prior to October 2nd, this individual would only need to come in with $125 at closing after the lender credited or waived the origination fee. However, that same borrower would need to come in with over

The Truth About Recent HECM Changes

What nuggets of truth can we glean from the most recent HECM reforms?

Continue readingHECM Changes & Impacts on Line of Credit Growth

HECM ‘line of credit’ growth still beneficial but more realistic

Recent changes to the Home Equity Conversion Mortgage enacted on October 2nd have reduced the ongoing FHA insurance premium substantially and led to many lenders reducing their loan margins to soften the blow of reducing lending ratios or PLF factors. What can be easily overlooked is the impact on the line of credit growth rate.

For decades the growth rate of the reverse mortgage’s principal limit, or ‘line of credit’ was largely ignored or overlooked. Few promoted this distinctive benefit unlike any other mortgage loan offered to homeowners. That changed as reverse mortgage professionals began to engage the financial planning community. The benefits of the reverse mortgage’s use in retirement, and more specifically a series of academic papers illustrated the ‘standby’ reverse mortgage strategy.

With lenders lowering margins by an average of a half of one-percent to soften the blow of reduced lending ratios, and drastically reduced ongoing MIP insurance premium rate the growth rate stands to be reduced by…

Will HECM Changes “Stop the Bleeding”?

The Home Equity Conversion Mortgage has come under increased scrutiny with HUD’s annual reports to Congress and the ensuing actuarial reports showing wild and unpredictable swings i

Continue readingHECM Changes: 5 Things to Expect

While the mortgagee letter was brief the potential impacts are considerable. Here are some impacts to anticipate and plan for in the wake of the most recent overhaul of the federally-insured reverse mortgage.

Continue readingHECM Changes & The Ensuing Crash

HECM Changes & the Ensuing Crash in Volume

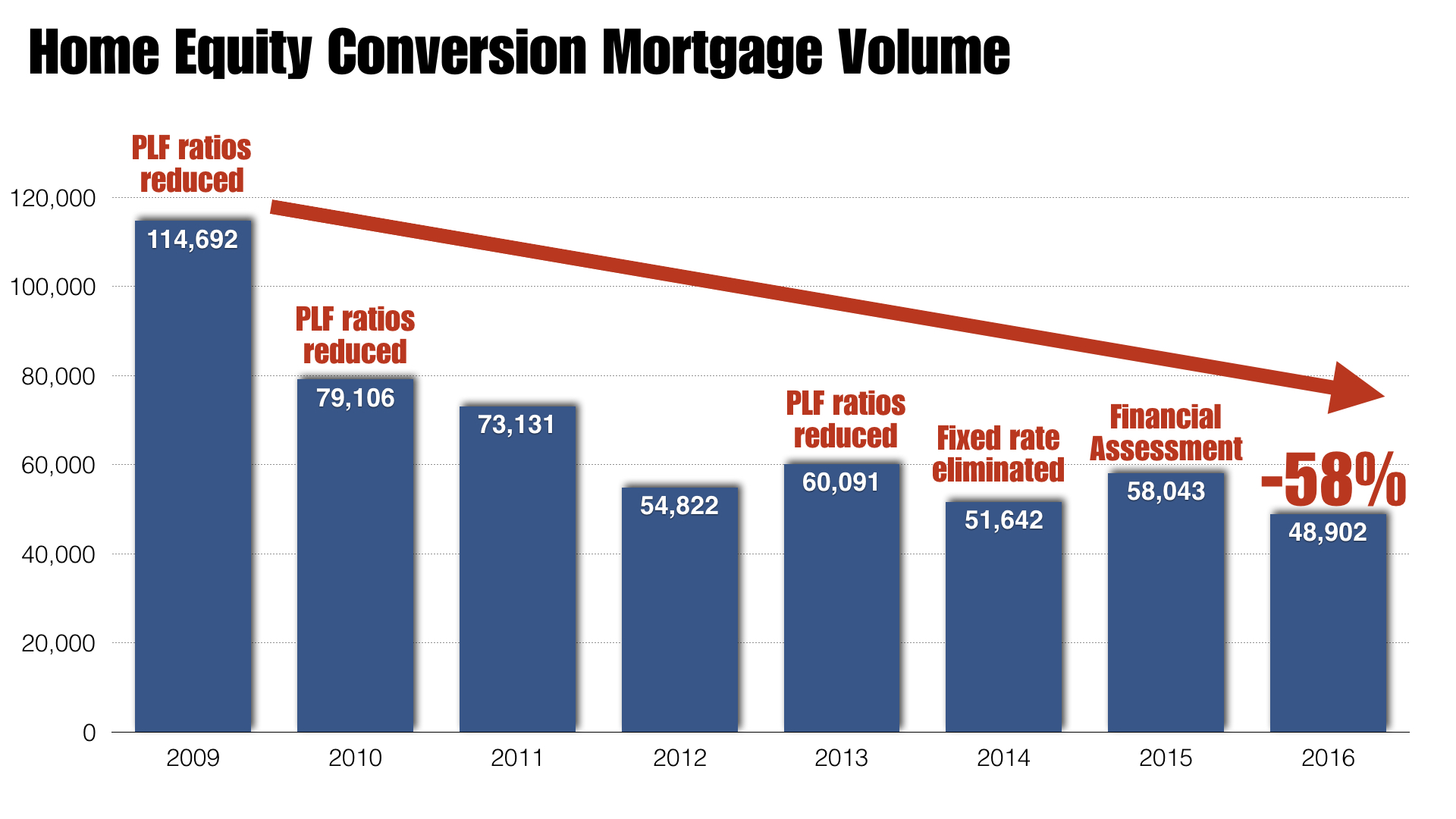

Since it’s introduction in the late 1980’s the Home Equity Conversion mortgage was a collateral-based product. In recent years the reverse mortgage or HECM has shifted from a loan based on the homeowner’s equity and age to a fully underwritten mortgage requiring borrowers to prove their financial capacity to pay property taxes and insurance.

Not surprisingly, these changes narrowed the potential market for the reverse mortgage and volumes have dropped by more than 50%, in part to the housing crash and numerous lending ratio reductions and financial underwriting requirements…

Download the video transcript here.

Do HECM Reforms Fix Past Losses?

Can recent HECM reforms ever repay the losses of the past?

An honest examination of the reverse mortgage would recognize that many loans originated prior to 2013, could easily become a future liability. Case and point the now defunct ‘Standard Fixed Rate HECM’. Introduced in the midst of an overheating housing market. With needs-based borrowers comprising a significant portion of HECM loans taken, the seeds of trouble sown came to fruition as housing values plummeted, causing many of these loans to ‘cross-over’ where the outstanding loan balance exceed the home’s value. Subsequent insurance claims spiked.

An honest examination of the reverse mortgage would recognize that many loans originated prior to 2013, could easily become a future liability. Case and point the now defunct ‘Standard Fixed Rate HECM’. Introduced in the midst of an overheating housing market. With needs-based borrowers comprising a significant portion of HECM loans taken, the seeds of trouble sown came to fruition as housing values plummeted, causing many of these loans to ‘cross-over’ where the outstanding loan balance exceed the home’s value. Subsequent insurance claims spiked.

Complicating matters is the method used to calculate the HECM program’s economic value which swung wildly from a positive valuation of $6.8 billion in 2015, to a negative value of $7.7 billion for the fiscal year 2016.

What are your thoughts? Please leave your input in the Comments section below, and share this post on social media using the Twitter, Facebook and LinkedIn icons at the top of this page. Thank you!