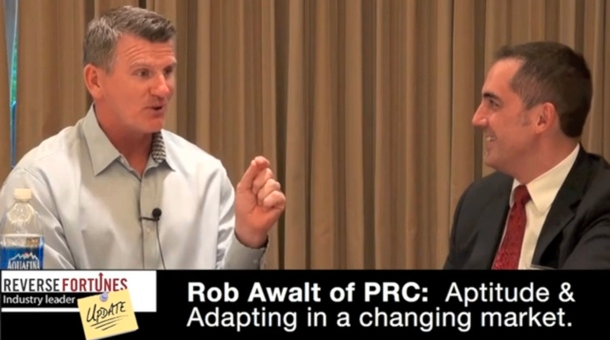

Rob Awalt of Premier Reverse Closings (PRC) speaks to adapting to a changing market, the skills required to thrive in more in our exclusive interview recorded at the NRMLA Western Regional Meeting in Irvine California.

Continue readingIndustry Outlook: Interview with Peter Bell

What is going on behind the scenes and what can we expect this year? See our interview with NRMLA President Peter Bell to learn more about regulation, lawmaking effecting reverse mortgages and more.

Continue readingState of Appraisals

What are the challenges with appraisals? We all face them every day. Our interview with Erik Richard of Landmark Network (AMC) sheds light on appraisal management, home values and more.

Continue readingNational RM Attorney speaks to future regulation & CFPB

What’s the future look like for reverse mortgage legislation? No better person to ask than Jim Milano, General Counsel to NRMLA and mortgage lender attorney. We discuss the CFPB, disclosures, LO compensation and more.

Continue readingWindow Shoppers: TV & Online Reverse Ads

Some are now saying “online reverse advertising will eventually replace television” Lenders are now focusing their efforts on the web. It seems odd considering that reverse mortgages were relatively unknown until the Robert Wagner ads

Continue readingFinancial advisor speaks about reverse mortgages

Financial advisors are just beginning to embrace the reverse mortgage. See what one advisor has to say. We interviewed Cliff Maas at the NRMLA meeting in Irvine California.

Continue readingThe new landscape of reverse lending

Much like an earthquake can change the overall landscape creating new shorelines, ridges and hills the exit of Metlife will most certainly change the mix of reverse mortgage products. The products most likely to see a reduction are…

Continue readingStalwart: The reverse remains

Since it’s creation in 1989 our product has withstood multiple recessions, boom and bust real estate markets, five presidents and stock market crashes. Consumers and their confidence in the HECM and the lenders that serve them.

Continue readingMetlife Exits Reverse Mortgages

In the wake of the aftershocks of the two largest reverse mortgage lenders leaving MetLife announced last Thursday they are leaving reverse mortgage lending. A look at the potential causes and more importantly the impact on our industry.

Continue readingIs 62 too young for a reverse mortgage?

People’s behavior makes sense if you think about it in terms of their goals, needs, and motives. That’s the case when it comes to the trend toward younger reverse mortgage borrowers. But senior advocates and others see it differently…

Continue reading