Many economists believe the Fed will cut rates in 2024 but for differing reasons…

Continue readingHECM Counseling Demystified

What happens during a HECM counseling session? Are reverse mortgage professionals properly preparing homeowners for their counseling sessions? We interviewed Greg Smalls with Consumer Education Services, Incorporated to answer these questions and more.

Continue readingFHA’s proposed HECM policy changes: What you need to know

Here are the key proposed policy changes for the HECM that every reverse mortgage originator should understand and communicate with borrowers who may find themselves in these specific situations.

Continue reading3 HECM Opportunities in an uncertain market

Here are three opportunities reverse mortgage originators can find even in today’s bloated housing market and uncertain interest rate landscape…

Continue readingWhy 8% 30-year fixed rates may benefit reverse lending

Today we find both the average HECM expected rate and the traditional 30-year mortgage hovering around eight percent. Here’s why that may be an advantage

Continue readingAll locked up! Homeowners struggle to tap equity

Despite holding trillions of dollars in home equity, U.S. homeowners are struggling to tap into it according to a report published by Point, an alternative equity release company.

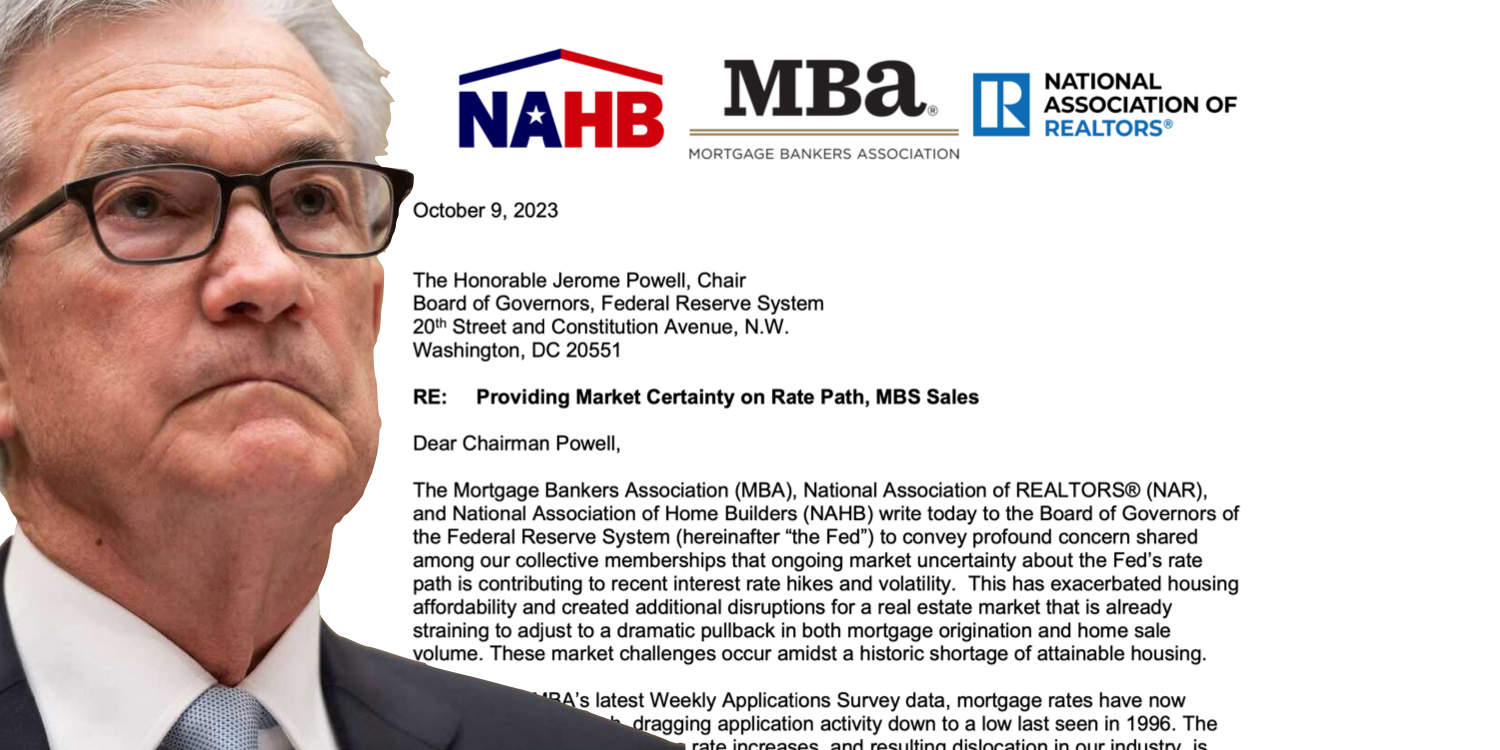

Continue readingOlder homeowners should know about this letter to the Fed

Older homeowners should know about this letter the housing industry just sent to the Federal Reserve. Here’s what the letter says…

Continue readingInflation Exposed: Increasing costs and asset classes

Today, every American consumer is feeling the pain in their pocketbooks as a result of our government’s unchecked spending as the purchasing power of the U.S. dollar continues to decline making goods and services that more expensive. But just how much more expensive?

Continue reading5 Signs of an Impending Recession

Here are the five signs of an impending recession, 4 which we’ve already seen.

Continue reading5 Mistakes Reverse Mortgage Borrowers Should Avoid

Borrower behavior before and after the loan can lead to these 5 avoidable mistakes

Continue reading