Deflation is here… even with inflation!

Continue readingWhat’s your weakness?

How your weakness can be a strength

Each of us has our own fragilities.

Extroverts, for example, are often great at creating new business relationships and sales but are lacking when it comes to having a disciplined system of follow-up. Introverts are often entrenched in sticking to a well-planned and proven way of doing things but may struggle to engage in an emotionally persuasive way with potential clients. Highly organized and concrete sequential types are disciplined laborers in the field of sales but are thrown off their game when new circumstances require a sudden change.

The truth is we all struggle with specific skills or a lack thereof. Yet some of history’s most notable achievers overcame their biggest weaknesses or turned them into a strength. Here are just a few.

The Apostle Paul described himself as unpolished in his speech, yet he became one of the most impactful messengers of Christianity, convincing thousands to follow in the faith.

The skateboarder Tony Hawk lacked the strength of larger skaters to yank the board up in the air. He turned his disadvantage into a strength by inventing ‘ollying’ where he stomped on the curved end of the board to get elevation or ‘air’. Problem solved.

Walt Disney was fired from a newspaper for not being ‘creative enough’. Coaches wouldn’t give young Michael Jordan a chance to play on their team because he was too short.

So how do we address where we lack? Here are a few ways to begin.

- Know specifically where you’re lacking strength.

- Decide what weakness you are going to commit to addressing.

- Engage with a person who possesses the strength you want to develop and ask for their input and how they developed their skill.

- Set specific benchmarks to measure your improvement.

- Read. There’s a universe of knowledge available on nearly any subject. Invest the time in educating yourself.

- Find a workaround that addresses your weakness. If it’s phone reluctance use set a goal to make at least xx amount of phone calls a day before you can go home. If it’s speaking in front of a large group take a class on public speaking. If it’s staying organized enroll in a time management course.

- Embrace where you are today but commit to incremental improvement.

Self-assessment

Take a few moments and write down your personal and/or professional weaknesses in one column and in the other how you will begin to transform that weakness into a strength or asset.

“My attitude is that if you push me towards something that you think is a weakness, then I will turn that perceived weakness into a strength.”

-Michael Jordan

7 Sales Strategies for more certainty in an uncertain world

5 ways to create more certainty in an uncertain lending world…

Continue readingMy neighbor slashed his home price and yours may too

My neighbor just slashed his home sale price and yours may be next…

Continue readingJust one more thing

The following originally appeared in HECMWorld in September 2020

“I’ll take my family on a nice vacation once I make enough money.”“I’m going to create a killer marketing plan that will attract more homeowners and help me close more loans.”

These are just a few examples of the rationalizations for why we’re doing things the way we are and avoiding the work required to reach our goals.

You may not have the money for a family cruise, but you may be able to take your family on a weekend getaway and not break the budget in the process. An imperfect business plan is better than nothing. Why not put pencil to paper and begin with a rough outline?

Truth be told, it’s the little things that often yield the best results. Taking 15 minutes without distractions to sit with your partner, child, or colleague to ‘check-in’ maybe ‘just one more thing’ but it may be the most important thing for them that day. Our lives have an overabundance of ‘just one more thing’ to do. The trick is to confront our tasks as if they were the last thing we will do.

What’s most important at this very moment? Taking a moment to give a sincere compliment? Inviting over your friend who’s overwhelmed to simply sit and relax in your backyard? Calling your widowed borrower to see how they’re faring during the pandemic? Is it shutting down your email and silencing your cell phone to make 15 outbound sales calls?

Each of us knows what that ‘just one more thing’ is. The question is what will we do without for the moment to make it happen?

Meet the new ‘needs-based’ borrower

Get ready to discard any old notions of who a needs-based borrower really is…

Continue readingAn avoidable tragedy

Don’t let those on the edge of eligibility fall through the cracks

Sadly many tragedies are preventable. Tens of thousands of older homeowners are on the edge of financial collapse due to their rapidly-dwindling purchase power and fixed income. Perhaps they’re just getting by today but who’s to say they’ll be able to financially survive two years from now? The tragedies that sting the most are those we could have avoided.

While the real estate market and interest rates have radically changed the HECM program has remained relatively unchanged in recent years. However, one thing has changed considerably -the 10-year Constant Maturity Treasury rate to which federally-insured Home Equity Conversion Mortgages (HECMs) expected rates are keyed.

Since November 2018 the US 10-year Constant Maturity Treasury (CMT) steadily declined until it hit a pandemic low of .54 percent in March of 2020- the same month when the median listing price of a home was $322,000. By March 2022 the median price has surged 26% to $405,000 and the 10-year CMT had increased over three-fold to nearly 2.5%. As of June 13th, the 10-year CMT rate is 3.09%.

The rapid increase of the 10-year CMT not only diminishes the funds a HECM borrower may qualify for but also reflects the surge in the 30-year fixed-rate mortgage rate which is softening buyer demand and putting pressure on home listing prices in several markets. Higher rates and slipping home values mean the window of opportunity is closing for many homeowners who previously inquired about the loan.

Here are 5 ways to find and reengage with prior reverse mortgage prospects.

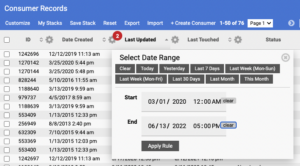

- Search in your CRM for a date range for records you haven’t opened in the last two years. Sales Engine CRM by Reverse Focus makes such a search a snap.

Sales Engine CRM’s powerful search function - Research the cities or regions where home sale prices are dropping or have already begun to decline. Use your CRM search for records with no sales in these areas.

- Schedule two hours each week to personally call each of your previous contacts who were potentially eligible for a reverse mortgage. Check in and let them know you’re reaching out considering the recent changes in interest rates and the housing market.

- Create an email series (drip-marketing). Make sure you don’t fatigue them with too many emails in a period of time. Typically, one email every 3 to 5 weeks should not annoy people to the point of unsubscribing.

- Get an SEO landing page for a specific region where home values and typical mortgage balances provide more potential reverse mortgage borrowers. This is a great way to target specific markets you’ve researched- especially if you’re using RMI’s Dashboard tool.

At this very moment, the window of opportunity is closing for those who previously inquired about a reverse mortgage. Don’t let them miss out just because they were not reminded that they may have an option to doing without. And don’t miss out on building your loan pipeline while helping older homeowners improve their quality of life in retirement.

The Obstacle is the Way

The obstacle to HECM growth is our path forward

We’ve just finished coming off a two-year sugar rush, actually, a gold rush of accumulated home equity that surprisingly surged after the Coronavirus pandemic reached our shores. Americans were awash with newfound equity thanks to their swelling home value.

However, today we face an obstacle in our path to increasing the market share of reverse mortgages among age-eligible homeowners. That obstacle is getting more first-time HECM borrowers. Certainly, there are other obstacles on the path to engaging more first-time borrowers. Obstacles such as rising interest rates, fewer refinances of existing HECMs and stalling home values or even declines in some markets.

“The obstacle in the path becomes the path. Never forget, within every obstacle is an opportunity to improve our condition.”

– The Obstacle is the Way- Ryan Holiday

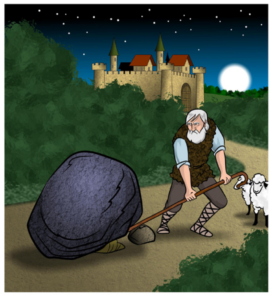

Usually, when we encounter an obstacle in our path we simply seek to find a way around it. But what if there isn’t? That brings to mind the story of the stone in the road.

Long ago there lived a good king who sought to teach his people to be industrious, fair, and strong. However, after years of abundance and wealth, they had become entitled and complained of the smallest of problems. One night the king placed a large boulder on the road that led to the city gates stopping all travel and commerce. He hid in the woods to watch. He witnessed many approach the stone and complain of the foolishness of whoever placed it there. Others criticized and some cursed the obstacle and turned away. Sometime later a humble shepherd approached the boulder. Unable to move it he thought for a moment pondering a solution. He used his staff and a smaller stone as a lever and was able to move the obstacle in the path revealing a bag of gold underneath and a note from the king.

The moral of the story is the obstacle is the way. It is the path forward. In fact, that’s the title of a book I recently read by Ryan Holiday, The Obstacle is the Way. Perhaps you’ve heard me mention his name or his blog the Daily Stoic in our Friday’s Food for Thought segments.

When it comes to increased reverse mortgage acceptance there’s no getting around the obstacle that we need more first-time borrowers whether it be for a HECM or proprietary reverse mortgage. That impediment will not be overcome merely by getting referrals from other professionals or increasing public educational classes. Our barrier to growth requires more workers, that is reverse mortgage originators going out and engaging with the public. Perhaps part of that expanded sales force will come from traditional mortgage professionals who are seeking new sources of business and revenue but more importantly seeking a less transactional mortgage market.

Looking back on our industry since the last of the big retail banks exited reverse mortgage lending, we see many successes and failures on our journey seeking growth. What those failures have done is show us the way by showing us what isn’t the path to growth. Our successes have shown us time and again how incredibly resilient and resourceful you, our reverse mortgage professionals, truly are.

Our first step to succeeding is to see clearly. Next is to act and then endure that which we find before us with tenacity and creativity.

Do we have obstacles in our path? Most certainly. But the obstacle is the way.

The bitterest of economic pills

The bitterest of economic pills

Stagflation is a particularly ugly word for those old enough to remember the brutal effects of high inflation and high unemployment in the 1970s. And speaking of inflation if we measure it by the same basket of goods used in the late 70s and 80s the annual inflation rate would be 15%, Apparently, inflation is neither 8.5% nor transitory. With inflation surging as the economy stagnates concerns of stagflation have returned. Stagflation, the dreaded S-word of the 1970s or what some economists call the bitterest of economic pills.

However, all is not lost. What we are witnessing is an economic cycle, one that reminds us that every bill eventually comes due. A bill for decades of government largesse, easy money, and trillions of dollars in Covid stimulus. Ironically, the pandemic didn’t crush our economy but our response to it will harm millions of Americans. Today we are just beginning to see the outcome of central bank policies and political will. Both stand to especially harm those who are retired and living on a fixed income.

And speaking of a fixed income, often the image of a poor miserly penny-pinching pensioner often comes to mind. But, truth be told, a retiree bringing in precisely $60,000 a year is just as much on a fixed income as the one earning $90,000. Beyond their income disparity, each will feel the brunt of inflation differently; what some financial planners call their individual inflation rate. For example, a 70-year-old widower who’s renting is exposed to more inflationary pressures with rising rents than a 70-year-old who’s living in a home with a fixed mortgage payment. Yet both are experiencing consumer price inflation in non-discretionary items such as gasoline, food, prescriptions, electricity, natural gas, and heating fuel.

So where does this leave future reverse mortgage applicants? In short, they’ll need to have considerably more equity accumulated to offset the impact of higher interest rates and the subsequent lower principal limit factors that determine how much money for which they may qualify. I say considerably because an effective interest rate of 7.5-8.5% for a HECM loan is not far-fetched. And, keep in mind in the years 2005-2007 during the heydays of HECM lending, the average expected rate hovered just below seven percent. Certainly, the presence of large retail banks originating HECMs helped, but the pool of eligible homeowners with adequate equity was there and remains today.

Looking back to interest rates keep in mind that the Federal Reserve has only just begun to throw cold water on inflation by increasing interest rates to slow the economy. Rates that many economists say must be higher than the rate of inflation to be effective. If true, this leaves much headroom for future rate hikes unless inflation shows early signs of retreating or unemployment begins to spike.

Granted, entering a period of inflation, economic contraction, and possible stagflation is somewhat unnerving. However, it is during these times of upheaval that economic solutions, such as reverse mortgages may regain their luster and appeal. After all, where else will older homeowners find the additional ten, fifteen, or twenty percent additional cash flow to offset the increased cost of living?

You can figure it out

How we can figure out much more than we believe we can

Continue reading