Problems often come all at once. Here’s how to better manage the battle and avoid the confusion of the fog of war…

Continue reading10 Tips for Getting Things Done

Here are 10 practical ways to get more ‘stuff’ done every day

Continue readingRetirement Wizardry: Where the Smart Money Meets Reverse Mortgage Magic

Fans of the Harry Potter books may not realize that Hogwarts’ headmaster, Albus Dumbledore, also knew something about smart retirement planning. That’s what happens when you live to be 150.

Continue reading11 ways to grow your business

Knowing HECM-to-HECM refinances will eventually fade, here are 11 practical ways to grow your business in any market.

- Review all previous leads that were short to close. See if they may qualify with today’s low interest rates.

- Find every potential borrower lead written down on a scrap of paper, Post-It-Note, or business card and input it into your CRM. If you don’t have a Customer Relationship Manager (CRM), check out our Sales Engine CRM made for reverse mortgage professionals.

- Isolate and find your top 50 professional contacts. Now divide them up to contact each on every 6 weeks. You can schedule this on your calendar or CRM.

- Check-in with your top 50 professionals by making at least eight phone calls a week. Keep it casual, informal, and fun- the point is to make positive contact.

- Schedule at least one meeting with a professional in your market each week. It could be a quick cup of coffee, lunch, or grabbing a beer. The point is to build a relationship or keep one strong.

- Contact your local newspaper and offer to write a column about reverse mortgages, aging in place, or the challenges facing retirees.

- Time-block recurring times each week for outbound sales calls. If it’s on your calendar it will happen.

- Consider scheduling follow-up calls with every applicant on Tuesdays and Fridays. Call them even if there are no new developments. Regular communication helps avoid unnecessary stress for your applicants and possible cancelations.

- Find one inspirational book to read. Schedule two nights a week to complete.

- Find one inspirational fellow reverse mortgage professional. Ask them if you could speak once each week. Give encouragement, perspective, and ideas to each other. Avoid the trap of complaining.

- Join your local chamber of commerce, a leads group, or your local financial professionals’ group. Be a friend, helper, and fellow professional. Don’t ask for leads first. Show your value and build a relationship.

-Shannon Hicks

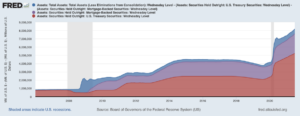

Federal Reserve urged to wind down asset purchases

Do you know who the biggest player in the housing market is today? Is it hedge funds, REITs, or the largest developers? If you answered the Federal Reserve, congratulations.

Some members of the Federal Reserve’s policy-setting committee want to end the Fed’s purchasing of $40 billion a month of MBS (mortgage-backed securities) sooner than later. The question is how much and how soon. In a presser following the Fed’s two-day meeting discussing how to reduce asset purchases Federal Reserve Chairman Jerome Powell said, “There really is little support for the idea of tapering MBS earlier than Treasuries. I think we will taper them at the same time.”

The wind-down of asset purchases will put pressure on yields. Today, with the Fed consistently purchasing most mortgage-backed securities lenders don’t have to offer higher yields to attract investors, this allows them to offer lower rates. When rates eventually do increase modestly homebuyers will have to reconsider the price range homes they consider for purchase. Sellers may also rethink their asking price as home affordability erodes. Both would cool the pace of housing appreciation and bring some modicum of normalcy to an overheated market.

Monday Federal Reserve Bank of Atlanta President Raphael Bostic said the central bank should move to taper asset purchases in light of recent strong employment gains. Speaking of the timing of tapering Bostic said, “Right now I’m thinking in the October-to-December range, but if the number comes back big” as with the last report “or maybe even a little bigger, I’d be open to moving it forward. If the number really explodes, I think we would have to consider that.”

While employment gains are substantial, many economists are concerned as millions of small businesses cannot fill open positions. Employer-mandated vaccinations or mask-wearing may further strain the rate of employment growth when coupled with the $300/week federal unemployment bonus. Both could postpone the Fed’s tapering of asset purchases. However, inflationary concerns could also spur the central bank to accelerate its timeline. The central banks’ mantra is they see the surge of inflation as merely transitory. Time will certainly tell.

For now, even a moderating seller’s market still will benefit reverse mortgage applicants in the short term when coupled with historic low interest rates significantly increasing their available loan proceeds. While it’s uncertain how long the market will continue its run, reverse mortgage originators couldn’t ask for a more ideal market.

-Shannon Hicks

Inflation, The Silent Killer!

By Robert Intelisano, CLU, CSA, LUTF

The Google definition of inflation is: “A general increase in prices and fall in the purchasing value of money over time. Inflation can occur when prices rise due to increases in production costs, such as raw materials and wages. A surge in demand for products and services can cause inflation as consumers are willing to pay more for the product.”

An example of inflation is the cost to cross the Marine Parkway-Gil Hodges Memorial Bridge. When the bridge opened on July 3rd, 1937, the cost to cross the bridge was between 10-15 cents, depending on the type of vehicle. The current cost is $5.09 by mail and $2.45 by E-Z Pass.

The Federal Reserve wants to keep inflation under the 2% benchmark. Right now, inflation is running around 3% which is in the danger zone. As per Barron’s, the FOMC (Federal Open Market Committee) released minutes from its June monetary policy meeting. Fed officials signaled that interest rates would rise sooner and faster than Wall Street expected prior to the meeting, as inflation is rising at its fastest pace since 2008.

What does this all mean? This means that if you are on a fixed income, your money will not go as far as it would during inflationary times. This also means, if you have investments and/or money in the bank that is “netting after-tax” less than 3%, you are losing money (purchasing power). These are important barometers that few people are paying attention to right now.

People have been cooped up (myself included) during the height of Covid-19 and many persons now have more spendable income. A combination of inflation, the Suez Canal blockage, and higher demand for travel has skyrocketed travel costs in the past month. Hotel costs in Miami Beach have risen 50% since the last week in June. Rental cars are up 110% this year and are 70% higher since the pre-pandemic in 2019. Oil prices could soon hit $100/barrel, which will also spike gas prices.

There are options where one can position assets to fight inflation or at least break even, as interest rates are likely to rise over the next 12-18 months.

-Shannon Hicks-

Now is the time to have a short conversation with potential borrowers about inflation. How is it impacting them? Does it change their retirement plans? What financial concerns do they have as a result? Inflation is not a selling point, but it’s certainly a reality. One where a reverse mortgage could potentially help.

“One of the biggest drivers of losses in the HECM”

This article was originally published in July 2019 yet the vexing issue of HECM servicing remains

The Urban Institute calls for loan servicing reform

Despite the good news last month that the backlog of HECM assignments has been cleared, significant problems remain according to the Urban Institute. “Rather than continuing to narrow eligibility—and decreasing participation further—the FHA should focus on reducing costs. Addressing losses on assigned loans would be the best step in that direction. This servicing issue is one of the biggest drivers of losses in the HECM program.” So begins the Urban Institute’s recent blog post on how FHA could more effectively stem the tide of continuing HECM claims against its insurance fund.

Much like a broken pipe dramatically reduces the reach of other sprinklers in the system, HECM borrower participation, and overall loan volume have been decimated in the wake of several cutbacks to the program in efforts to stem continued losses. The trick is finding where the leak is. Evidently, numerous reductions to the amount of money loaned (PLF factors), the financial assessment, and first-year distribution restrictions have not had their anticipated effect as projected losses continue according to HUD’s annual actuarial reports.

All which leads us to the question where’s the proverbial leak? Nearly one year ago FHA Commissioner Brian Montgomery said of HECM losses, “My sense is that it’s more on the back end in terms of the losses we are experiencing. Part of ‘triaging’ is [determining] why that is happening.”

The Senate Appropriations Committee seems to agree to instruct HUD to improve its resolution of defaulted and foreclosed FHA Home Equity Conversion Mortgage loans which have been assigned to HUD. Today 60 percent of HECM loans are not assigned to the agency. This is often due to tax delinquencies, pending foreclosures, or bankruptcies. Of the 40% of loans ultimately assigned to HUD 42% incur losses or result in an insurance claim, while only 12% for loans still with the loan servicer result in a loss. Consequently, the Urban Institute recommends that FHA’s policies be changed to allow the current servicer to manage the loan even after the loan is assigned.

HUD’s losses may be higher because they are required to pay future delinquent property taxes after the loan has been assigned. However, before a loan servicer can assign the loan property taxes must be current. In some cases, the servicer may choose to pay the current outstanding taxes anticipating future delinquencies and assign the loan at that time.

For most HECM professionals loan servicing goes largely unnoticed. However, the importance of effective and efficient loan servicing cannot be overstated when it comes to verification of tax payments, borrower occupancy, and property maintenance. There have been numerous anecdotal reports of HECM properties no longer being occupied by renters or family members long after the borrower has moved or passed away. In other instances, properties are not effectively supervised and become dilapidated decreasing the value of the loan’s underlying security- the home.

Contrary to the Congressional Budget Office’s recent recommendation to assign loans much earlier at 80% of the maximum claim amount versus 98%, the Urban Institute points to a potential source of a significant number of HECM insurance claims. Would this approach fix the leak and once again place the HECM closer in reach for those who could benefit?

Urban’s blog post concludes stating, “If the FHA were to allow existing servicers to retain the servicing for the rest of the life of the loan, it would stem these unnecessary losses. This is critical to the future viability of this valuable program for seniors.”

The Problem with Drift Net Marketing

How today’s top-producers are succeeding

Last fishing season I sat down with my friend Mike and caught up on his recent fly fishing exploits in Shasta Lake, California. As an experienced fisherman, he related to me how he adjusted his typical techniques due to the rapidly-rising waters in the reservoir after several weeks of heavy rain and snowfall. The water was brown in several spots obscuring the fish below the surface, the currents had changed, and small inlets disappeared. Basically, he had to reinvent his approach in a rapidly changing environment. His flexibility paid off with over 20 fish caught and released.

Mike’s technique is specific and targeted. The opposite approach is deep sea drift netting, which hangs several large net curtains under the water’s surface catching nearly everything in its path- often entangling smaller fish that must be thrown back.

While it is easy to lament the decline in homeowners taking a reverse mortgage, the more intriguing question is how do a handful of HECM professionals succeed in today’s marketplace? Here are just a few of the ways today’s top producers tell us they attracting and closing qualified homeowners.

- Referrals– Most salespeople in any industry fail to get referrals. One of the best ways to enter a sphere of influence is to ask each borrower if they know any local CPA, attorney, or financial planners in your community you could speak with. Take note of each name and ask them if you can use them as a reference when you make your introduction.

- Relationship management– if you have contacted professionals in the past, when is the last time you spoke with them? When was your last coffee or lunch meeting? When was your last phone conversation? Do they see you as a friend or just another salesperson looking for a free lead?

- Targeted investment– Your time is an asset you choose to invest each day. Are you spending 80% of your time on activities that produce 20% of the results? Take a hard, cold, pragmatic look at where you are marketing. Are you trying to reach every age-eligible homeowner in your area? If so, chances are you’re getting burned out on unqualified applicants. Instead, seek out the homeowners who are most likely to qualify and utilize a reverse mortgage. This could be those seeking to right-size into a new home in retirement, who want to avoid taking more taxable withdrawals from their retirement accounts or are simply looking for an alternative to a home equity line of credit.

Whichever method you choose, commit to hanging up your driftnet and pick up your fly rod and reel. Explore the smaller niche inlets and coves overlooked by most that are rich with opportunity.

Foreclosure Moratoriums Ending

Millions face foreclosure

When it comes to pending foreclosures for mortgages in forbearance younger Americans are not alone. Many older homeowners are facing the specter of losing their homes.

Foreclosure moratoriums are ending

A Harvard University housing report warns that over 2 million American homeowners who have delinquent mortgages are at risk of foreclosure. As the Covid-19 pandemic ebbs a new contagion of housing insecurity is preparing to spread creating a wave of evictions.

Over 7 million American homeowners were placed under the protection of a foreclosure moratorium as a result of the Coronavirus Aid, Relief, and Economic Security Act (CARES) last spring. The Biden administration extended the moratorium as millions seek a way to modify their loans or find a way to save their homes.

Numerous deadlines have passed and been extended by both federal, state, and local governments. This myriad of ever-changing expiration dates has left many confused and uncertain. However, one thing is clear. The federal government is determined to prevent a wave of foreclosures and evictions as evidenced by a foreclosure moratorium on all federally-insured mortgages until July 31st, 2021.

However, Financial Reg News reports that the Federal Housing Finance Agency (FHFA) is offering borrowers protections after moratoriums end. “FHFA officials announced that Fannie Mae and Freddie Mac servicers would not be permitted to make the first notice or filing for foreclosure that would be prohibited by the Consumer Financial Protection Bureau’s (CFPB) Protections for Borrowers Affected by the COVID-19 Emergency Under the Real Estate Settlement Procedures Act (RESPA), Regulation X Final Rule before the CFPB rule takes effect.” This rule prevents any move to foreclose before December 31, 2021.

When it comes to senior homeowners facing potential foreclosure there’s little if any data. However, it’s no leap of logic to conclude that there are thousands, perhaps tens of thousands of older homeowners who don’t know how to save their homes. And yes, surprisingly, some may not be aware that a reverse mortgage could in fact save the very roof over their head.

2021 May Be A Boom Year

Despite mortgage forbearances, here’s why 2021 may shine bright

[4-minute read]

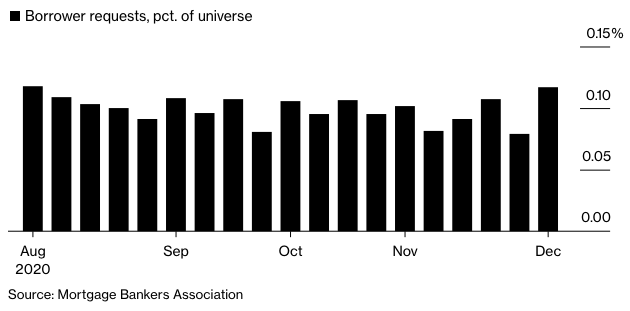

An extension, followed by another extension, and then another.

No one should be surprised. Certainly, no one wanted to see Americans evicted from their home and left scrambling to find a new roof over their head. Therefore, mortgage forbearances and extended deadlines seem prudent, however, they will come at a cost.

Yesterday HUD announced FHA’s fourth extension for foreclosures and evictions since the COVID-19 pandemic hit early this spring. What does this have to do with reverse mortgages? Ironically it may actually make 2021 a prosperous year for our industry.

Homeowners with loans backed by FHA must request forbearance from their loan servicer on or before February 28, 2021- a deadline that was set to expire on December 31, 2020. HUD’s press release reads, “FHA requires mortgage servicers to provide up to six months of COVID-19 forbearance when a borrower requests this assistance, and up to an additional six months of COVID-19 forbearance for borrowers who request an extension of the initial forbearance. Borrowers needing assistance must engage with their servicer to obtain an initial COVID-19 forbearance on or before February 28, 2021.” However, there’s no application deadline for those with loans backed by Fannie or Freddie until these GSE’s decision to stop offering extensions.

This means homeowners unable to make any or part of their contractual mortgage payments could conceivably postpone payments until February of 2022, that thanks to the initial six-month forbearance and subsequent six-month extension if needed.

How could this impact reverse mortgage lending?

Reverse mortgage lenders and originators may not feel the secondary repercussions until mid-2022 should a glut of expiring forbearances become foreclosures. The first swathe of forbearances are expected to expire in March of next year- precluding any last-minute federal intervention.

Moreover, the promised ‘V-shaped recovery’ touted last fall did not come to pass as evidenced by nearly 4 million American workers who have been unemployed for more than six months (27 weeks) and a growing percentage of homeowners seeking mortgage forbearance protection. The continued challenges of unemployment coupled with tranches of expiring forbearances stand to significantly impact future home values. The question is when and how much.

While few mainstream housing economists are forecasting a crash, many do see a modest correction in home pricing with inventory increasing as foreclosures come onto the market. After all, you can only kick the proverbial can down the road so far. The good news is despite economic uncertainty and COVID challenges 2021 could be another record year for home sales. As inventory levels remain markedly constrained and interest rates hover near zero- the home-buying frenzy could continue throughout most of next year. Future reverse mortgage borrowers stand to benefit during these curious times with an elevated home value and an increased PLF ratio thanks to absurdly-low interest rates.

While few mainstream housing economists are forecasting a crash, many do see a modest correction in home pricing with inventory increasing as foreclosures come onto the market. After all, you can only kick the proverbial can down the road so far. The good news is despite economic uncertainty and COVID challenges 2021 could be another record year for home sales. As inventory levels remain markedly constrained and interest rates hover near zero- the home-buying frenzy could continue throughout most of next year. Future reverse mortgage borrowers stand to benefit during these curious times with an elevated home value and an increased PLF ratio thanks to absurdly-low interest rates.

Now that’s something to look forward to next year.

Additional Reading:

The Fool: The End of COVID-19 Relief Could Open Up Housing Inventory

FHA EXTENDS OPTIONS FOR SINGLE FAMILY BORROWERS FINANCIALLY IMPACTED BY COVID-19

Shannon Hicks.