I Survived COVID-19

The tale of one ‘fluffy’ middle-aged man in the age of the modern plague

[4-minute read]

Stoicism holds a particularly strong appeal. Perhaps because it pushes me toward embracing uncomfortable realities. One of the more pragmatic comments I made this year was, it wasn’t ‘if but when’ I would contract the novel coronavirus. Seeing the early signs of what I believed was certain to become a pandemic emerging from China in mid-January I began my preparations.

I certainly didn’t starve myself to drop weight, but I did take some practical measures to give myself a fighting chance should I contact the infection. As one friend who caught the virus told me, “if you’re not cheating you’re not trying”. The strategy was to make my system inhospitable for any virus, much less COVID by taking a strategic set of vitamin supplements every day. It was the prudent choice having had a long history of childhood bronchitis and a few bouts of bacterial pneumonia, one that left me gasping for air 7 years ago. Would it guarantee a result? No. However, having a vitamin deficiency is to begin at a disadvantage.

Now before you go any further know this- I’m not a doctor but I dress like one when I don my snazzy surgical mask when shopping or in an indoor public space. That said, always seek the advice of a medical professional before undertaking any regimen.

As the annual tradition of the Super Bowl neared I finalized my daily ‘winning set’ of vitamins.

- 50mg of Zinc

- 4,000 IU Vitamin D3 (this is NOT the USDA recommended amount)

- 3,000 mg Vitamin C

Not included are my daily allergy pill, B-vitamins, and antacid.

In February a relative in Southern California was exposed to the virus working out. As a result, I decided to stop going to my crowded gym and instead began a 1-hour cardio regiment through a nearby nature preserve.

Each Sunday afternoon I reloaded my arsenal of vitamins into a prescription box with my virus-kicking power combo hoping for the best when that appointed day should come.

That day was Friday the 13th, November 2020. How ironic.

That evening after concluding an evening Zoom session with a group of friends who I typically met in-person each week, I noticed something quite odd. I couldn’t smell much. As a test, I sprayed some of my trusty cologne onto my fingers, rubbed them together, and held them directly under my nostrils. “Sniff, sniff”. Nada- nothing-zilch. I had absolutely zero sense of smell! It was a clear and sobering sign that I had likely contracted COVID-19. Oddly enough I had already scheduled a test two days earlier for that Sunday having been potentially exposed the prior week. How fortuitous.

Test or no test I sprang into action. I doubled my zinc and vitamin D3 doses and forced myself to do something I hadn’t done in decades- get over 8 hours of sleep throughout the week. After all, a rested body is best suited to fight an invading pathogen.

As the days passed nine-months of terrifying COVID-19 news segments replayed in my head. I anxiously waited for the other shoe to drop. Would I go into respiratory distress? Would there be other complications? Would this be worse than the bilateral pneumonia I suffered in 2013? Should you ever contract COVID know this- you must fight to keep your emotions in check. In addition to a virus, there’s a pandemic of fear that can induce your body to make itself sick. One particular evening, a sense of foreboding fear washed over me. My lungs began to tighten and even feel congested. Minutes later after telling myself that perception isn’t always the reality- the symptoms faded never to return. One thing that finally did return 5 days later was my test results. The PCR exam was positive for COVID-19. To be honest it was a relief to know I was one step closer to putting this episode behind me.

As the days passed nine-months of terrifying COVID-19 news segments replayed in my head. I anxiously waited for the other shoe to drop. Would I go into respiratory distress? Would there be other complications? Would this be worse than the bilateral pneumonia I suffered in 2013? Should you ever contract COVID know this- you must fight to keep your emotions in check. In addition to a virus, there’s a pandemic of fear that can induce your body to make itself sick. One particular evening, a sense of foreboding fear washed over me. My lungs began to tighten and even feel congested. Minutes later after telling myself that perception isn’t always the reality- the symptoms faded never to return. One thing that finally did return 5 days later was my test results. The PCR exam was positive for COVID-19. To be honest it was a relief to know I was one step closer to putting this episode behind me.

In the end, I was extremely fortunate. While my smell has yet to return my worst symptoms included a few weeks of intermittent fatigue but not quite enough to keep me completely away from exercise or chores. However, sadly many of us have lost friends or family to the disease or have seen some hospitalized. It’s important to remember that everyone’s experience is unique.

You may be asking what about your family? To respect their privacy I’ve omitted specific details. However, everyone in our home did contract the virus- some, unfortunately, exhibiting ‘super-charged influenza’ symptoms. Today, everyone is healthy and thriving once again.

Just as everyone who contracts the virus wasn’t necessarily careless, each individual’s reaction and severity of symptoms will vary widely with little apparent rhyme or reason. Outside of self-care the randomness of severe symptoms seems to point to the human genome.

In the near future, you will likely know someone who has become infected. If so, encourage them to not give in to negativity and fear. Even better, if you’ve recovered from COVID-19 you may have the opportunity to donate convalescent plasma to your local blood bank which could help critically ill members of your community. Many blood banks are testing for antigens at no cost.

Someday, COVID-19 will be behind us. However, fighting fear while protecting and caring for your family, neighbors, and friends is a never-ending mission.

Stay healthy. Stay positive. Be Smart.

Shannon Hicks.

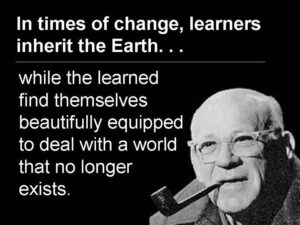

change, learners inherit the earth while the learned find themselves beautifully equipped to deal with a world that no longer exists.”

change, learners inherit the earth while the learned find themselves beautifully equipped to deal with a world that no longer exists.”

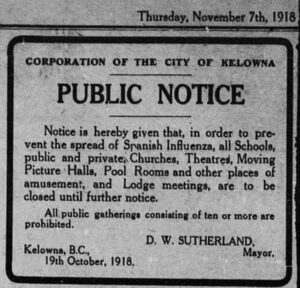

These are not unprecedented times, but they certainly are for us. Over 100 years ago the Thanksgiving holiday was unlike any before it. In 1918 the nation was in the grip of the second wave of the Spanish Flu which killed over 195,000 Americans in the month of October alone. Consequently, millions of families found themselves not only separated to avoid the spread of the contagion but grieving the loss of a family member. Case numbers surged in the week’s following massive crowds celebrating the end of World War One, now known as Armistice Day. Another surge came around the Christmas holiday following Thanksgiving Day festivities.

These are not unprecedented times, but they certainly are for us. Over 100 years ago the Thanksgiving holiday was unlike any before it. In 1918 the nation was in the grip of the second wave of the Spanish Flu which killed over 195,000 Americans in the month of October alone. Consequently, millions of families found themselves not only separated to avoid the spread of the contagion but grieving the loss of a family member. Case numbers surged in the week’s following massive crowds celebrating the end of World War One, now known as Armistice Day. Another surge came around the Christmas holiday following Thanksgiving Day festivities.