There are five key metrics that a prospective borrower should likely keep in mind before making a decision about whether or not to proceed with a reverse mortgage. So says Financial advisor Robert Klein in Reverse Mortgage Daily’s summary of his recent video on The Street.

Continue readingThe HECM’s 2021 performance likely best 2020

Unable to use the embedded player? Listen here.

EPISODE #695

It’s less about preserving equity and more about cash flow

With millions of first-time homebuyers finding few suitable housing options and tenants enduring the ravages of rent hikes, some are sitting on a mountain of home equity whilst needing a significant boost to their monthly cash flow.

.

Other Stories:

-

HECM is an important part of HUD providing housing stability- MMI fund may show marked improvement

-

How To Avoid Reverse Mortgage Lending Traps

Why so few? It’s complicated.

Why so many don’t consider a reverse mortgage.…

Why so many don’t consider a reverse mortgage.…

“The numbers are worrisome. The typical 54- to 64-year-old with a 401(k) or IRA owns a median portfolio worth about $135,000 and more than a quarter of workers don’t have retirement savings accounts”, writes Chris Farrell in his column Is This a Good Time to Get a Reverse Mortgage in Next Avenue.

Considering the stark figures Farrell just cited the word ‘yes’ comes to mind. And the fact that homeownership for households 65 and older has risen to 81% according to the Harvard Joint Center for Housing Studies, would further bolster the argument that now is the time for many to at least look into a reverse mortgage. But many may not. It’s complicated. Laurence Kotlikoff, a Boston University economics professor and expert on personal finance and retirement planning explains. “I went from not liking them to thinking they aren’t as bad as I thought”.

So why are reverse mortgages not going mainstream, as many of us in our industry have hoped? Kotlikoff puts it this way. “I looked more carefully with our software, and it got me back to not thinking favorably about reverse mortgages,

[read more]

It’s a complicated product to get your brain around. If you couldn’t come up with any other option to stay in the home, then use a reverse mortgage.” Farrell agrees.

Therefore in his upcoming book Money Magic: An Economist’s Secrets to More Money, Less Risk, and a Better Life, Kotilikoff suggests a number of alternatives to a reverse mortgage. A multigenerational home, renting out rooms on Airbnb, or a sales leaseback are just a few options he suggests.

What is a multigenerational home? The U.S Census Bureau defines a multigenerational home as a household that consists of more than two adult generations living under the same roof or grandparents living with grandchildren under the age of 25. Ironically, before the advent of FHA, government-backed financing, and suburban developments such an arrangement was the norm for millions of Americans.

A sales leaseback entails the homeowner selling their home to a family member or company, possibly pulling out some equity, and continuing living in it while making monthly rent payments to the buyer. Unlike a reverse mortgage, this strategy requires relinquishing ownership to another party. Renting a room or accessory dwelling unit on Airbnb sounds appealing but typically requires approval from local authorities, the ability to provide regular thorough housekeeping or to hire out cleans, a loss of privacy, and liability insurance.

Each of the alternatives to a reverse mortgage has its own wrinkles and complications. But let’s look again at why many see today’s reverse mortgage is complicated. One reason the Center for Retirement Research at Boston college cites is homeowners’ aversion to borrowing again, whether they have a low loan balance, and especially if the home is paid off free and clear.

The California Department of Real Estate’s brochure Reverse Mortgages. Is One Right for You says reverse mortgages are more complicated than conventional loans and that the consequences of the various plans and options offered in the loan are not always obvious? In fact, there are dozens of state and federal consumer publications that describe the loan as complicated.

While these are valid explanations for why reverse mortgages appear to be complicated, they ignore one obvious explanation that’s hiding in plain sight. It’s a counter-intuitive loan. As the name implies it flips the idea of a traditional mortgage on its head. That in itself is enough to give some pause, and that’s to be expected. But I would caution, what seems simple to reverse mortgage originators is often intimidating and ambiguous to others. Finding a way to bridge the homeowner’s basic understanding of their traditional mortgage works to how a reverse mortgage function differently is key.

What’s your opinion? Leave your comments below.

Stories mentioned in this article:

Next Avenue: Is This a Good Time to Get a Reverse Mortgage?

Centers for Retirement Research: Home Equity: Useful but Unused

California Departement of Real Estate: Reverse Mortgages. Is One Right for You?

Harvard Joint Center for Housing Studies: Housing America’s Older Adults

[/read]

October Top 100 HECM Lenders Report

Two things that should be in every retirement plan

Two assets are typically ignored in retirement financial planning. One is Social Security claiming, that is the most advantageous way to structure Social Security benefit payouts. The other is…

Continue readingFew worried about a housing bubble- just like last time

Unable to use the embedded player? Listen here.

EPISODE #694

CNN Business: No one seems worried about a housing bubble. Just like last time the bubble burst

Good news. Few economists, if any, believe that the housing market will crash. The bad news most experts believed the same in the months and years leading up to the 2008 housing market crash.

Other Stories:

-

If You Get This Message About Your Mortgage, Contact Authorities, FBI Says

-

Another lender is offering a reverse mortgage for Generation X

A window of opportunity is closing

As the housing market cools 2022 will require a pivot away from HECM refinances. Older homeowners stand to gain the most today.

As the housing market cools 2022 will require a pivot away from HECM refinances. Older homeowners stand to gain the most today.

In the first week of October traditional mortgage application volumes have plummeted to a three month low, and traditional mortgage refinances transactions are 16 percent lower than the same week one year ago. Then in late September the Federal Reserve signaled they would be tapering its $120 billion purchase of U.S. Treasury bonds and mortgage backed securities.Then there’s housing inventory which is up 30 percent since May. While some of these factors are not directly tied to the reverse mortgage market each will have an impact on interest rates, and most importantly, consumer sentiment in the housing market.

Meanwhile, U.S. homeowners 62 and older are sitting on a mountain of home equity. NMRLA’s RiskSpan Reverse Market Index shows senior housing wealth grew by 3.7 percent from the first to the second quarter of 2021 for a record total of $9.57 trillion. Is the window of opportunity closing for these equity-rich homeowners who haven’t got a reverse mortgage? It may be for those that have a high mortgage balance that leaves them on the cusp of qualifying at today’s interest rates and record home values. Then there’s older homeowners with little or no mortgage balance are likely to qualify in the future, albeit with higher interest rates and potentially lower home values.

Who would of thought we would see such ideal an ideal housing market and favorable lending conditions in an economy many expect is headed into a deep recession? However, as the housing market inflated the purchasing power of the U.S. dollar was steadily eroded by inflation, so much so that Social Security recipients will see a 5.9% cost of living adjustment in 2022 as we reported last week.

So the logical question is what’s next? First is the pivot.

[read more]

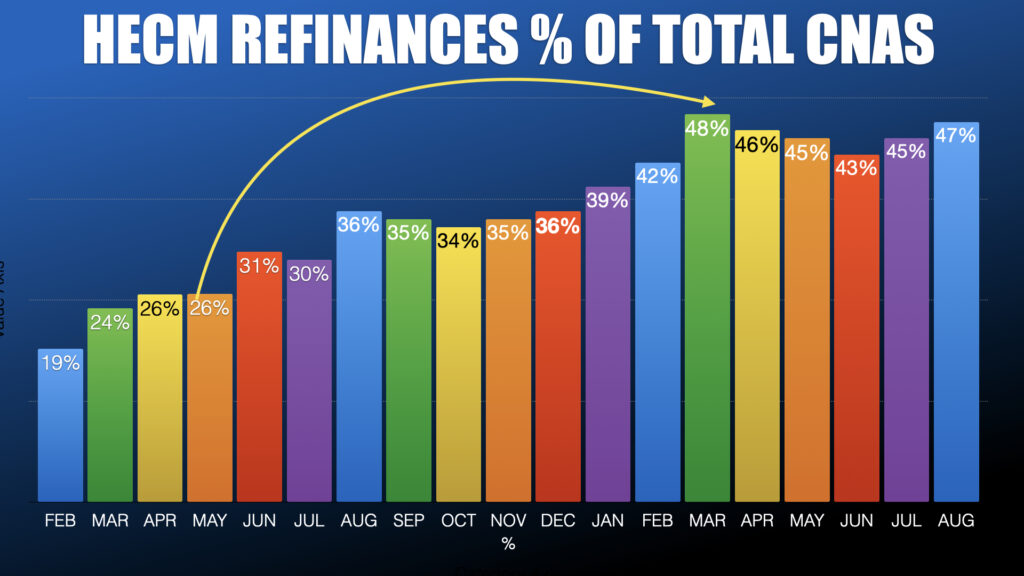

Since March HECM-to-HECM refinances have accounted for nearly 50% of all applications. Surprisingly that trend has persisted revealing that the market’s refi potential may not be quite tapped dry. But at some point it will. Looking forward to 2022 HECM the majority of endorsement volume will have to be drawn from first-time HECM borrowers. Today anecdotal reports show lenders and brokers are anticipating a move to a more customary lending market and are planning accordingly.

Since March HECM-to-HECM refinances have accounted for nearly 50% of all applications. Surprisingly that trend has persisted revealing that the market’s refi potential may not be quite tapped dry. But at some point it will. Looking forward to 2022 HECM the majority of endorsement volume will have to be drawn from first-time HECM borrowers. Today anecdotal reports show lenders and brokers are anticipating a move to a more customary lending market and are planning accordingly.

The shift to a more typical HECM market in 2022 is likely to be aided by increasing inflation and a growing sense of unease about the American economy. If history has taught us one thing it’s that financial need or anxiety are often the forces that push most to even consider a reverse mortgage in the first place. Certainly there are the mass-affluent who see an opportunity to hedge their future cash flow, but for most it’s a pragmatic decision fueled by their current financial circumstances. And that’s our window of opportunity. Record home values and low interest rates amidst an economy that’s flashing the warning signs of a recession and possibly stagflation. This increasingly makes the reverse mortgage an increasingly attractive bulwark against the ravages of inflation and economic hardship.

.

[/read]

How to tap into your home’s value safely

Unable to use the embedded player? Listen here.

EPISODE #693

Consumer Reports: How to tap into your home’s value safely

Consumer Reports outline several ways a homeowner may tap into their home’s equity safely. Only one choice doesn’t require monthly mortgage payments. .

Other Stories:

-

Reverse Market Insight’s Market Minute

-

Zillow exits homebuying – Home price growth will slow dramatically in 2022 says Core Logic

Why a 6% increase in Social Security may fall short

Social Security recipients are slated to receive a six percent cost of living adjustment or COLA in 2022, that thanks to a historic spike in inflation. The benefits increase would be the largest in nearly four decades

Continue readingMore demand for guaranteed retirement income

A recent survey reveals that 78%of advisors report that predictable income is more important to clients than earnings and returns…

Continue reading