The Home Equity Conversion Mortgage has come under increased scrutiny with HUD’s annual reports to Congress and the ensuing actuarial reports showing wild and unpredictable swings i

Continue readingHECM Changes: 5 Things to Expect

While the mortgagee letter was brief the potential impacts are considerable. Here are some impacts to anticipate and plan for in the wake of the most recent overhaul of the federally-insured reverse mortgage.

Continue readingHECM Changes & The Ensuing Crash

HECM Changes & the Ensuing Crash in Volume

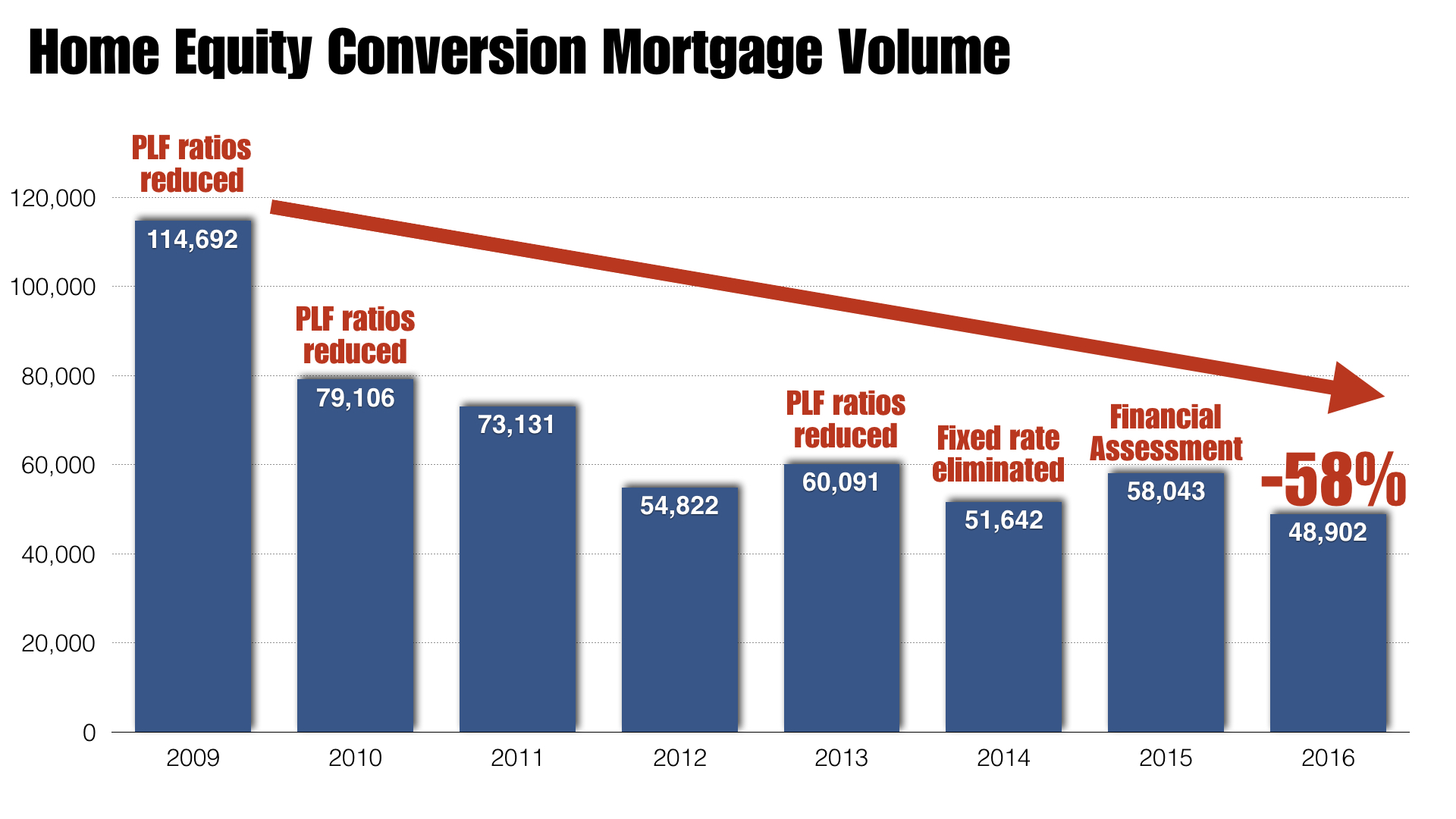

Since it’s introduction in the late 1980’s the Home Equity Conversion mortgage was a collateral-based product. In recent years the reverse mortgage or HECM has shifted from a loan based on the homeowner’s equity and age to a fully underwritten mortgage requiring borrowers to prove their financial capacity to pay property taxes and insurance.

Not surprisingly, these changes narrowed the potential market for the reverse mortgage and volumes have dropped by more than 50%, in part to the housing crash and numerous lending ratio reductions and financial underwriting requirements…

Download the video transcript here.

Do HECM Reforms Fix Past Losses?

Can recent HECM reforms ever repay the losses of the past?

An honest examination of the reverse mortgage would recognize that many loans originated prior to 2013, could easily become a future liability. Case and point the now defunct ‘Standard Fixed Rate HECM’. Introduced in the midst of an overheating housing market. With needs-based borrowers comprising a significant portion of HECM loans taken, the seeds of trouble sown came to fruition as housing values plummeted, causing many of these loans to ‘cross-over’ where the outstanding loan balance exceed the home’s value. Subsequent insurance claims spiked.

An honest examination of the reverse mortgage would recognize that many loans originated prior to 2013, could easily become a future liability. Case and point the now defunct ‘Standard Fixed Rate HECM’. Introduced in the midst of an overheating housing market. With needs-based borrowers comprising a significant portion of HECM loans taken, the seeds of trouble sown came to fruition as housing values plummeted, causing many of these loans to ‘cross-over’ where the outstanding loan balance exceed the home’s value. Subsequent insurance claims spiked.

Complicating matters is the method used to calculate the HECM program’s economic value which swung wildly from a positive valuation of $6.8 billion in 2015, to a negative value of $7.7 billion for the fiscal year 2016.

What are your thoughts? Please leave your input in the Comments section below, and share this post on social media using the Twitter, Facebook and LinkedIn icons at the top of this page. Thank you!

HECM Changes: Followup Q&A with Survey Results

Exclusive Interview with John Lunde of Reverse Market Insight

Exclusive Interview with John Lunde, founder of Reverse Market Insight

Exclusive Interview with John Lunde, founder of Reverse Market Insight

John Lunde is the president and founder of Reverse Market Insight (RMI). They closely track the reverse mortgage (HECM) industry data points and trends.

John discusses the following

- Impacts of the reduced Principal Limit Floor

- How this recent announcement compares to previous HECM changes

- Lender profitability and consumer pricing

- Key industry metrics we should be watching closely

- What opportunities does this change present?

HUD is soliciting feedback from interested parties until September 29, 2017. Feeback can be submitted to: answers@hud.gov

Official Mortgagee Letter 2017-12 “Home Equity Conversion Mortgage (HECM) Program: Mortgage Insurance Premium Rates and Principal Limit Factors”

What are your thoughts? Please leave your input in the Comments section below, and share this post on social media using the Twitter, Facebook and LinkedIn icons at the top of this page. Thank you!

HUD Reins in HECM Program: Industry Reacts

Exclusive Interview with Shelley Giordano from Funding Longevity

This week we discuss:

- How HECM lenders will compete under the new rules

- Potential changes to the how the HECM is viewed by seniors and HECM professionals

- The recent changes in light of the HECM’s mission

- Impact of lowered ongoing FHA premiums on the principal limit growth (line of credit)

- The ‘ruthless’ option

HUD is soliciting feedback from interested parties until September 29, 2017. Feeback can be submitted to: answers@hud.gov

Official Mortgagee Letter 2017-12 “Home Equity Conversion Mortgage (HECM) Program: Mortgage Insurance Premium Rates and Principal Limit Factors”

What are your thoughts? Please leave your input in the Comments section below, and share this post on social media using the Twitter, Facebook and LinkedIn icons at the top of this page. Thank you!

Market Disruption Brings Opportunity

BREAKING: HUD Cuts PLF Factors, % Rate Floor & Increases Upfront FHA Insurance Premiums

Without any prior warning or industry comment, HUD formally announced an increase of upfront insurance premiums for all borrowers, regardless of initial distributions, to 2% upfront, and .5% for ongoing mortgage insurance premiums. The agency stated the need to ensure the continued economic sustainablity of the HECM program and its fiduciary responsiblity to taxpayers. [See Mortgagee Letter 2017-12] [ Wall Street Journal Article View on Facebook to see full article]

HUD has lowered the interest rate ‘floor’ from 5.06% to 3.00% in it’s PLF tables, essentially pushing lenders to compete on interest rates and margins. We expect to see more lenders switch from the monthly to the annual adjustable LIBOR index in response. In addition the new PLF tables accomodate a rising interest rate enviornment with lending ratios provided as high as up to 18.875%, wheras the previous tables zeroed out lending ratios at 10%. [New 2017 PLF Tables] [Old 2014-2017 PLF Tables]

In our analysis, the reduction in ongoing FHA premiums will significantly reduce the ongoing growth of the HECM’s Principal Limit (available funds), or what many refer to as the line of credit. This development will substantially change several strategies touted in recent years, such as the Standby Reverse Mortgage, and those seeking to use increasing available funds as a hedge against unexpected financial shocks in retirement.

Principal Limit Factor will be reduced from 64% to 58% on average and an approximate 20% reduction available funds for most borrowers:

* 20% reduction with new PLFs and lower interest rate floor after October 2nd, 2017

HUD is soliciting feedback from interested parties until September 29, 2017. Feeback can be submitted to: answers@hud.gov

Official Mortgagee Letter 2017-12 “Home Equity Conversion Mortgage (HECM) Program: Mortgage Insurance Premium Rates and Principal Limit Factors”

What are your thoughts? Please leave your input in the Comments section below, and share this post on social media using the Twitter, Facebook and LinkedIn icons at the top of this page. Thank you!

A HECM or a Jumbo?

Equity consumption, home appreciation, and heirs

Million dollar homes are more commonplace than many would expect and with more affluent borrowers considering a reverse mortgage, the question arises: does a reverse mortgage make sense? Jack Guttentag’s (aka The Mortgage Professor) latest column in the Herald Tribune addresses the strategies and risks to consider with high valued properties. Guttentag compare two borrowers aged 62 with homes worth $636,150 (today’s HECM lending limit) and $1 million respectively. If both take the maximum tenure payment of $1,854 per month and remain in their homes until the ripe old age of 100, their loan balances would have ballooned to $2.75 million. This assumes a relatively unchanged interest rate for both borrowers..

Million dollar homes are more commonplace than many would expect and with more affluent borrowers considering a reverse mortgage, the question arises: does a reverse mortgage make sense? Jack Guttentag’s (aka The Mortgage Professor) latest column in the Herald Tribune addresses the strategies and risks to consider with high valued properties. Guttentag compare two borrowers aged 62 with homes worth $636,150 (today’s HECM lending limit) and $1 million respectively. If both take the maximum tenure payment of $1,854 per month and remain in their homes until the ripe old age of 100, their loan balances would have ballooned to $2.75 million. This assumes a relatively unchanged interest rate for both borrowers..

However, the pivotal factor in this scenario is the assumed appreciation rate of 4%. With an appreciation rate of 4% the heirs of the lesser valued home would stand to receive about…