While the mortgagee letter was brief the potential impacts are considerable. Here are some impacts to anticipate and plan for in the wake of the most recent overhaul of the federally-insured reverse mortgage.

Continue readingPerspective & Opportunity

In today’s HECM marketplace a mindset that seeks opportunity is crucial…

Continue readingHow to be Unsinkable in the new HECM marketplace

You can feel unsinkable in the new HECM market…

Norcom has a business model that will fit your business model…especially after HECM changes begin October 2nd.

Norcom has a business model that will fit your business model…especially after HECM changes begin October 2nd.

About John Luddy: John has trained reverse mortgage professionals how to be successful when sitting face-to-face at the kitchen table with prospective HECM borrowers. Norcom is looking for qualified loan officer candidates. To learn more call 1-860-507-2582 or email John Luddy here

September Top 100 HECM Lenders Report

Download your September 2017 Top 100 Retail HECM Lenders Report Here.

This Report Does Not Include Broker or TPO Data

This report was compiled from data courtesy of Reverse Market Insight.

HECM Changes & The Ensuing Crash

HECM Changes & the Ensuing Crash in Volume

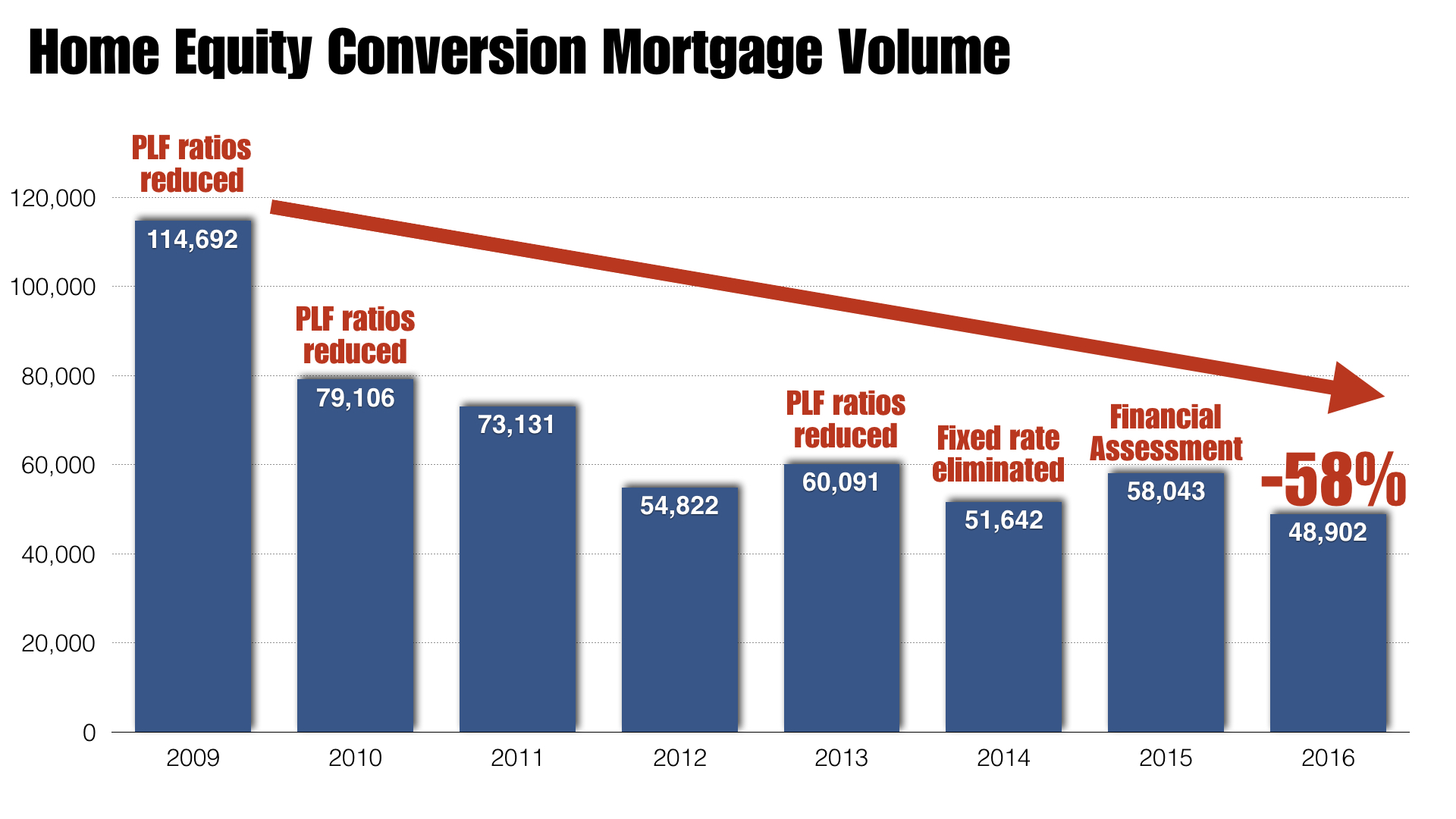

Since it’s introduction in the late 1980’s the Home Equity Conversion mortgage was a collateral-based product. In recent years the reverse mortgage or HECM has shifted from a loan based on the homeowner’s equity and age to a fully underwritten mortgage requiring borrowers to prove their financial capacity to pay property taxes and insurance.

Not surprisingly, these changes narrowed the potential market for the reverse mortgage and volumes have dropped by more than 50%, in part to the housing crash and numerous lending ratio reductions and financial underwriting requirements…

Download the video transcript here.

Taking back control

Why you should take control of your calendar today

An empty calendar holds a world of possibility, mischief, and potential abuse. An empty calendar is great if you have a day scheduled off away from the demands or your job as a busy reverse mortgage professional, but not on work days.

An empty calendar holds a world of possibility, mischief, and potential abuse. An empty calendar is great if you have a day scheduled off away from the demands or your job as a busy reverse mortgage professional, but not on work days.

If you’ve arrived at your desk Monday morning with a nearly empty calendar, save that required conference call, you’re missing out and you may pay dearly for it. “Nature abhors a vacuum”- this idiom that reminds us that empty spaces go against the laws of nature itself. They may also go against the laws of good time management. Why?

If you worked in a collaborative environment where you and your coworkers share your calendars, they will see your ‘free time’ and…

What comes after October 2nd?

What comes after 10/2? Norcom can help…

Norcom has a business model that will fit your business model…especially after HECM changes begin October 2nd.

Norcom has a business model that will fit your business model…especially after HECM changes begin October 2nd.

About John Luddy: John has trained reverse mortgage professionals how to be successful when sitting face-to-face at the kitchen table with prospective HECM borrowers. Norcom is looking for qualified loan officer candidates. To learn more call 1-860-507-2582 or email John Luddy here

Staying Smart About Senior “Savings”

Are smooth sales pitches depleting senior wallets?

Continue readingDo HECM Reforms Fix Past Losses?

Can recent HECM reforms ever repay the losses of the past?

An honest examination of the reverse mortgage would recognize that many loans originated prior to 2013, could easily become a future liability. Case and point the now defunct ‘Standard Fixed Rate HECM’. Introduced in the midst of an overheating housing market. With needs-based borrowers comprising a significant portion of HECM loans taken, the seeds of trouble sown came to fruition as housing values plummeted, causing many of these loans to ‘cross-over’ where the outstanding loan balance exceed the home’s value. Subsequent insurance claims spiked.

An honest examination of the reverse mortgage would recognize that many loans originated prior to 2013, could easily become a future liability. Case and point the now defunct ‘Standard Fixed Rate HECM’. Introduced in the midst of an overheating housing market. With needs-based borrowers comprising a significant portion of HECM loans taken, the seeds of trouble sown came to fruition as housing values plummeted, causing many of these loans to ‘cross-over’ where the outstanding loan balance exceed the home’s value. Subsequent insurance claims spiked.

Complicating matters is the method used to calculate the HECM program’s economic value which swung wildly from a positive valuation of $6.8 billion in 2015, to a negative value of $7.7 billion for the fiscal year 2016.

What are your thoughts? Please leave your input in the Comments section below, and share this post on social media using the Twitter, Facebook and LinkedIn icons at the top of this page. Thank you!

What if this was your last week…

What if someone told you that this was your last week? What would you do? Where would you focus your thoughts?

Continue reading