Why refis may persist despite rising interest rates

Twice in 2021, I predicted that we would see the pace of HECM refinances slow. In both instances I was wrong. Knowing that there is a finite number of homeowners with a reverse mortgage who would qualify I reasoned that the well would eventually run dry.

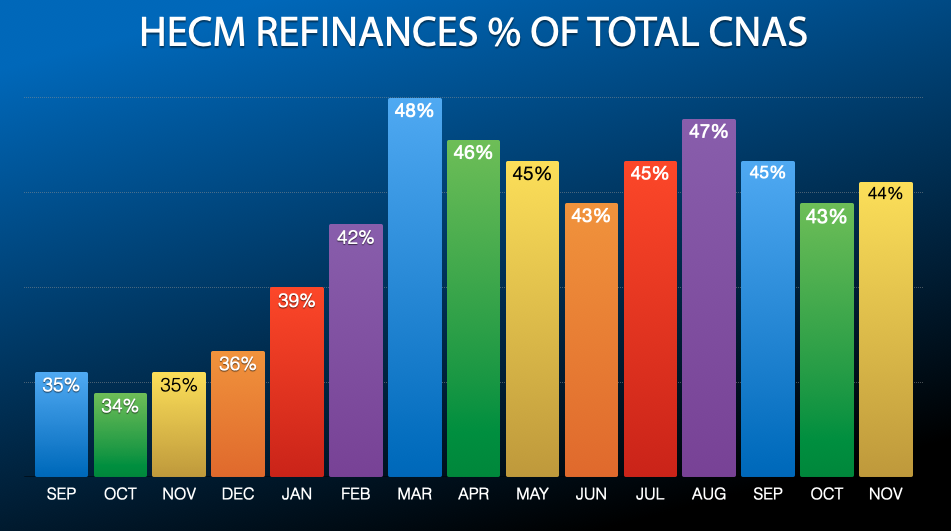

The most recent FHA Single Family Production report reveals in November 44% of all new HECM case number assignments for new applications were for HECM-to-HECM refinances. A one-percent drop from October. However, there’s one factor that could boost or prolong the surge of refinances. The 2022 increase of the HECM maximum claim amount or lending limit.

Thanks to 2021’s average home price appreciation and the FHFA mandatory calculation of lending limits, the 2022 lending limit was increased by $148,425 to $970,800. Homeowners with properties near or above the 2021 limit of $822,375 that took out their loan in 2020 0r could see a net benefit in refinancing their existing reverse mortgage despite recent increases in the Constant Maturity Treasury rate.

While refinances have provided a boom in overall HECM volume investors are less than enthused. Not surprising considering payoffs of HMBS exceeded $1 billion for 10 months in a row. New View Advisors noted, “December came close in both dollar amount and speed: $1.28 billion, representing a 24% annual payoff rate”. Faster prepayment speeds of existing securitized HECMs, they noted, means investors will see smaller yields.

Where moderate interest rate increases may temper the pace of HECM refinances the higher lending limit will provide a new source of refis from higher-valued homes.

New View Advisors: Refinancing is the Holiday Guest That Won’t Leave

1 Comment

Shannon,

Like you I am surprised about the duration of the sustained rise in Refis. Like you once again I have learned that my crystal ball is more of an eight ball that is creaked and dripping the oil that it contains and that makes it look black.

The strength of the rise seems to be a result not of current HECM borrowers reaching out to originators but rather the significant marketing efforts of most originators to reach out to current HECM borrowers to stir them up to find out if they qualify for more cash. Some originators talk about their concern for the seniors and yet refuse to encourage these borrowers to seek the advisability of a Refi with their financial advisors. The root of that concern generally is that the originators believe the chances of closing a Refi drop precipitously when that advise is obtained. So as to doing the right thing for the senior, that seems to be more hype than fact.

So as long as 1) the high rate of Refi marketing continues, 2) the Refis can generally withstand the “ravages” of underwriting, and 3) investors are willing to continue rewarding us at substantially the same rates for closing HECM Refis as for closing Traditional HECMs and H4Ps, I expect to see a substantially higher endorsement rate for HECM Refis (to total endorsements) than at any time before 10/1/2018.

While the current overall MCA (Maximum Claim Amount) limit is so much greater than that same number for 2021, how long it alone will sustain a percentage rate of over 40% endorsed Refis to total endorsements is a very heated discussion. Fortunately, lower interest and ongoing MIP rates continue to be significant components of our current Refi craze.

When looking at the monthly percentages of CNAs (Case Number Assignments) for Refis to total CNAs and comparing those percentages to the percentages of endorsed Refis to total endorsements one thing jumps out. The endorsement percentage for Refis to total endorsements is now substantially higher than same percentage for CNAs. This says that the closing rates for Refis appears to higher than for HECMs with new HECM borrowers. Of course this has been anecdotally rumored for months and months but HUD stats are now bearing these anecdotes out.