The mortgage meltdown.

Are reverse mortgages the recession-proof solution?

The pieces are now falling into place. Consumer spending has dropped considerably. Large ticket items and even housing could see deflation. Inflation is crushing consumers who are now cutting back on discretionary spending. Last week the nation’s two largest retailers Walmart and Target reported massive drops in profits. Target alone shed 25% of its stock value last week after reporting a stunning 52% drop in profits. CNN Business reports Target was also forced to write down the value of excess inventory that’s just sitting in warehouses. In other words, consumers are on strike only buying necessities.

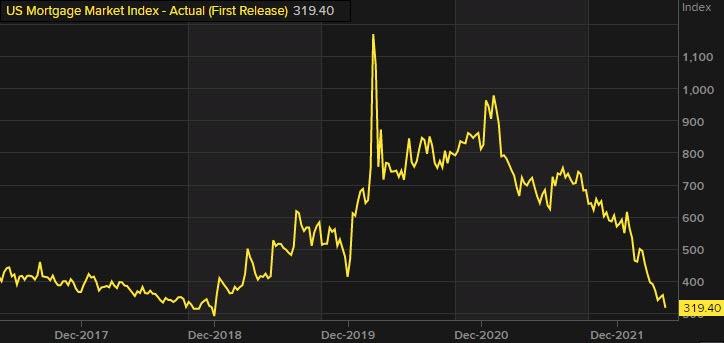

Traditional mortgage lending is feeling the full force of economic forces that have returned to roost after a decades-long absence; inflation and rising interest rates.

On the supply side…

Read More

the National Association of Homebuilders released a report that homebuyer traffic for new homes is down 29% year-over-year from May 2021. In a statement, the association said, “In a sign that the housing market is now slowing, builder confidence took a steep drop in May as growing affordability challenges in the form of rapidly rising interest rates, double-digit price increases for material costs, and ongoing home price appreciation are taking a toll on buyer demand.” The finance side of the housing market is feeling the full force of this economic storm. The average 30-year fixed mortgage rate began at 3.66% in February and is now floating around 5.45%. Consequently, purchase and refinance applications have tumbled. Mortgage News Daily reports both suffered double-digit hits with its Market Composite Index that measures application volume dropping 11% from the previous week. Year-to-year application volumes are down 15%. Refinance volumes have fallen off a cliff. Today home refinances are down 76% from May of last year. The issue is not merely interest rates. Case in point, in November 2018 the average 30-year fixed-rate loan was nearly five percent or just one-half point less than today’s average rate. The rub is both the massive inflation of home values and consumer goods. The median home price in November 2018 was $322,800; today it’s $428.700. The Consumer Price Index (a measure of the inflation of consumer goods) was only 2.2% in November 2018. Today the annually-adjusted inflation rate is estimated to be 8.5% It’s natural that higher mortgage payments coupled with the rapidly-increasing price of consumer goods is pushing many out of the housing market and forcing others to discard any hopes of a cash-out refinance or HELOC. As a result, many mortgage lenders are now eying reverse mortgages, and who could blame them? Unlike younger homeowners who have little or no equity, older homeowners are sitting on trillions of dollars of accumulated equity- many who would qualify for a reverse mortgage, even at today’s interest rates. Anecdotal reports already indicate today’s changing market is pushing many who’ve previously considered a reverse mortgage off the fence. Traditional mortgage lenders without a reverse mortgage division will find the move into reverse not only logistically challenging but culturally foreign to most of their originators. However, those lenders who have already bifurcated their business into traditional and reverse can more easily pivot prioritizing their investment and energies toward reverse lending. Wholesale mortgage brokers will be shopping for turn-key reverse mortgage business models. One thing is certain. The historical increase in reverse mortgage loan activity corresponds with the number of lenders actively originating the loan. Does this mean we will see the return of one or two large retail banks? It’s too early to tell. However, with necessity being the mother of innovation we can expect to see more small to midsize banks and mortgage lenders move to reverse. In the end, that’s a good thing.

1 Comment

The highest year for H4P endorsements since 9/30/2017 was fiscal year 2018 with just 2,610; the worst such year was fiscal 2021 with just 2,230 for a drop of 14.6%. The highest year for Traditional HECM endorsements since 9/30/2017 was fiscal year 2018 with just 39,869; the worst was fiscal 2021 with just 26,167 for a drop of 34.4%. Those drops are alarming.

Both totals are considered first time HECM borrower loans; however, just because a consumer gets a new home with a HECM, it does not necessarily mean that the last home the borrower sold did not have a HECM. But let us assume that all H4P borrowers are indeed first time HECM borrowers. So now look at the total endorsements for HECMs associated with first time borrowers.

Total HECMs for first time HECM borrowers for fiscal 2018 is 42,479 while that same total for fiscal 2021 is 28,397 for a drop of 33.2%.

Two material conclusions can be drawn from this drop in first time HECM borrower production. The first is that it will not be easy to gain back 50% more first time HECM borrower endorsement production over fiscal 2021. That should result in lower total endorsed HECMs in fiscal 2023 than in fiscal 202 (yes, I skilpped fiscal year 2022) while HECM Refis are tanking meaning that total HECM endorsements should be lower than same sum in fiscal 2021. The second conclusion is that despite all of the rhetoric about how well the industry is doing through Realtor and financial advisor/planner referrals, a 34.4% drop in first time borrower HECM endorsements means there is no credible empirical evidence supporting that myth.