The Federal Reserve’s interest rate cuts and government economic stimulus have given our economy a pure sugar rush. One of the early manifestations of this ‘sugar high’ can be found in the mortgage market’s surge of refinancing activity.

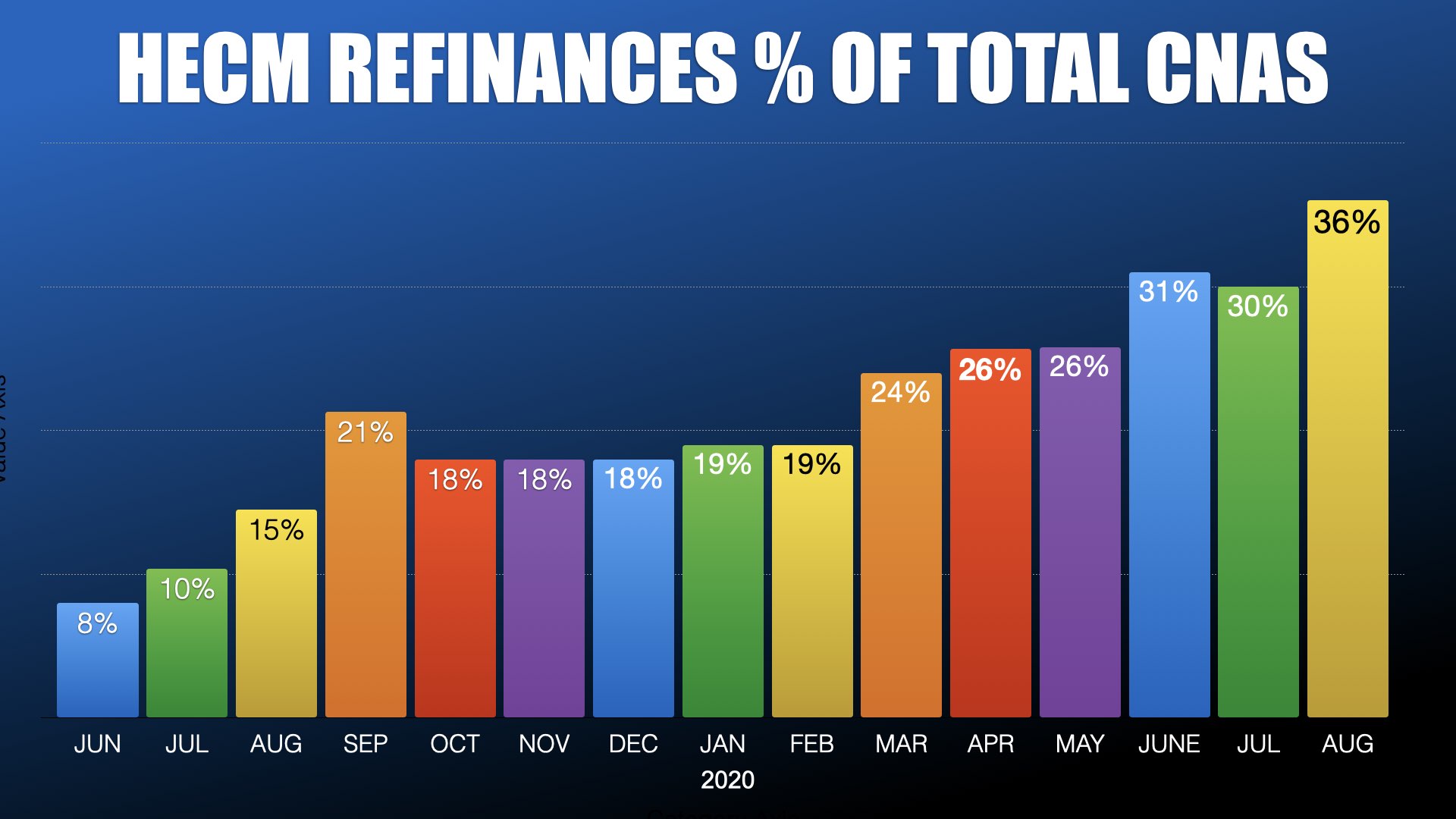

Traditional mortgage refinances are 50% higher than a year ago according to the Mortgage Bankers Association. Home Equity Conversion Mortgage refinance transactions also climbed from an average of 5.4% in 2019 to an average of 20% of all FHA case numbers issued for the federally-insured reverse mortgage. In fact, August set a new high for refinance activity with 36% of all HECM case numbers being HECM-to-HECM refis transactions.

Against this backdrop fiscal year 2020 endorsements for the HECM grew 34% over 2019. A considerable part of that increase can be attributed to this new yet anticipated spike in HECM refinance activity.

Read More

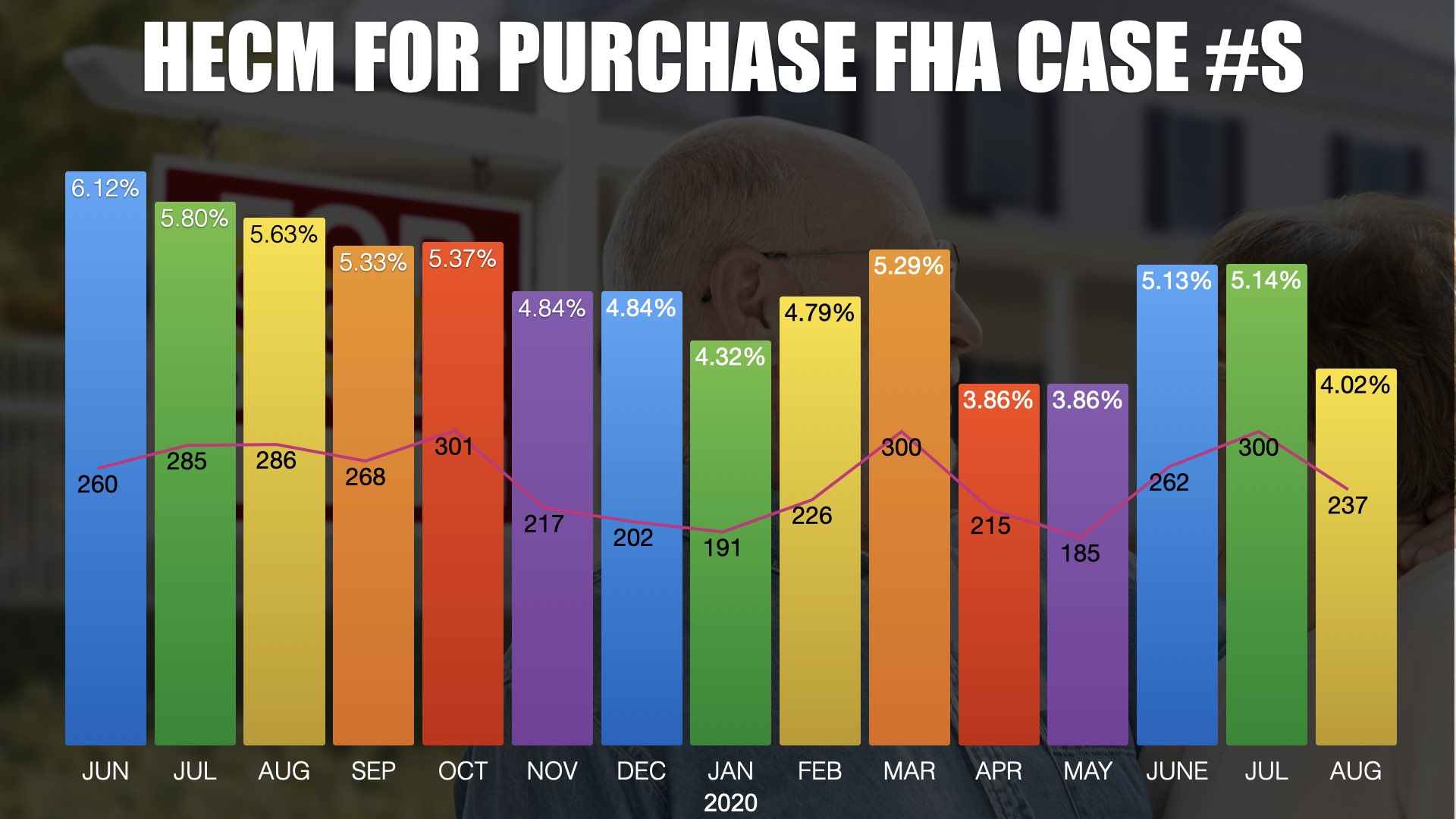

While traditional borrowers are reducing their monthly payment by hundreds of dollars, those refinancing a HECM are harvesting additional cash thanks to their home’s value and record low interest rates. All with all cycles, they eventually end. Where will originators turn once the refinance boom fueled by low rates fades? One market that still holds potential but has yet to see significant growth are HECM purchase transactions. Since June 2019 H4P (HECM for Purchase) case numbers have hovered between a modest four to six percent of application case numbers assigned by FHA. While the H4P market certainly requires ‘a particular set of skills’ to work closely with realtors and a solid understanding of sales transactions, originators still can make significant inroads. With real estate values peaking buyers can sell their home at a record price and make a much smaller down-payment thanks to effective interest rates between three and four percent. However, buyers face the challenge of a housing inventory shortage. The outcomes of economic stimulus can be seen in all segments of the U.S. economy. Preparing for the next phase of HECM marketing and production is vital for success as we face the economic uncertainty of a second wave of the coronavirus and enter the new year.

Existing home sales hit a 14-year high but not enough new homes are being built to meet demand. Last month Bloomberg reported that home inventories would be exhausted in three months at our current pace of existing home sales. Not surprising considering the impact the COVID-19 pandemic shutdowns had on new construction labor, materials manufacturing, and financing disruptions. Housing inventory is expected to increase appreciably next year when mortgage and eviction forbearance measures end and new home construction projects are completed.

No comment yet, add your voice below!