Changing Perceptions and Expanding Opportunities

By Bonnie Davis, Adam Ennabe, and Chad Gipidy

The Home Equity Conversion Mortgage (HECM) program has long been perceived as a last resort loan option for retirees despite being the best loan for their situation. We can attract a more affluent clientele and reshape public opinion by reintroducing the HECM Saver program. The HECM Saver program, first introduced in 2010, but later discontinued, offered borrowers a reduced upfront cost option compared to the standard HECM loan. In exchange for the lower UFMIP, FHA lowered the principal limit factor to reduce their risk. Reviving this program will remove the price objection that many borrowers have today and increase the popularity of the program. This article explores how specifically bringing back the HECM Saver program could transform the perception of reverse mortgages and make the age of 62 a long-awaited milestone for becoming eligible for a beneficial reverse mortgage.

1. Attracting Affluent Borrowers

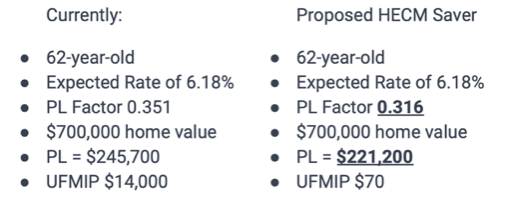

One of the main deterrents for affluent borrowers considering a reverse mortgage is the upfront cost associated with the loan. Lowering UFMIP makes the HECM program more appealing to those whose only objection is the high initial cost. Currently, a borrower with a $50,000 mortgage balance on their home with a value of $750,000, would result in a UFMIP fee of $15,000, almost one-third of their current outstanding mortgage! Re-introduce the HECM Saver and this same borrower would pay $75 in UFMIP, making this a much more attractive option for this consumer. The reverse mortgage will have a low-cost option for those who qualify. Introducing a low UFMIP option will give choices consumers to appeal to a much broader audience. The HECM becomes much more than a loan of last resort and instead becomes a strategic tool to be incorporated into every qualifying senior’s retirement plan.

2. Financial Advisors’ Recommendations

Financial advisors play a crucial role in guiding their clients’ financial decisions. Currently, many advisors are not recommending reverse mortgages to their clients simply because it is an unfamiliar product for them. Most people who work with financial advisors are in a favorable financial position, and when they learn about the HECM program their main objection is the excessively large UFMIP. We have the opportunity to change the cycle from one of decline to one of growth.

Financial advisors will have more and more clients entering into reverse mortgages and will need to become educated on the program. The HECM Saver program aligns with the financial goals of affluent borrowers, and financial advisors will be endorsing the program. And why wouldn’t they with all the benefits available: tax benefits, Increased liquidity, growing lifetime line of credit, protection for spouses and heirs, etc. and all this being guaranteed by the federal government?

Financial advisors will have more and more clients entering into reverse mortgages and will need to become educated on the program. The HECM Saver program aligns with the financial goals of affluent borrowers, and financial advisors will be endorsing the program. And why wouldn’t they with all the benefits available: tax benefits, Increased liquidity, growing lifetime line of credit, protection for spouses and heirs, etc. and all this being guaranteed by the federal government?

3. Shifting Public Perception

The media often portrays reverse mortgages as loans of last resort. The HECM does attract people in difficult financial situations because those people don’t have other options and they are most likely not to be as concerned with the high UFMIP. The media sees who is attracted to the HECM program and jumps to the conclusion that the program is meant for people in difficult financial situations. The HECM program is meant for all senior homeowners and is a great tool. By reintroducing this great

program and educating financial advisors more people will learn and recommend the reverse mortgage program. With more people obtaining the reverse mortgage out of opportunity instead of necessity, we will reshape the opinion of the product and its many benefits.

This change will take a few years and will lead to a massive increase in acceptance of the reverse mortgage product. At the peak of the HECM market, from about 2007-2009, FHA was endorsing around 110,000 HECMs annually, about twice the volume we saw in 2022. Yet, the population of seniors has increased by approximately 50% in that same timeframe. It is true that there were several factors that contributed to this decline. The truth is still that we have a life-changing product greatly underutilized simply because of its perception. The industry volume should be closer to 200,000 units annually, and this can be achieved with the reintroduction of the HECM Saver.

4. Increasing Popularity and Accessibility

Getting wealthy people to use the program, educating financial advisors, and changing public perception is a great long-term strategy that the HECM Saver program plays well into. However, there is an immediate result in reintroducing the HECM saver and that is the options provided to the current senior population searching for the program but turned off explicitly because of that upfront cost. More choices equal more consumers. This would be available for those with the extra equity to qualify with a reduced principal limit factor, and this may be the one thing that can tip the scales for many homeowners wanting the program.

The reintroduction of the HECM Saver program has the potential to significantly increase the popularity of reverse mortgages among a wider audience. With lower UFMIP, more homeowners will be encouraged to explore the benefits of utilizing their home equity. This increased accessibility will enable borrowers to leverage their housing wealth more effectively, contributing to improved retirement planning and financial stability.

The Math for FHA

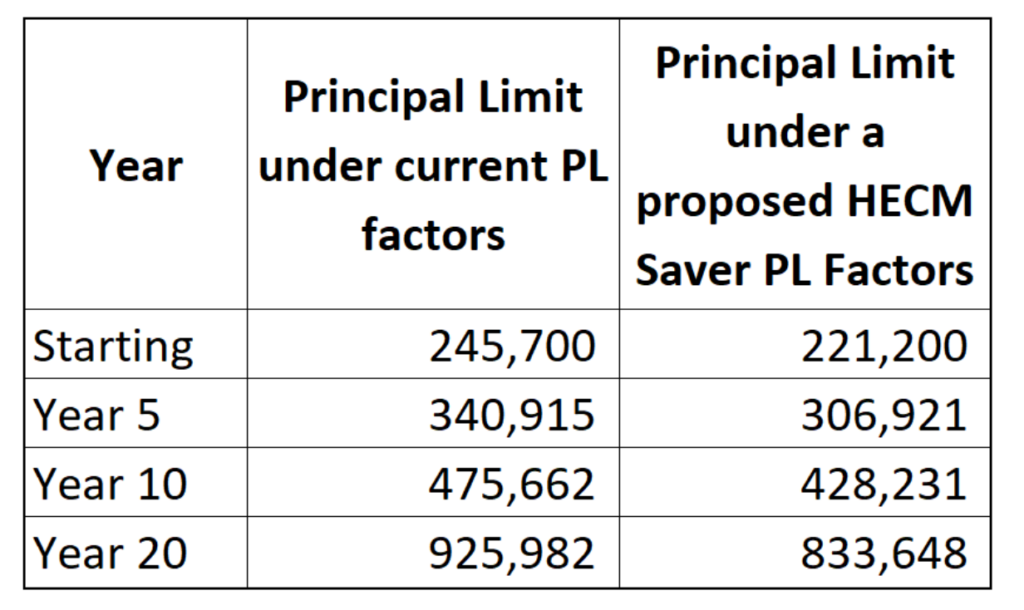

FHA risk is reduced with lower Principal Limit Factors. In order for FHA to consider a lower UFMIP option the FHA would have to reduce their risk and exposure.

Over a 20-year time frame, a reduction of just 3.5% of the principal limit upfront saves FHA $92,000 of risk or about 10% of the loan amount.

Written by: Bonnie Davis, Adam Ennabe, and Chad Gipidy

Are you interested in contributing a column for publication on HECMWorld? If so, send your submission request to info@hecmworld.com .

6 Comments

this is exactly what I mentioned several months ago. It never should have been offered and then canceled in short order. Hud has to step up with more support for the program if the product ever has a chance of becoming mainstream. There should be a renewed effort to develop a industry counsel and more lobbying support from the industry.

Thank you Bonnie, Adam, and Chad for bringing this up. Choice is always good, as our HECM prospects often have two sensitivities: 1) COST and 2) PROCEEDS. From 2010 to 2013, if the borrower was COST-sensitive, they could choose the SAVER. If the borrower was PROCEEDS-sensitive, they could choose the STANDARD.

For you HECM historians out there, on 9/1/2010, ML10-34 announced the following:

“[FHA] is pleased to announce a second option for the Home Equity Conversion Mortgage (HECM) Program. FHA designed HECM Saver as a second initial mortgage insurance premium (MIP) option for the purpose of lowering upfront loan closing costs, for mortgagors who want to borrow a smaller amount than what would be available with a HECM Standard.”

Sadly, the Saver option was eliminated on September 30, 2013.Ten years later, we have one product with the high costs of a STANDARD and the low proceeds of a SAVER.

A real common sense improvement to the loan program. Hopefully the idea can get some traction at the federal level.

The HECM Saver option was a great tool to have and has been sorely missed since it was taken away. It would be fantastic for a revision of the old program or something similar to what was proposed here in this article. It’s really good to have new options and innovations like the Equity Avail & HomeSafe Second or Alternative Reverse Mortgage programs from the Proprietary Lenders, but a low cost or “Saver” option really is needed as well.

Thank you for this great article. This is becoming a larger and larger concern of mine and for clients with higher home values and lower mortgage balances. Let’s bring the HECM Saver back or another option for borrowers with a much lower UFMIP please!

“For the small mortgage we still have on it, the 2 points for FHA mortgage insurance will keep me in other options. I’m sure the government thinks they are protecting me from something with the required fees (and high closing costs), but it makes no sense to my rational mindset…The PMI is the show-stopper for me so if anything ever changes, let me know.”

Thank you all for the thoughtfulness in the article. This is exactly what should be presented to FHA as some of the reasons to re-introduce the Saver. Even if FHA were to consider the Saver again, with some tweaks to the original, it would still be a game changer.

The current market for our clientele, and their advisors, with lower PLs and higher costs has many remaining on the sideline. We know the HECM is one of the best credit facilities available to our retirees. It’s hard for most of them to swallow 2% of the value for the cost of this option. I’m hopeful FHA has realized with the proper origination of the program and some of the other updates they’ve made, the FHA Insurance fund is on solid ground, and bringing back the Saver would make sense to drive better adaptation of the program. It’s all about options and this would be a great option to have on the table.