Deflation is here… even with inflation!

Inflation remains the lead story in nearly every evening newscast but more importantly, you are feeling its impact on your pocketbook. The most recent consumer price index (CPI) which measures inflation was 8.5% since July 2021- still one of the highest rates of inflation seen in over 40 years. Yet amid rising prices and our loss of purchasing power we are seeing the first signs of deflation creeping into the U.S. economy.

What chicken wings can teach us

In the last year, the supply of chicken wings shot up 31% above the five-year June average according to Pilgrim’s Pride. Pandemic demand for chicken wings surged during lock-downs straining supplies and causing prices to soar. Food retailers responded by switching to boneless wings made from chicken breast leading to a rebound in chicken wing inventory. A deflation of wing prices followed with prices dropping substantially. In the case of the aviation-themed restaurant chain Wingstop, wing prices fell by 19% in one year. A sudden spike in demand, shortages, record high prices, and finally deflation. It’s a long-established pattern. Here’s an April episode of The Industry Leader Update where I discussed where we can expect deflation.

Deflation can be found

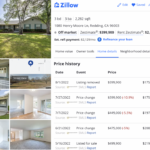

However, there’s one major asset class that’s showing the early signs of a deflationary cycle. Housing. Despite several indicators of a softening housing market Zillow, Redfin, and Realtor.com have been stubbornly bullish. However, a deluge of data has these real estate giants singing a different tune.

Yesterday, Redfin reported that new home listings have fallen 12% from one year ago (Housing Market Update: Newly-Listed Homes Fall Most Since 2020 as Sellers Pull Back). The forces behind the market’s shift can be primarily attributed to demand destruction. What was once a booming housing market has become a nightmare for both home buyers and home sellers alike. That should come as no surprise as just one year ago the average 30-year mortgage rate was 2.87% In Contrast that Freddie Mac’s report last week shows the typical 30-year mortgage stands at 5.22%.

Rising rates have curtailed homebuyer purchasing power, and now many have decided to sit on the sidelines.

While a sense of panic has not set in yet for home sellers there are signs that sellers are beginning to worry. Home inventory is up by 98% or more in several markets and the number of days homes are listed is increasing. Price reductions which were once unheard of six months ago are becoming increasingly common. Here in Redding California, just 2 hours south of the Oregon border, home sellers have been dropping their listing prices as their home languishes on the MLS. One seller dropped their asking price by $100,000 in two and a half months, a twenty percent reduction! Dozens of other listings are showing price drops of ten, fifteen percent, or more.

We have to admit that the surge in home prices since the spring of 2020 while impressive was unhealthy and unsustainable. Unhealthy in that demand was artificially created with historically-low interest rates. Unsustainable as buyer demand quickly retreated once the Federal Reserve began hiking interest rates to curb record inflation. What remains, however, is the majority of U.S. home values are still sitting at record high values- a unique yet limited opportunity for older homeowners to maximize their ability to tap into their home’s value with a reverse mortgage to help offset the effects of inflation.

Additional reading:

Housing Market Update: Newly-Listed Homes Fall Most Since 2020 as Sellers Pull Back

There is deflation in some items as Wingstop notes dropping chicken wing prices

Consumer prices rose 8.5% in July, less than expected as inflation pressures ease a bit

No comment yet, add your voice below!