Realistic Optimism?

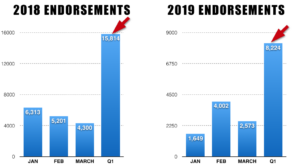

No matter how you slice it, HECM endorsement volumes are down- significantly. The first quarter of 2019 has

48% fewer endorsements than Q1 2018. Even when factoring in the lagging endorsements from the late 2018 rush to beat October 2, 2017, HECM changes– the trend is undeniable. HECM volumes have broken their previous cycle of ‘secular stagnation’ with drops and rebounds as a new trend appears.

While the October 2017 cutbacks to the HECM’s principal limit factors and dropping the interest rate floor may have reduced the program’s risk to the MMI Fund, they have also prompted an extended slump in HECM lending volumes.

What may frighten and dismays us may not be our industry’s falling loan volume, but the way in which we think about it.

A number of factors may be contributing to fewer HECM endorsements should be kept in mind:

- A reduction in Principal Limit Factors (10/2/17)

- A reduction in the interest rate floor (10/2/17)

- Attrition in the HECM salesforce (originators/brokers)

- Internal beliefs by originators on the value of the HECM for the consumer

- Fewer marketing dollars to invest

- An uptick in jumbo reverse mortgage loans

- Increasing mortgage debt held by older homeowners

The good news is that the vast majority of older American’s wealth is tied up in their home- which means policymakers will have to find a way to sustain the reverse mortgage financially while retaining it as a viable solution. Although President Trump’s call to examine the ‘financial viability’ of the HECM program may be just cause for concern, it may be the impetus to finally isolate the true causes of ongoing HECM claims against FHA’s MMI Fund.

1 Comment

Seeing so many LOs getting away from RMs makes me think that is where more of my time should be placed! I like less competition and more opportunity to help the seniors who can use my knowledge to better their lives.