Here are the top stories of 2021. To learn more visit the links below…

Continue reading2021: Lessons Learned

Looking back at 2021 we see the continued impact of the global Covid-19 pandemic that not only transformed the way we work but heavily influenced our economy. Here are my takeaways from lessons learned this year.

Continue reading2021 May Be A Boom Year

Despite mortgage forbearances, here’s why 2021 may shine bright

[4-minute read]

An extension, followed by another extension, and then another.

No one should be surprised. Certainly, no one wanted to see Americans evicted from their home and left scrambling to find a new roof over their head. Therefore, mortgage forbearances and extended deadlines seem prudent, however, they will come at a cost.

Yesterday HUD announced FHA’s fourth extension for foreclosures and evictions since the COVID-19 pandemic hit early this spring. What does this have to do with reverse mortgages? Ironically it may actually make 2021 a prosperous year for our industry.

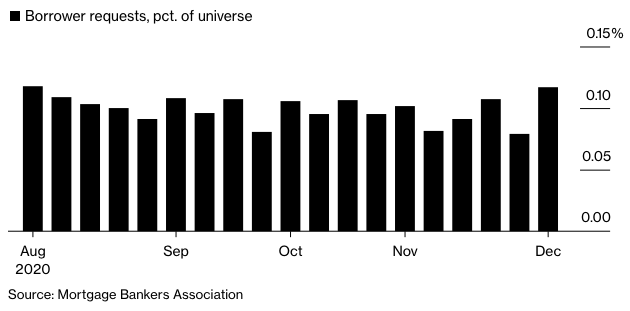

Homeowners with loans backed by FHA must request forbearance from their loan servicer on or before February 28, 2021- a deadline that was set to expire on December 31, 2020. HUD’s press release reads, “FHA requires mortgage servicers to provide up to six months of COVID-19 forbearance when a borrower requests this assistance, and up to an additional six months of COVID-19 forbearance for borrowers who request an extension of the initial forbearance. Borrowers needing assistance must engage with their servicer to obtain an initial COVID-19 forbearance on or before February 28, 2021.” However, there’s no application deadline for those with loans backed by Fannie or Freddie until these GSE’s decision to stop offering extensions.

This means homeowners unable to make any or part of their contractual mortgage payments could conceivably postpone payments until February of 2022, that thanks to the initial six-month forbearance and subsequent six-month extension if needed.

How could this impact reverse mortgage lending?

Reverse mortgage lenders and originators may not feel the secondary repercussions until mid-2022 should a glut of expiring forbearances become foreclosures. The first swathe of forbearances are expected to expire in March of next year- precluding any last-minute federal intervention.

Moreover, the promised ‘V-shaped recovery’ touted last fall did not come to pass as evidenced by nearly 4 million American workers who have been unemployed for more than six months (27 weeks) and a growing percentage of homeowners seeking mortgage forbearance protection. The continued challenges of unemployment coupled with tranches of expiring forbearances stand to significantly impact future home values. The question is when and how much.

While few mainstream housing economists are forecasting a crash, many do see a modest correction in home pricing with inventory increasing as foreclosures come onto the market. After all, you can only kick the proverbial can down the road so far. The good news is despite economic uncertainty and COVID challenges 2021 could be another record year for home sales. As inventory levels remain markedly constrained and interest rates hover near zero- the home-buying frenzy could continue throughout most of next year. Future reverse mortgage borrowers stand to benefit during these curious times with an elevated home value and an increased PLF ratio thanks to absurdly-low interest rates.

While few mainstream housing economists are forecasting a crash, many do see a modest correction in home pricing with inventory increasing as foreclosures come onto the market. After all, you can only kick the proverbial can down the road so far. The good news is despite economic uncertainty and COVID challenges 2021 could be another record year for home sales. As inventory levels remain markedly constrained and interest rates hover near zero- the home-buying frenzy could continue throughout most of next year. Future reverse mortgage borrowers stand to benefit during these curious times with an elevated home value and an increased PLF ratio thanks to absurdly-low interest rates.

Now that’s something to look forward to next year.

Additional Reading:

The Fool: The End of COVID-19 Relief Could Open Up Housing Inventory

FHA EXTENDS OPTIONS FOR SINGLE FAMILY BORROWERS FINANCIALLY IMPACTED BY COVID-19

Shannon Hicks.