What nuggets of truth can we glean from the most recent HECM reforms?

Continue readingHECM Changes May Have Helped Close the “Credibility Gap”

Further compounding this general skepticism are products whose unique features are highly advantageous leading many to say ‘if it sounds too good to be true, it probably is’.

Continue readingHECM Changes & Impacts on Line of Credit Growth

HECM ‘line of credit’ growth still beneficial but more realistic

Recent changes to the Home Equity Conversion Mortgage enacted on October 2nd have reduced the ongoing FHA insurance premium substantially and led to many lenders reducing their loan margins to soften the blow of reducing lending ratios or PLF factors. What can be easily overlooked is the impact on the line of credit growth rate.

For decades the growth rate of the reverse mortgage’s principal limit, or ‘line of credit’ was largely ignored or overlooked. Few promoted this distinctive benefit unlike any other mortgage loan offered to homeowners. That changed as reverse mortgage professionals began to engage the financial planning community. The benefits of the reverse mortgage’s use in retirement, and more specifically a series of academic papers illustrated the ‘standby’ reverse mortgage strategy.

With lenders lowering margins by an average of a half of one-percent to soften the blow of reduced lending ratios, and drastically reduced ongoing MIP insurance premium rate the growth rate stands to be reduced by…

Will HECM Changes “Stop the Bleeding”?

The Home Equity Conversion Mortgage has come under increased scrutiny with HUD’s annual reports to Congress and the ensuing actuarial reports showing wild and unpredictable swings i

Continue readingThe Real-Life Impacts of the HECM Overhaul

Beyond absorbing the recent HECM overhaul with it’s lower lending ratios, reduced interest rate floor, and a higher upfront FHA insurance premium should prompt two crucial questions- how will this impact my potential borrowers? How should I adjust my marketing and sales approach as a result?

Continue readingHECM Changes: 5 Things to Expect

While the mortgagee letter was brief the potential impacts are considerable. Here are some impacts to anticipate and plan for in the wake of the most recent overhaul of the federally-insured reverse mortgage.

Continue readingPerspective & Opportunity

In today’s HECM marketplace a mindset that seeks opportunity is crucial…

Continue readingHECM Changes & The Ensuing Crash

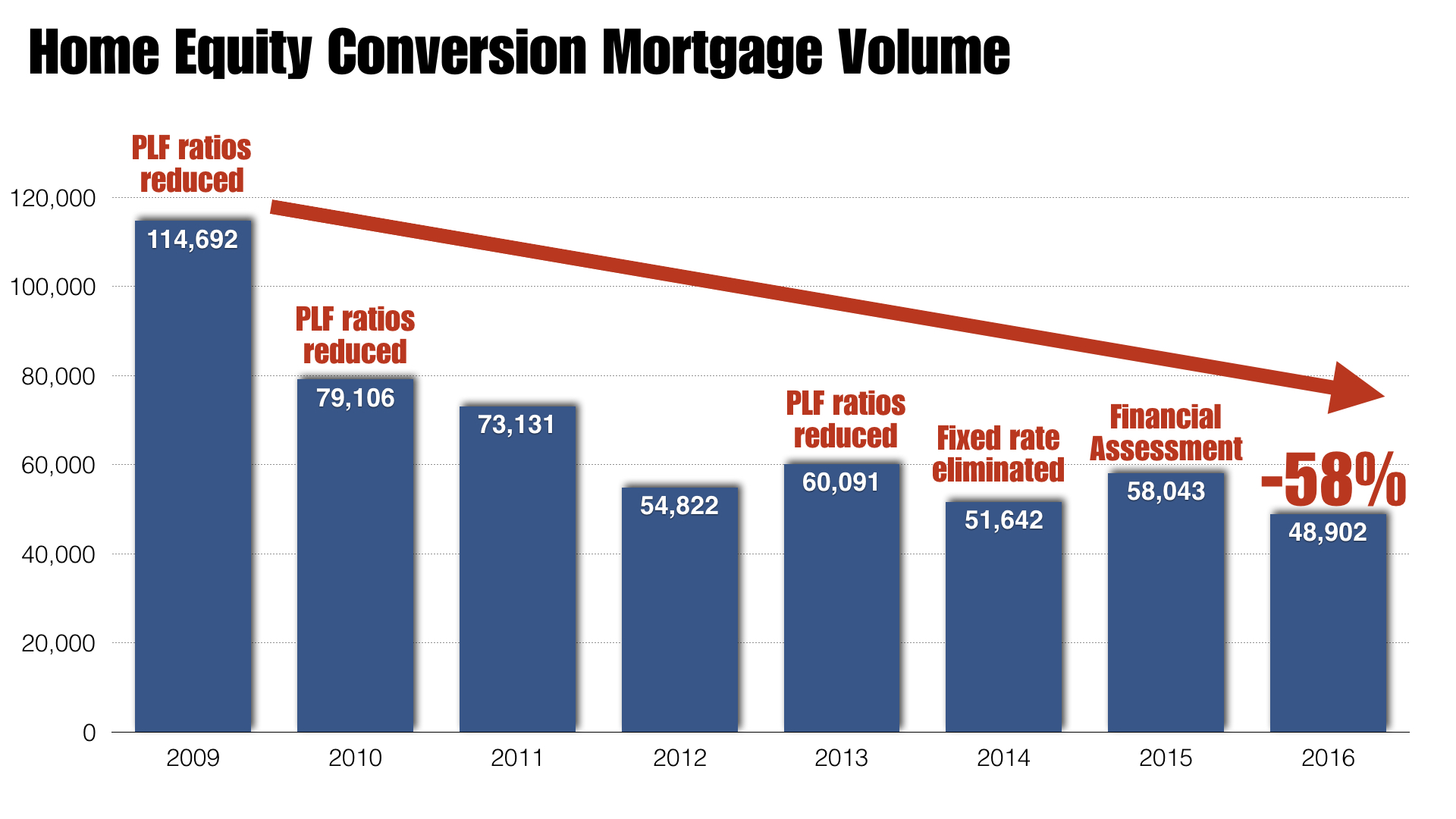

HECM Changes & the Ensuing Crash in Volume

Since it’s introduction in the late 1980’s the Home Equity Conversion mortgage was a collateral-based product. In recent years the reverse mortgage or HECM has shifted from a loan based on the homeowner’s equity and age to a fully underwritten mortgage requiring borrowers to prove their financial capacity to pay property taxes and insurance.

Not surprisingly, these changes narrowed the potential market for the reverse mortgage and volumes have dropped by more than 50%, in part to the housing crash and numerous lending ratio reductions and financial underwriting requirements…

Download the video transcript here.

What comes after October 2nd?

What comes after 10/2? Norcom can help…

Norcom has a business model that will fit your business model…especially after HECM changes begin October 2nd.

Norcom has a business model that will fit your business model…especially after HECM changes begin October 2nd.

About John Luddy: John has trained reverse mortgage professionals how to be successful when sitting face-to-face at the kitchen table with prospective HECM borrowers. Norcom is looking for qualified loan officer candidates. To learn more call 1-860-507-2582 or email John Luddy here