A look at President Trump’s recent executive order addressing America’s housing affordability crisis and what it means for current and potential reverse mortgage borrowers.

Continue readingHUD’s Inspector General points to remaining HECM issues

HUD’s Office of the Inspector General (OIG) pointed to a handful of continuing issues that undermine the FHA insurance fund. One of them, not surprisingly, deals with violations of HUD’s HECM occupancy requirements…

Continue readingA Reversion to the Mean

The Math proves it.

The time to use an inflated asset to offset inflation is ending

If there’s one word that comes to mind when describing home prices today it’s inflated. Today’s inflated home values are primarily a product of two things: years of cheap money (low interest rates), and a long-term shortage of housing inventory.

Reflecting on the current state of the housing market many may say, “something has to give”, meaning this cannot possibly last forever. They’re right.

What’s likely to happen is a reversion to the mean.

Not a nasty person or a ‘mean’ housing market, but a return to the historic norm. Let’s take home appreciation. Just like gravity eventually pulls an object back to earth, economic forces eventually exert enough resistance to pull back home appreciation rates back to their historical mean.

The reversion of home price appreciation is the natural result of a highly speculative, abnormal, and highly-inflated market. It’s also extremely painful for those who may have lost the opportunity to restructure their debt while tapping into some of their home’s value.

The impact of repeated interest rate hikes would generally be offset if home values miraculously continued to appreciate by 15-20% a year. The fact is such daydreams never materialize; especially not when potential homebuyers have fewer dollars to invest in a home thanks to historically-high inflation that shrinks their dollar each day.

Despite a historically-established record of housing booms, busts, or deflations, many homeowners choose instead to believe the myth that home values will never fall. Of course, they will and do. The question is what happens to those who don’t secure some of their home’s value only to see it drop by ten, fifteen, or twenty percent?

For those who are not cash strapped despite the spike in the cost of living the answer is ‘very little’. However, for many, the regret and anguish will feel as real as the bricks in their home. They missed the opportunity to leverage an inflated asset (their home) to offset the inflation of the costs of goods and services during retirement. That’s when a reversion to the mean in home values can feel quite nasty.

Few worried about a housing bubble- just like last time

Unable to use the embedded player? Listen here.

EPISODE #694

CNN Business: No one seems worried about a housing bubble. Just like last time the bubble burst

Good news. Few economists, if any, believe that the housing market will crash. The bad news most experts believed the same in the months and years leading up to the 2008 housing market crash.

Other Stories:

-

If You Get This Message About Your Mortgage, Contact Authorities, FBI Says

-

Another lender is offering a reverse mortgage for Generation X

A Housing Bubble or Cool-Down?

The government-sponsored loan that’s ignored

The appeal and eligibility of reverse mortgages for older homeowners are largely driven by home values and interest rates. And there are signs that the housing market may be beginning to falter. First new home sales rose in June and July but that’s only the second increase in the last six months. Second, new home sales have steadily fallen since March with only a modest increase in July. Third, housing inventory began steadily increasing this spring, a trend that’s expected to continue now that the eviction bans have ended. Keep in mind evictions and sales of rental properties will lag several months as landlords step through the arduous eviction process so don’t expect an immediate surge for several months.

[read more]

What we are witnessing is an artificially inflated housing market spurred by slashing interest rates and government stimulus. The question is how long can this continue? After all, today’s low interest rates that have skyrocketed a homebuyer’s purchasing power are unlikely to go lower. So what happens when banks can foreclose, landlords can sell rentals, and banks increasingly tighten credit and strengthen their cash positions. Truth be told, this ‘irrational exuberance’ to quote Alan Greenspan will be paid for. So are we in a housing bubble or simply a boom in prices? Core Logic’s Chief Economist Frank Nothaft expects a boom rather than a bubble. Nothaft says I don’t expect we’re going to see a housing price crash. I don’t think we’re in a bubble.”

What would sustain today’s record home values? Continued constraints in housing supply, and continued low interest rates. What could trigger a housing bubble? CNBC real estate correspondent Diana Olick says “you need a catastrophic economic event to make a housing bubble pop. You can definitely have a pullback in the heat in the housing market. But to really have that market crash there needs to be that event”. In 2008 that catastrophic event was the failure of investment banks and investment losses from subprime-related investments to name a few.

So barring any sudden economic crisis or a sudden several of the Federal Reserve’s interest rate and inflation strategy we’re more likely to see the housing market cool down. And truth be told that would be the ideal outcome with far less damaging consequences for homeowners and the U.S. economy.

Certainly, evictions and foreclosures will increase overall inventory but not enough to offset a decade of lackluster new home construction. This is good news for reverse mortgage professionals and their future borrowers. Elevated home values and low rates will provide increased borrowing power allowing many homeowners to retire their existing mortgage and perhaps secure a line of credit for these most uncertain times.

[/read]

The Early Signs of a Housing Crisis?

Are we seeing the early signs of another mortgage crisis or housing bubble?

Perhaps you’ve noticed that housing prices are blowing up despite an uncertain economy and what appears to be a building second wave of COVID-19 infections. At this point, most of us are ready to accept some good news. However, there are some indicators that we are approaching a housing crisis while certainly, we have solid market indicators of improvement. As one Polish poet put it, “the truth usually is in the middle. Most often without a tombstone. Let’s dive in.

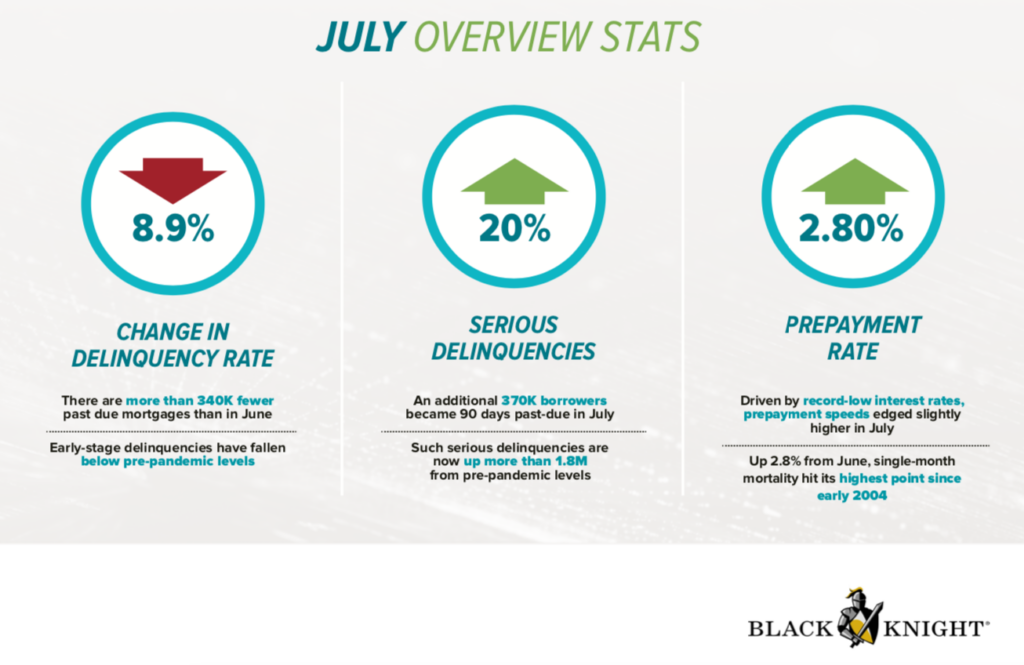

First, we will see a spike in evictions- not because landlords are booting out non-paying tenants, but because those property owners cannot pay the mortgage to the bank when they are no longer receiving rent payments. While this does not directly impact senior homeowners it will contribute toward increasing housing inventory which has a direct impact on housing prices. Next, let’s look at the state of the market comparing Black Knight’s July and August Mortgage Monitor reports.

[read more]

In its July report Black Knight’s stats who show serious mortgage delinquencies- that’s those who are 90 days past due or longer- jumped 20 percent in July for a total of 1.8 million more delinquencies before the pandemic. However, the overall delinquency rate fell by nearly 9%.

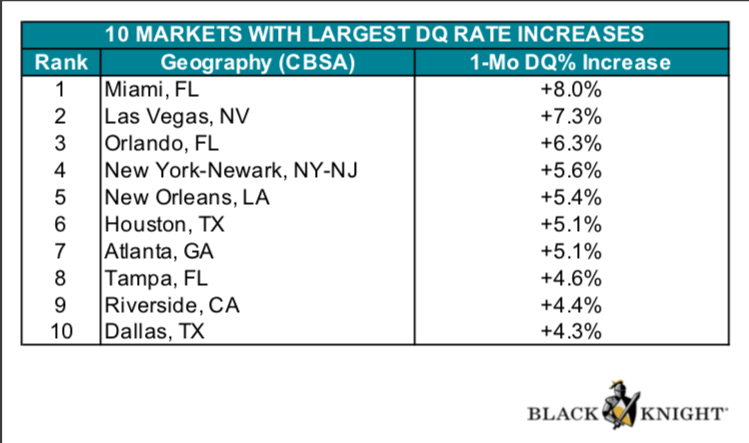

Now, this is where our viewers serving some of our nation’s largest metros will want to pay attention. Here are the ten cities that had the largest increase in delinquencies in July. Florida holds three spots with Miami, Tampa, and Orlando. It’s not surprising to see New York and New Jersey on the list as two of the areas hardest-hit by COVID-19. Cities with the highest delinquencies will see more future foreclosures which naturally increases inventory and lowers prices. The markets with the largest delinquency increases are most likely those where state or local officials have enacted strict shut-down measures shuttering small businesses and spiking unemployment rates. However, keep in mind if we do see a reset in home values it historically has begun in larger metros and then trickles down to smaller communities.

Now, this is where our viewers serving some of our nation’s largest metros will want to pay attention. Here are the ten cities that had the largest increase in delinquencies in July. Florida holds three spots with Miami, Tampa, and Orlando. It’s not surprising to see New York and New Jersey on the list as two of the areas hardest-hit by COVID-19. Cities with the highest delinquencies will see more future foreclosures which naturally increases inventory and lowers prices. The markets with the largest delinquency increases are most likely those where state or local officials have enacted strict shut-down measures shuttering small businesses and spiking unemployment rates. However, keep in mind if we do see a reset in home values it historically has begun in larger metros and then trickles down to smaller communities.

Now on to some positive signs of improvement. The rate of serious delinquencies slowed from July’s 20 percent to only 5 percent growth in August. As the U.S. GDP jumped nearly 33% in the third quarter this year and unemployment rates continue to drop many hope that requests for forbearance plans continue to dwindle after their spike earlier this spring. Outside of historically-low interest rates, the continued lack of housing inventory is sustaining current housing prices. Mortgage delinquencies 100-113% higher than last year as millions found themselves unable to earn an income while sheltering in place, The good news is that many of these individuals are going back to work as evidenced by 41% of those were in a COVID-19 forbearance plan have resumed making their monthly payment.

While these are positive signs of a partial recovery uncertainty remains our biggest challenge. Black Knight Data & Analytics President Ben Graboske explained, “At the current rate of improvement, delinquencies would remain above pre-pandemic levels until March 2022. What’s more, when the first wave of COVID-19-related forbearance plans reach their 12-month expiration period, we would still have a million excess delinquencies.”

In conclusion, what we have is a mixed bag. What could be a looming housing crisis, positive economic indicators, millions resuming their mortgage payments, and of course a red-hot housing market? Our best approach is a stoic one- don’t overindulge in dire predictions, watch key market indicators closely, and consider adjusting your marketing efforts outside larger metros should housing trends turn sour in urban markets.

Resources mentioned in this episode:

BLACK KNIGHT’S JULY 2020 MORTGAGE MONITOR [READ]

BLACK KNIGHT’S AUGUST 2020 MORTGAGE MONITOR [READ]

[/read]

Are Forbearances Creating a Housing Bubble?

Will forbearances create another housing bubble?

Mortgage forbearances are being extended. How will home values and borrowers be impacted once they end?

It’s compassionate and pragmatic. Mortgage forbearance allows borrowers to suspend or reduce their monthly payments, however, delinquent payments must be repaid. The good news is homeowners with a federally or GSE-backed mortgage (FHA, VA, USDA, Fannie & Freddie) are protected from a lender initiating foreclosure until December 31st of this year thanks to the CARES Act. FHA-insured Home Equity Conversion Mortgage borrowers are protected under this provision.

[read more]

However, there is a less-publicized provision of the Coronavirus Aid Relief & Economic Safety act; a provision that is certain to have a major impact on the housing market and home values. That provision is the right for the aforementioned homeowners to apply for up to six months and if desired another extension for up to 360 days. No documentation of financial hardship is required to qualify. Basically, that means millions of American homeowners will not be making a payment for up to one year. In essence, our government has attempted to stem a tidal wave of foreclosures and slow damage to our fragile economy delaying the inevitable. The silver lining is home values should remain relatively stable during this temporary calm. That’s a win for reverse mortgage originators who can offer more borrowing power with high home values and low interest rates. Home sales slowed to a crawl in this spring as the first waves of COVID-19 hit our shores. Then the summer months brought record-breaking home sales volumes

as a flood of pent up demand hit the market.

But what happens after mortgage forbearances work their way through the system? Some housing analysts predict 1.9 million or 40% of those in forbearance will end up defaulting. That’s a sobering number but nowhere close to the 3.1 million foreclosure filings seen in the 2008 housing crisis which created a glut of housing inventory driving prices down. A correction in housing values is assured in a cyclical real market but it’s unlikely we’ll see home values plummet immediately. The hope is the air will be released slowly from the housing bubble we find ourselves in today. However, eventually, a toll will be extracted from the housing market for the unprecedented shutdown of our national economy.

Housing prices are marching to the beat of a different drum and seniors are part of the new rhythm which is further constraining housing inventory. “Seniors are scaling down at a far slower rate than in the previous, additional constraining supply. “We were predicting that baby boomers, like past generations at their age, would move into apartments, condos, or to their second homes en masse,” says Ed Pinto- Director of the American Enterprise Institute in a recent Fortune Magazine column. “That isn’t occurring. The main reason they aren’t moving is that their adult children move back in and work from the home they grew up in.”

Two things will mitigate and deflation in housing prices. Housing demand and employment. As more Americans regain employment they are more likely to voluntarily decline further mortgage forbearance and resume making payments. All things considered, a gradual deflation is preferable to a sudden bursting of a housing bubble.

[/read]

Filling the Gap: This week’s HECM news

Private reverse mortgages are filling the HECM gap. Australia opens the doors for reverse mortgages. Are we entering another housing bubble?

Continue reading