Defying Gravity- It’s not falling home prices that will reduce reverse mortgage eligibility

To see how first-world economies may react to the pandemic’s repercussions we may need to look no further back than the 1970s stagflation- That is an economy with increasing inflation and a stagnant economic output or GDP. Think of it as a recession coupled with the increasing cost of goods and services.— That is an excerpt from my comments from August 10th, 2020 on this show. Unfortunately, stagflation appears not to be such a far-fetched possibility. Let’s examine our current economic state of affairs and the potential impact on the eligibility of older homeowners to qualify for a reverse mortgage.

First, there’s no denying that supply chain interruptions and shipping costs have contributed to the increasing cost of goods and services, but there’s something much more significant the media is not telling you. 40% of US dollars in circulation were printed since the Covid-19 pandemic began.

Is there any chance that too many dollars chasing goods and services are driving record inflation? The Federal Reserve Chairman thinks not. Fed Chair Jerome Powell dismissed money printing as the source of surging inflation and instead points to an imbalance of supply versus pent-up demand as the economy reopens up in the wake of the pandemic. Powell believes financial innovations- whatever those are, mean that there’s is no longer a link between massive money-printing and inflation. Perhaps there’s ‘nothing to see here’ as some say.

While this massive injection of money has benefited Wall Street and hedge funds, it is average Americans who will be stuck paying the bill.

So in these uncertain economic times what stands to reduce the future eligibility of older homeowners to get a reverse mortgage?

[read more]

Most likely it won’t be falling home prices. The Federal Reserve’s planned series of interest rate hikes are unlikely to cause a bust in home values. Sure, home prices were propped up by untenably low interest rates helping create an asset bubble, however, it’s a continued lack of housing supply that is likely to protect home prices from falling as interest rates climb.

Bank of America predicts that U.S. home values will be up 10% by the end of 2022. Truth be told, real estate companies and economists have a mixed record forecasting where the housing market is headed. For example, early in the pandemic Zillow and CoreLogic predicted home values would drop by spring 2021. Instead, home values posted an 18% gain that year.

So what’s the potential future impact of eligibility? Today a 74-year-old homeowner with a $350,000 home would qualify for $183,400 with an expected rate of 4.25%. Having a mortgage payoff of $175,000 that would leave them approximately $8,400 remaining to finance fees, closing costs, and insurance. Fast forward to 2023 and the home has appreciated 5% to $367,500 but the expected rate that determines his borrowing power has jumped to 5.25%. Despite a gain in home value and being one year older their gross principal limit is $176,000 thanks to a higher interest rate which leaves them short to close to cover the loan fees and insurance after paying off their mortgage. Had they secured a reverse mortgage today they could have created a buffer against the ravages of inflation by eliminating their monthly mortgage payments.

Until unemployment climbs or foreclosures surge beyond expectations, home values are unlikely to crash. The bigger threat for future eligibility will be increasing interest rates. If the housing market is truly in an asset bubble, then declines in home values would follow. For now, we should keep a watchful eye on the central bank’s rates.

Resources:

Fortune: Where home prices are headed through 2023, as forecast by Bank of America

SOFX: 80% of all US dollars in existence were printed in the last 22 months

Washington Post: Inflation has Fed critics pointing to spike in money supply

[/read]

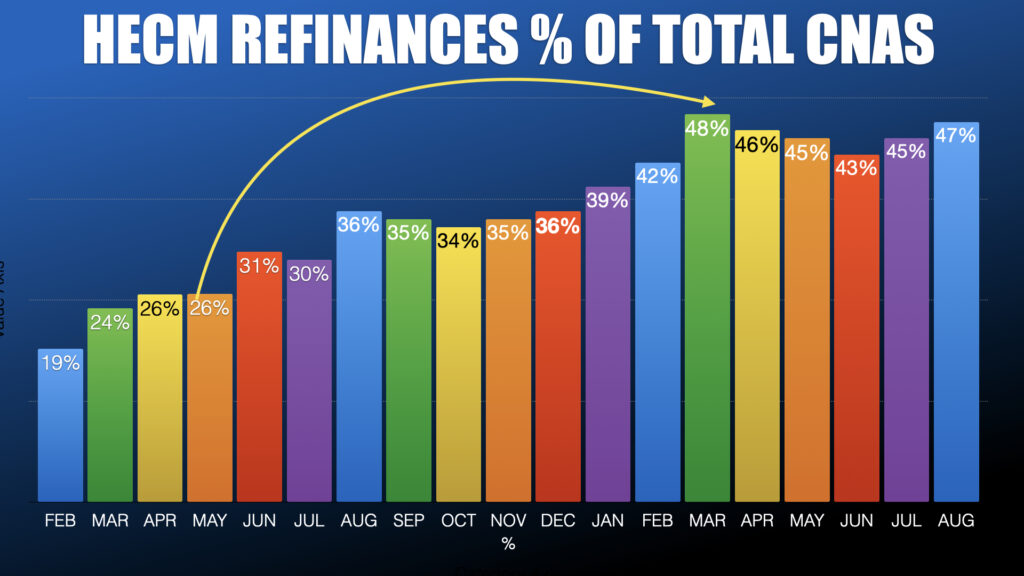

Since March HECM-to-HECM refinances have accounted for nearly 50% of all applications. Surprisingly that trend has persisted revealing that the market’s refi potential may not be quite tapped dry. But at some point it will. Looking forward to 2022 HECM the majority of endorsement volume will have to be drawn from first-time HECM borrowers. Today anecdotal reports show lenders and brokers are anticipating a move to a more customary lending market and are planning accordingly.

Since March HECM-to-HECM refinances have accounted for nearly 50% of all applications. Surprisingly that trend has persisted revealing that the market’s refi potential may not be quite tapped dry. But at some point it will. Looking forward to 2022 HECM the majority of endorsement volume will have to be drawn from first-time HECM borrowers. Today anecdotal reports show lenders and brokers are anticipating a move to a more customary lending market and are planning accordingly.