It’s not boom or doom when it comes to the housing market. While Americans are getting priced out of the housing market millions of savvy older homeowners are sitting on a goldmine. Not just a motherlode of equity but a potential source of cash flow that could be mined to help temper the impacts of inflation and as a hedge against financial shocks.

Continue readingFederal Reserve urged to wind down asset purchases

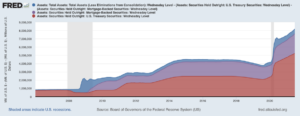

Do you know who the biggest player in the housing market is today? Is it hedge funds, REITs, or the largest developers? If you answered the Federal Reserve, congratulations.

Some members of the Federal Reserve’s policy-setting committee want to end the Fed’s purchasing of $40 billion a month of MBS (mortgage-backed securities) sooner than later. The question is how much and how soon. In a presser following the Fed’s two-day meeting discussing how to reduce asset purchases Federal Reserve Chairman Jerome Powell said, “There really is little support for the idea of tapering MBS earlier than Treasuries. I think we will taper them at the same time.”

The wind-down of asset purchases will put pressure on yields. Today, with the Fed consistently purchasing most mortgage-backed securities lenders don’t have to offer higher yields to attract investors, this allows them to offer lower rates. When rates eventually do increase modestly homebuyers will have to reconsider the price range homes they consider for purchase. Sellers may also rethink their asking price as home affordability erodes. Both would cool the pace of housing appreciation and bring some modicum of normalcy to an overheated market.

Monday Federal Reserve Bank of Atlanta President Raphael Bostic said the central bank should move to taper asset purchases in light of recent strong employment gains. Speaking of the timing of tapering Bostic said, “Right now I’m thinking in the October-to-December range, but if the number comes back big” as with the last report “or maybe even a little bigger, I’d be open to moving it forward. If the number really explodes, I think we would have to consider that.”

While employment gains are substantial, many economists are concerned as millions of small businesses cannot fill open positions. Employer-mandated vaccinations or mask-wearing may further strain the rate of employment growth when coupled with the $300/week federal unemployment bonus. Both could postpone the Fed’s tapering of asset purchases. However, inflationary concerns could also spur the central bank to accelerate its timeline. The central banks’ mantra is they see the surge of inflation as merely transitory. Time will certainly tell.

For now, even a moderating seller’s market still will benefit reverse mortgage applicants in the short term when coupled with historic low interest rates significantly increasing their available loan proceeds. While it’s uncertain how long the market will continue its run, reverse mortgage originators couldn’t ask for a more ideal market.

-Shannon Hicks

The housing market shift has begun

Eviction Ban Drama & the signs of a cooling housing market

As the housing market goes, so goes our industry. And a shift in the U.S. housing market has begun. Before we dive into the data showing why let’s discuss the most recent breaking news- eviction bans.

In a 5-4 decision on June 29th, the U.S. Supreme Court put the Centers for Disease Control on notice saying the agency overstepped its statutory authority in issuing a nationwide eviction ban. However, with the ban’s expiration of July 31st fast approaching the high court allowed the ban to remain in place another month. The CDC argued the eviction moratorium was warranted to prevent homelessness which they argued would lead to further spread of COVID-19.

Why does the eviction ban matter?

[read more]

First, once the bans actually expire available housing inventory would increase as rental properties are sold increasing inventory which could slow the pace of red-hot home values. That means slightly reducing the available proceeds for future reverse mortgage borrowers. Second, the White House under increasing and unrelenting pressure from top House and Senate Democrats directed the CDC to extend the deadline again despite the Supreme Court’s warning. On August 3rd the CDC issued another temporary order for an eviction ban, however, this time is limited to renters in counties with a high level of COVID-19 community transmission. The new ban is to expire on October 3rd.

While the moratorium drama played out a significant shift in the housing market was largely underreported and generally unnoticed. In fact, the market is at a tipping point. Consider these statistics. In June the pace of homes under contract fell 1.9%. “Buyers are still interested and want to own a home, but record-high home prices are causing some to retreat,. The moderate slowdown in sales is largely due to the huge spike in home prices”, said Lawrence Yun, Chief Economist for the National Association of Realtors. You can’t blame potential homebuyers for standing back since median home prices have increased for over 112 months. According to a U.S. Census Bureau report, sales of new single-family homes dropped by 6.6% in June compared to May. Annually, sales of newly constructed houses were down by more than 19% compared to a year ago.

In their July 2021 report, Zillow said, “for-sale inventory saw meaningful recovery for the second month in a row, improving 3.1% over May”. Realtor-com reports a 10.9% increase of newly-listed properties from May to June. Perhaps the housing market shift has already begun.

While the eviction bans will prevent some rental properties from going on the market, homebuyer fatigue from a hyperactive market appears to be slowing home purchases and relieving some pressure on housing inventory. The means future reverse mortgage borrowers are likely to see their home appreciation slow or even plateau in several markets. A gradual slowdown or soft-landing of the real estate market is not only more likely but also much more preferable to reset in home values. In the meantime, older homeowners are poised to get the most with a reverse mortgage with robust home prices and a Federal Reserve that’s reluctant to tinker with today’s low interest rates.

[/read]

Podcast E646: How COVID vaccines could upend the housing market

Unable to use the embedded player? Listen here.

How COVID-19 Vaccines will Upset the Housing Market

The coronavirus pandemic has dramatically changed the landscape of the housing market- especially in urban areas. Here’s how COVID-19 vaccines in 2021 are poised to upset housing trends once again.

Other Stories:

-

COVID has slowed but hasn’t stopped FHA’s search for a new servicer

Housing Crash in 2021?

Housing Market & Interest Rate Changes

What recent changes in the housing market and mortgage interest rates mean for HECM lenders

We rarely discuss what is happening in the traditional mortgage market. Yet the larger overall mortgage market and prevailing 30-year mortgage rates have a direct impact on reverse mortgage borrowers and our industry at large.

A Sick Housing System?

As a reverse mortgage professional have you ever pondered the forces behind our housing market? What makes the lending world keep running? What natural or artificial forces are at play that influence home prices and affordability?

Continue reading