Inspector General report points to specific risks

In October HUD’s Office of the Inspector General released their report which telegraphs what changes to the HECM we may see in 2019.

In October HUD’s Office of the Inspector General released their report which telegraphs what changes to the HECM we may see in 2019.

If you were to ask ten HECM professionals what their outlook was for 2019, you would likely get ten different answers. Of all the responses one were to receive the most honest and realistic would be- expect more change.

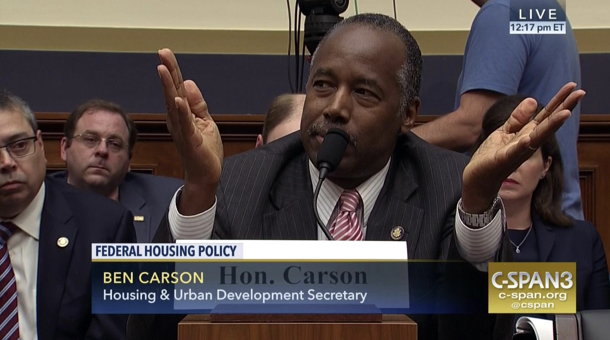

There’s been much talk in the media of Inspector Generals recently- most of it centered on the political war that rages in the wake of alleged Russian collusion in the Trump administration and also the Inspector General (IG) investigations into the Department of Justice and the intelligence community. However, what most may not know is that all major federal agencies have a functioning IG who serve as watchdogs to ensure that the best interests of the government and taxpayers are served. On October 15, 2018, the U.S. Department of Housing and Urban Development Inspector General’s office released their report outlining 6 challenges facing the agency.

Of the six the most troubling and problematic are the continued risks to FHA’s Mutual Mortgage Insurance fund, which backs both HECM and traditional FHA loans. The OIG states that HUD is presently lacks sufficient safeguards to prevent loan servicers that fail to meet foreclosure and conveyance deadlines from incurring holding costs which are passed onto HUD. It is estimated these delays cost the agency $2.23 billion in ‘unreasonable and unnecessary’ holding costs in a five year period. While not specifically mentioning HECMs it’s not a stretch to believe these issues plague both traditional and HECM loans. This comes as no surprise considering our recent report and an article in HousingWire which reveals a number of illegitimate occupants continue to remain in properties with a reverse mortgage; many times years after the borrower has moved, passed away, or in some cases even rented the property to another party. In other instances, heirs have reported considerable delays in getting a deed in lieu of foreclosure processed or waiting over 5 months for an appraiser to come to the property so the family can arrange for a purchase. While noncompliant occupancy of HECM properties is not specifically addressed, the report does cite delayed property claim reporting by servicers and/or lenders.

There’s no question that the HECM is flashing brightly on the radar of government watchdogs as evidenced in the report which reveals large losses attributed to the reverse mortgages… [download transcript]

In October HUD’s Office of the Inspector General released their report which telegraphs what changes to the HECM we may see in 2019.

In October HUD’s Office of the Inspector General released their report which telegraphs what changes to the HECM we may see in 2019.