How have Social Security benefits kept up with inflation? With 97 percent of older adults (aged 60 to 89) either receiving Social Security or will it’s imperative to measure the impacts of inflation against Cost of Living Adjustments

Continue readingThe Retirement Double-Whammy

Here are two forces that will squeeze retirees retirement savings pushing many to return to work or look to other assets…

Continue readingRetirees could face a perfect storm of economic conditions.

There are growing concerns among economists that the U.S. could be heading into a perfect storm of economic conditions.

Continue readingAnother wave of inflation is coming

Despite the Federal Reserves rate hikes inflation has begun to surge. A look at the underlying factors that continue to push up the cost of living…

Continue readingShould I live under a bridge?!

The common objection to reverse mortgages is that they’re too expensive. The question is, expensive compared to what?

Continue readingSenior debt is climbing while inflation accelerates. Is there a way out?

Sandwiched between the Millennials and Boomers Generation Xers who are poised to become the next reverse mortgage market.

Continue readingHere’s how many Social Security recipients have their home paid off

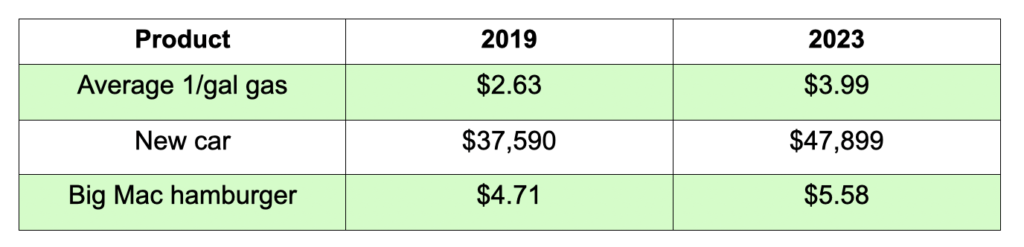

What HECM Pros Should Know About Inflation

There’s one conversation that every financial advisor should have with their clients. A conversation that should also be explored by reverse mortgage professionals with every potential borrower. Inflation. Questions such as “How are you coping with the higher price of everyday goods and services you’re paying today?” can reveal a cashflow crunch that needs to be addressed.

Continue readingDon’t Believe the CPI ‘Lie’

Don’t be fooled by ‘cooling’ inflation

The next time someone tells you inflation’s coming down? Ask, from what?!

Continue reading