As the housing market cools 2022 will require a pivot away from HECM refinances. Older homeowners stand to gain the most today.

As the housing market cools 2022 will require a pivot away from HECM refinances. Older homeowners stand to gain the most today.

In the first week of October traditional mortgage application volumes have plummeted to a three month low, and traditional mortgage refinances transactions are 16 percent lower than the same week one year ago. Then in late September the Federal Reserve signaled they would be tapering its $120 billion purchase of U.S. Treasury bonds and mortgage backed securities.Then there’s housing inventory which is up 30 percent since May. While some of these factors are not directly tied to the reverse mortgage market each will have an impact on interest rates, and most importantly, consumer sentiment in the housing market.

Meanwhile, U.S. homeowners 62 and older are sitting on a mountain of home equity. NMRLA’s RiskSpan Reverse Market Index shows senior housing wealth grew by 3.7 percent from the first to the second quarter of 2021 for a record total of $9.57 trillion. Is the window of opportunity closing for these equity-rich homeowners who haven’t got a reverse mortgage? It may be for those that have a high mortgage balance that leaves them on the cusp of qualifying at today’s interest rates and record home values. Then there’s older homeowners with little or no mortgage balance are likely to qualify in the future, albeit with higher interest rates and potentially lower home values.

Who would of thought we would see such ideal an ideal housing market and favorable lending conditions in an economy many expect is headed into a deep recession? However, as the housing market inflated the purchasing power of the U.S. dollar was steadily eroded by inflation, so much so that Social Security recipients will see a 5.9% cost of living adjustment in 2022 as we reported last week.

So the logical question is what’s next? First is the pivot.

[read more]

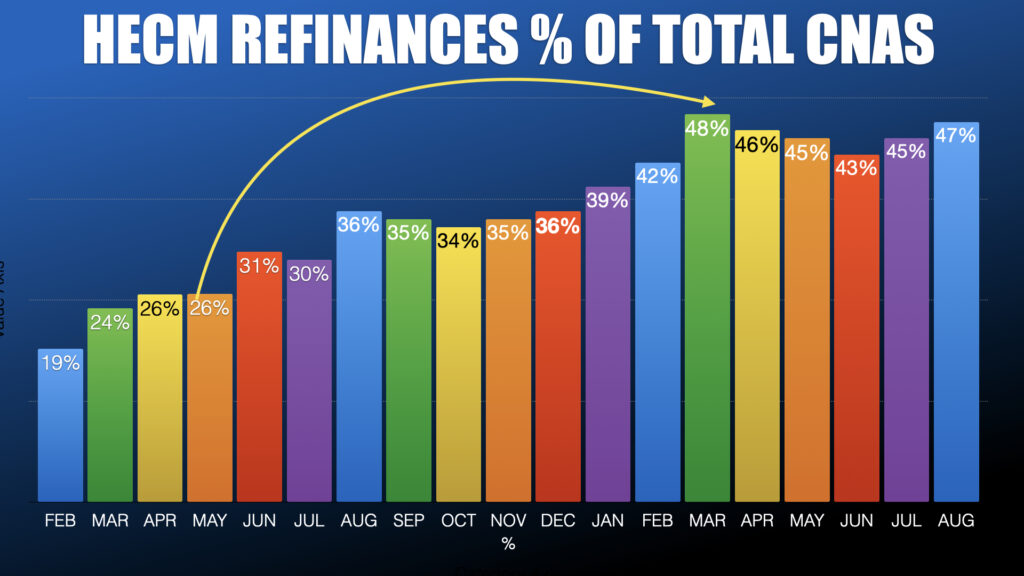

Since March HECM-to-HECM refinances have accounted for nearly 50% of all applications. Surprisingly that trend has persisted revealing that the market’s refi potential may not be quite tapped dry. But at some point it will. Looking forward to 2022 HECM the majority of endorsement volume will have to be drawn from first-time HECM borrowers. Today anecdotal reports show lenders and brokers are anticipating a move to a more customary lending market and are planning accordingly.

Since March HECM-to-HECM refinances have accounted for nearly 50% of all applications. Surprisingly that trend has persisted revealing that the market’s refi potential may not be quite tapped dry. But at some point it will. Looking forward to 2022 HECM the majority of endorsement volume will have to be drawn from first-time HECM borrowers. Today anecdotal reports show lenders and brokers are anticipating a move to a more customary lending market and are planning accordingly.

The shift to a more typical HECM market in 2022 is likely to be aided by increasing inflation and a growing sense of unease about the American economy. If history has taught us one thing it’s that financial need or anxiety are often the forces that push most to even consider a reverse mortgage in the first place. Certainly there are the mass-affluent who see an opportunity to hedge their future cash flow, but for most it’s a pragmatic decision fueled by their current financial circumstances. And that’s our window of opportunity. Record home values and low interest rates amidst an economy that’s flashing the warning signs of a recession and possibly stagflation. This increasingly makes the reverse mortgage an increasingly attractive bulwark against the ravages of inflation and economic hardship.

.

[/read]