Ryan Ponsford shares one method reverse mortgage professionals can use to approach financial fact-finding.

Continue readingHECM Financial Fact-Finding. Do We Need it?

What is the role of financial fact-finding in originating reverse mortgages? To answer that question we interviewed wealth planner Ryan Ponsford of Equity Wealth Strategies.

Continue readingA Gray Divorce Solution in Reverse

Yahoo Finance republished A Housing Wire’s column by Chris Clow which examines how reverse mortgages could be a viable solution for older couples facing a silver or gray divorce.

Continue readingHere’s Why Few Financial Advisors Look to Housing Wealth

This may be why so many advisors ignore what is most often their client’s largest asset.

Continue readingUnlocking Hidden Retirement Cash

Innovation continues despite an uncertain housing and real estate market. One such product could be seen as a reverse mortgage in your pocket

Continue readingTwo things that should be in every retirement plan

Two assets are typically ignored in retirement financial planning. One is Social Security claiming, that is the most advantageous way to structure Social Security benefit payouts. The other is…

Continue reading5 Questions Homeowners are Asking Before Retiring

The 5 Questions Your Sixty-Something Homeowners are Asking? Are you prepared?

It’s not a mistake that the age of eligibility for the federally-insured reverse mortgage is 62. Americans in their sixties begin to seriously consider the merits of continued full-time work against the rewards of a more leisurely lifestyle. Here are five factors each pre-retiree is likely to contemplate before bidding farewell to report to work each day.

First is their retirement readiness. One facet that’s typically ignored in favor of crunching numbers is psychological preparedness. Newly retired individuals can begin with feelings of excitement and anticipation only to fall into a morass of depression, anxiety, and restlessness. Aging expert and author Sources of Income/Cashflow says, “people spend more time planning a wedding than planning retirement. It’s very important to think about your identity and what you’re losing, and how you get a new identity. What would give you a sense of meaning and purpose?” Next is financial readiness which is typically determined by creating a post-employment budget. This will include reliable sources of monthly income throughout their retirement years. The good news is their expenses may be considerably less when factoring in they’re no longer raising children or incurring ongoing costs related to employment such as transportation.

[read more]

Second, are sources of income and cash flow. Some may decide not to completely disavow employment and instead find part-time work. One retiree I know took a job at the local historical society- a job she finds much more enjoyable than her previous career. Typical income sources are defined pension benefits, investment dividends or distributions, royalties, Social Security, and distributions from 401(k)s and IRAs. The magic of the reverse mortgage is that it can help close many gaps in monthly cashflow that are often found when considering retiring. A portion of the home’s illiquid value is converted into an available standby line of credit, monthly tenure payment, or simply retires the burden of an existing monthly mortgage payment. Of course, those pesky property taxes and insurance do remain until death or home do you part.

The third question almost every soon-to-be retiree faces is when to begin taking Social Security benefits and that question hinges on whether to take full or reduced benefits. As the ratio of retirees to active workers continues to grow Uncle Sam has moved the goalposts over the years with those born before 1938 being able to take full benefits at the age of 65, and younger retirees seeing a graduated reduction based on age. Some look to not only their need for the monthly benefit but their likely life expectancy with those in poorer health opting to start sooner rather than risk dying before collecting a full benefit. As a reverse mortgage professional you will want to avoid giving advice on when to begin drawing benefits, but again, knowing the considerations involved is useful to understand the homeowner’s mindset.

The fourth consideration revolves around Medicare. Fewer workers are retiring with a medical insurance benefits package. The good news is they can enroll in Medicare at the age of 65 and purchase a Medicare supplement policy that is typically much less expensive than the private insurance premiums they would pay individually.

Fifth, and lastly are Required Minimum Distributions. Did you know that while 401(k) and IRA deductions reduce taxable income distributions must be taken to avoid penalties, in many cases up to 50%?! For decades retirees had to begin taking distributions or payouts from these accounts at the age of 70 1/2. However, thanks to the 2019 SECURE Act and increasing life expectancy that age is 72. Some younger retirees in their early sixties have postponed taking money to avoid more taxable income from these accounts while allowing them to grow by using a reverse mortgage. Either way, the money must be systematically withdrawn.

Understanding these five factors can help reverse mortgage originators increase their confidence when working with both financial professionals and homeowners. Be mindful to stay in your lane not providing unlicensed advice but also recognize that your foundational grasp of these basic concepts will not go unnoticed. It will help not only build rapport but trust and efficiency in helping shape a plan that best meets the need of the homeowner.

[/read]

RMs Getting a Serious Second Look

The reverse mortgage market got some new respect earlier this year. When it looked like…

Continue readingHere’s what’s wrong with retirement planning

Retirement planning requires a solution-based approach

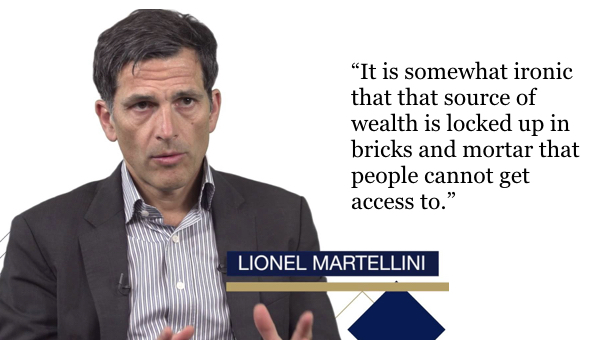

“It’s ironic that the biggest source of wealth is locked up in bricks & mortar…”

While more financial professionals are embracing the HECM, ironically our cousins across the pond seem to better grasp the concept of home equity management and its role in funding retirement. Is today’s choice of retirement investment vehicles adequate to meet the needs of today’s savers and retirees? Can asset management live up to it’s name without including a retiree’s largest tangible investment?

While more financial professionals are embracing the HECM, ironically our cousins across the pond seem to better grasp the concept of home equity management and its role in funding retirement. Is today’s choice of retirement investment vehicles adequate to meet the needs of today’s savers and retirees? Can asset management live up to it’s name without including a retiree’s largest tangible investment?

Hedgeweek is a blog for hedge fund managers and institutional investors…the big players. Moving in the deep waters of asset management, their recent post recognizes challenges similar to those faced by American retirees seeking to fund retirement. Beyond a lack of saving, individual investors are stymied with a choice of investment products that may not meet their needs.

[mailmunch-form id=”538935″]