The Motley Fool’s Robert Brokamp interviewed Geoffrey Sanzenbacher, an economist with the Center for Retirement Research at Boston College discussing the macro trends in retirement. One of his frustrations is the retiree’s reluctance to consider a reverse mortgage.

Continue readingA fourth stimulus check for seniors?

A nonpartisan group is asking Congress to issue another round of $1,400 stimulus checks, and this time the payments would go just to older Americans.

Continue readingWhen stimulus is not enough

“I lost my job during the pandemic. Now I have $40,000 in credit card debt”. Similar tales of economic devastation as a result of the Covid-19 pandemic are not limited to younger working Americans. In fact, many older workers who were preparing for retirement now find themselves saddled with much more debt than they had one year ago. Some tapped into their retirement savings without penalty thanks to special emergency provisions of the coronavirus CARES Act. The true impact of the pandemic on those approaching retirement remains to be seen. [read more]

Unemployment checks and stimulus payments only went so far in mitigating a job loss, a reduction of hours, or the increased cost of living as inflation continues to surge. As a result many may consider postponing retirement or working a side-hustle to bring in a bit of extra income each month. The Wall Street Journal reports, “The Labor Department reported Tuesday that its consumer-price index increased 5.4% in June from a year earlier. Excluding volatile food and energy categories, prices rose 4.5% from a year earlier, the most in 30 years.” Older homeowners feeling the squeeze of inflation or cut in income have several choices. Cut expenses, work longer, get a part-time job, start taking Social Security benefits earlier or later, or perhaps looking to their home’s value.

Options are your best asset when facing a financial challenge. While every older homeowner may not need to seriously consider getting a reverse mortgage, millions should but never do either from a sheer lack of awareness or fear having been told by friends or the media to avoid the loan altogether. Such prejudices preemptively eliminate a strategy when practical solutions are needed most. With this in mind we should discuss what options the homeowner has considered so far and why they have not chosen them.

Here are several alternatives to a reverse mortgage that may be considered and their benefits and liabilities.

First, refinancing into a lower interest rate. While this may lower the monthly principal and interest payment a couple hundred dollars each month- many are restarting their amortization and in effect will be saddled with required payments for decades.

Then there’s the cash-out refi. While this certainly borrowing at a low interest rate the homeowner’s monthly payments may actually increase with a higher starting principal loan balance.

Others may contemplate selling and downsizing to reduce monthly expenses but few do preferring to stay put . Getting a HELOC or home equity line of credit sounds appealing but there’s still a required monthly payment and payments will increase after the initial draw period expires.

Most of the so-called alternatives to reverse mortgages presented in the press are short-term solutions for a long term problem. In other words, they focus on the immediate need often ignoring the enduring need to meet their monthly cash flow challenges.

All things considered, despite short-term unemployment bonuses, mortgage forbearance, and stimulus checks millions of older Americans are in need of a long-term solution and strategy that helps meet their needs for decades to come- not one that gives them a cash infusion and new debt that further strains their cash flow. [/read]

The pandemic exacerbated the retirement savings gap

Unable to use the embedded player? Listen here.

EPISODE #678

Forbes: The pandemic exacerbated the retirement savings gap

“We still do not know all the long-term consequences for the economy in general and retirement savings in particular. There are some early indicators worth considering…”

Other Stories:

-

National Mortgage News: The Florida Supreme Court says lender can foreclose on non-borrowing spouse

-

Fox Business: Housing market showing signs of cooling

The question every older homeowner should be asking…today

Washington Post: “Should you tap into your home equity to fund your retirement?”

It’s perhaps the most important question every older homeowner could be asking. Should you tap into your home equity to fund your retirement? That question is the title of a recent column written by David Mount in the Washington Post. Mount presents a fair and factual representation of reverse mortgages. However, we will also examine his approach as to when one may be appropriate.

[read more]

“The strong stock market and a new perspective from the coronavirus pandemic may have you considering home equity as a way to accelerate a move in retirement”, writes Mount. An interesting point and one that leads me to reflect on the present state of both the real estate and equities markets. Much like we rush to buy replacement wiper blades during the first week of the rainy season, homeowners considering a reverse mortgage often wait until it’s too late. In some cases that means they no longer qualify lacking the required proceeds to pay off their mortgage. In other instances, they can no longer make a monthly withdrawal from their investment accounts due to stock market losses. In a nutshell- a proactive strategy will always outperform a reactive one.

Mounts cautions if one is to use their home equity for retirement “it should be done at the right time and for the right reasons”. Mount notes three of the most popular options for tapping into home equity. The first two are to refinance your existing mortgage to lower your payments or taking out a HELOC or home equity line of credit. Each will only improve a homeowner’s cash flow position modestly not to mention the inherent risks with variable rate HELOCs and payment shock after the initial draw period ends. The third option Mount presents is a reverse mortgage.

When should an older homeowner look to their home’s equity? “Overall, using home equity toward retirement works best for those with a high level of equity in their home,” Mount writes. That position makes sense for someone taking out a line of credit or a cash-out refinance but with one caveat: their cash flow must support the new loan. Does that mean seniors with sizable savings should only consider these typical home equity extraction methods? Not necessarily. And that’s where Mr. Mount and I would disagree when he writes, “Reverse mortgages are a viable option for those with limited access to funds and a sizable amount of equity in their home.”

Let’s unpack that statement. Should homeowners with adequate funds steer clear of a reverse mortgage as a rule of thumb? It really depends on their unique situation. Perhaps some moderately affluent homeowners and their advisors not only see the benefit of a reverse mortgage but are using it as part of a larger financial strategy. “As with any big financial decision, you should work with a financial adviser to create a plan and strategize scenarios that will help you stay financially independent into and through retirement.” Now that’s a statement I can agree with.

Read the Washington Post column

[/read]

I won’t live to see my mortgage paid off

Unable to use the embedded player? Listen here.

I’m retired and won’t live to see my mortgage paid off. Should I refinance to lower my monthly payment?

“Is it worth having my home refinanced at a lower, fixed percentage rate and paying closing costs? What other options should I consider?”

.

Other Stories:

-

USA Today: 4 ways to avoid running out of money in retirement

-

The equity release issue: What’s stopping older Aussies from ‘eating their house’?

5 Questions Homeowners are Asking Before Retiring

The 5 Questions Your Sixty-Something Homeowners are Asking? Are you prepared?

It’s not a mistake that the age of eligibility for the federally-insured reverse mortgage is 62. Americans in their sixties begin to seriously consider the merits of continued full-time work against the rewards of a more leisurely lifestyle. Here are five factors each pre-retiree is likely to contemplate before bidding farewell to report to work each day.

First is their retirement readiness. One facet that’s typically ignored in favor of crunching numbers is psychological preparedness. Newly retired individuals can begin with feelings of excitement and anticipation only to fall into a morass of depression, anxiety, and restlessness. Aging expert and author Sources of Income/Cashflow says, “people spend more time planning a wedding than planning retirement. It’s very important to think about your identity and what you’re losing, and how you get a new identity. What would give you a sense of meaning and purpose?” Next is financial readiness which is typically determined by creating a post-employment budget. This will include reliable sources of monthly income throughout their retirement years. The good news is their expenses may be considerably less when factoring in they’re no longer raising children or incurring ongoing costs related to employment such as transportation.

[read more]

Second, are sources of income and cash flow. Some may decide not to completely disavow employment and instead find part-time work. One retiree I know took a job at the local historical society- a job she finds much more enjoyable than her previous career. Typical income sources are defined pension benefits, investment dividends or distributions, royalties, Social Security, and distributions from 401(k)s and IRAs. The magic of the reverse mortgage is that it can help close many gaps in monthly cashflow that are often found when considering retiring. A portion of the home’s illiquid value is converted into an available standby line of credit, monthly tenure payment, or simply retires the burden of an existing monthly mortgage payment. Of course, those pesky property taxes and insurance do remain until death or home do you part.

The third question almost every soon-to-be retiree faces is when to begin taking Social Security benefits and that question hinges on whether to take full or reduced benefits. As the ratio of retirees to active workers continues to grow Uncle Sam has moved the goalposts over the years with those born before 1938 being able to take full benefits at the age of 65, and younger retirees seeing a graduated reduction based on age. Some look to not only their need for the monthly benefit but their likely life expectancy with those in poorer health opting to start sooner rather than risk dying before collecting a full benefit. As a reverse mortgage professional you will want to avoid giving advice on when to begin drawing benefits, but again, knowing the considerations involved is useful to understand the homeowner’s mindset.

The fourth consideration revolves around Medicare. Fewer workers are retiring with a medical insurance benefits package. The good news is they can enroll in Medicare at the age of 65 and purchase a Medicare supplement policy that is typically much less expensive than the private insurance premiums they would pay individually.

Fifth, and lastly are Required Minimum Distributions. Did you know that while 401(k) and IRA deductions reduce taxable income distributions must be taken to avoid penalties, in many cases up to 50%?! For decades retirees had to begin taking distributions or payouts from these accounts at the age of 70 1/2. However, thanks to the 2019 SECURE Act and increasing life expectancy that age is 72. Some younger retirees in their early sixties have postponed taking money to avoid more taxable income from these accounts while allowing them to grow by using a reverse mortgage. Either way, the money must be systematically withdrawn.

Understanding these five factors can help reverse mortgage originators increase their confidence when working with both financial professionals and homeowners. Be mindful to stay in your lane not providing unlicensed advice but also recognize that your foundational grasp of these basic concepts will not go unnoticed. It will help not only build rapport but trust and efficiency in helping shape a plan that best meets the need of the homeowner.

[/read]

Threats Seen & Unseen

Involuntary Retirement

Older workers face ‘involuntary retirement’.

Are we reaching these homeowners?

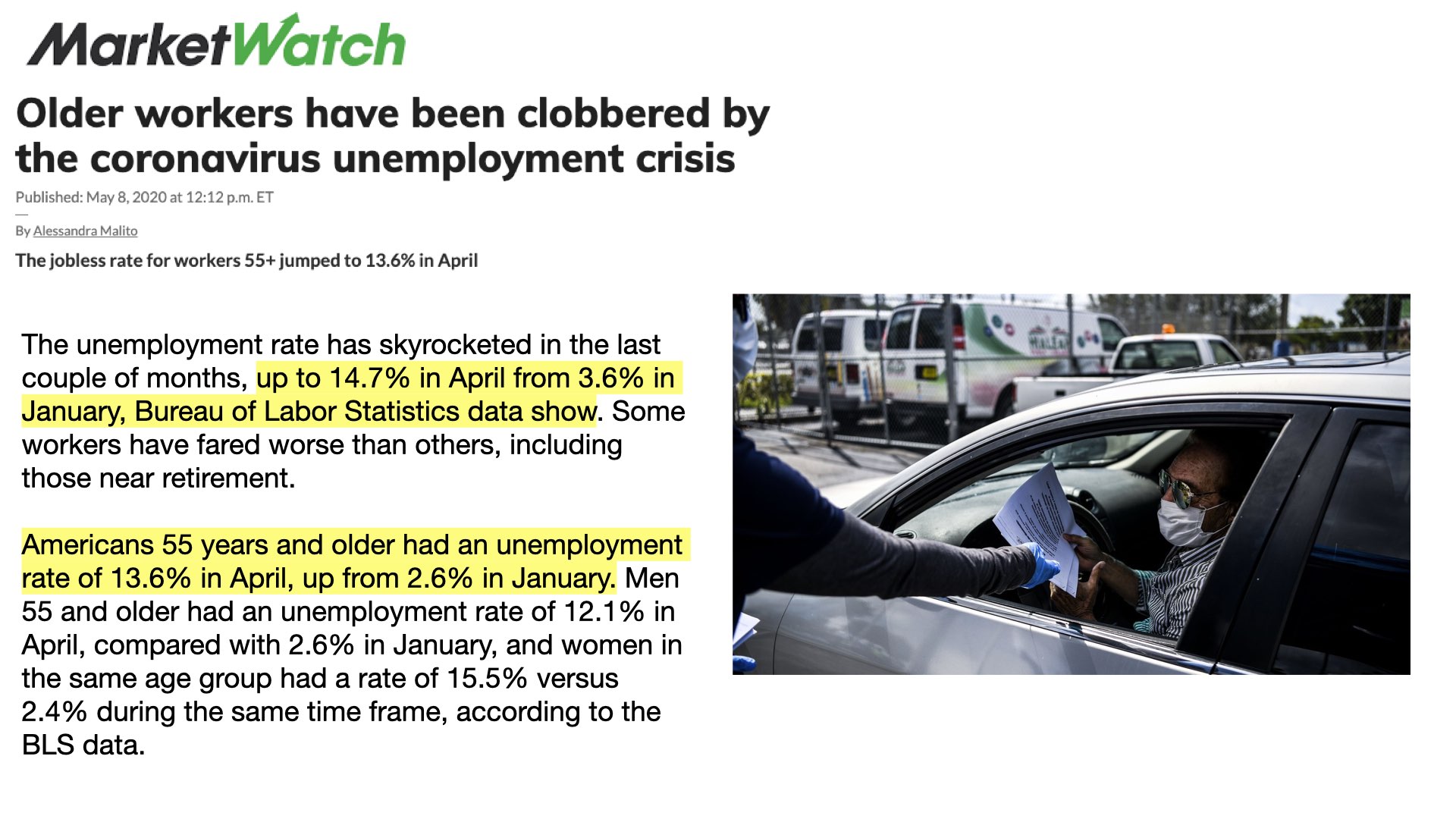

- In January 2020 the unemployment rate for those 55 and older was 2.6% [MarketWatch]

- By April 2020 the unemployment rate spiked to 13.6% for those 55 and older [MarketWatch]

- After the last recession (2008) those between the ages of 51-60 waited for an average of 9 months before finding new employment while those 25-34 were working within 6 months. [Urban Institute]

Many older Americans are still working, or at least recently were. Either way, they must meet their daily living expenses. This demographic while not completely forgotten is rarely mentioned. Even on this show I typically say a reverse mortgage may help those in their non-working years or retirees. However, a recent column caught my attention.

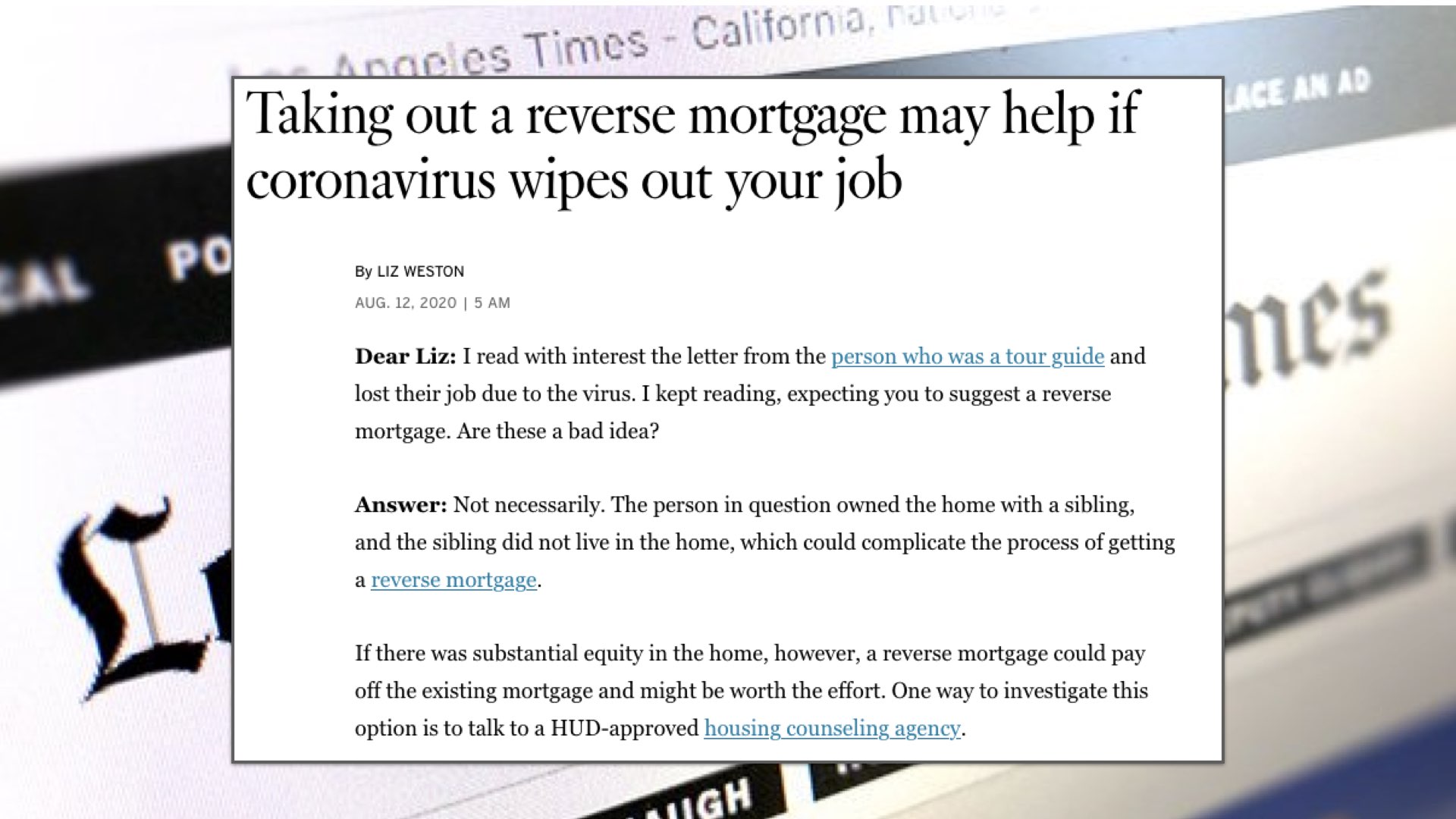

“Dear Liz”, writes one reader to LA Times columnist Liz Weston, “I read with interest the letter from the person who was a tour guide and lost their job due to the virus. I kept reading, expecting you to suggest a reverse mortgage. Are these a bad idea?”. Weston replies, “not necessarily” and then goes on to explain if there’s sufficient equity in the home a reverse mortgage could pay off the existing mortgage and “might be worth the effort”. In May MarketWatch noted Americans 55 and older have been clobbered by the coronavirus’ economic fallout…

[read more]In January of this year, MarketWatch notes the unemployment rate for those 55 and older was 2.6%. By April that unemployment number jumped to 13.6%. While our youngest workers have a higher rate of unemployment, older unemployed workers face unique challenges. The Urban Institute found that after the last recession of 2008 those between the ages of 51-60 waited an average of 9 months to find a new job while those 25-34 were working again within 6 months. Age discrimination is easier to recognize on the job but is much more subtle during the hiring process. All which leads us to the undeniable fact that millions of older homeowners are facing a forced retirement and financial crisis.

The good is many may find their solution literally right above their heads and in the walls that surround them. Where unemployment benefits and a loss of income create a cashflow crisis reverse mortgages will increasingly become the logical solution.

So let’s step back for a moment and consider our marketing. What is our message? Are we using the term retiree repeatedly? Do our mailers, emails, and online ads ASSUME that the homeowner is retired? It may be time to tweak our approach to appeal to the unemployed worker over the age of 62 who owns a home. So, practically how could YOU reach this target audience? One possible approach is to host workshops on the subject of ‘INVOLUNTARY RETIREMENT’ -for older workers who were laid off. These sessions could include short presentations from key senior service providers or experts and of course feature how homeowners may leverage their home to replace lost income with a reverse mortgage’s loan proceeds. CPAs and financial advisors may want to begin to inquire about their client’s employment status which may have changed as a result of the pandemic. Another tactic is to reach out to your local television and radio stations to pitch an interview on the impacts of unemployment for older residents and realistic solutions.

On August 6th PlanSponsor-dot-com wrote that The New School’s Retirement Equity Lab expects another 1.1 million older workers will leave the labor force in the next three months. The need to fund retirement is ever-present but the more immediate and pressing challenge of INVOLUNTARY RETIREMENT or unemployment of older Americans should spur our specific and strategic efforts. In summary, the solution remains the same while our approach should evolve to adapt to the specific pitfalls our present economy presents.

[/read]

Listen to this episode here:

Lifelong Mortgages: The New Norm?

Younger borrowers are taking longer mortgages- then comes a reverse?

When debt is king and aging populations are exploding across developed countries, more are finding themselves with a mortgage throughout their adult years. Lifelong mortgages may soon become the rule rather than the exception. Overall baby boomers are not doing too badly when compared to younger generations, but they have challenges as well. Fannie Mae reports over 51% of baby boomers are still paying a mortgage. CNBC columnist Bob Pisani writes that 45% of baby boomers born between the years 1946 to 1964 have zero savings for retirement…

While we can debate the exact percentages one trend is emerging. Fewer older American will be paying off their homes before retirement, or for that matter before they die. That should come as no surprise as only…